- Digital Transformation: India's economy has increased convenience but also heightened cybercrime, leading to widespread financial fraud.

- Reporting Mechanism: Victims can report crimes via the NCRP or helpline 1930, initiating tracing of stolen funds.

- Account Freezes: Innocent accounts can be frozen due to links in fraud investigations, greatly impacting merchants and freelancers.

- Legal Framework: Key statutes like BNSS and articles like Article 21 safeguard individual rights against unjust freezes.

- Court Precedents: Landmark rulings advocate against blanket freezes and support converting them to specific liens.

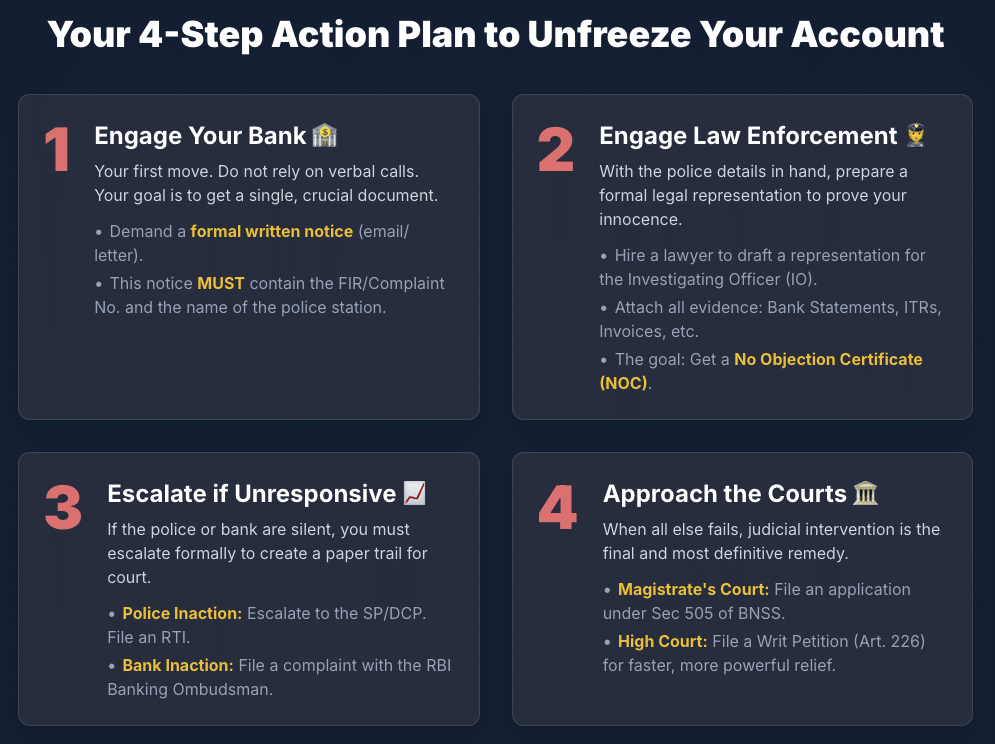

- Action Steps: Engage lawyers and follow structured representation approaches to unfreeze accounts following a rapid response.

- Preventive Measures: Maintain detailed records and secure digital access to mitigate risks of future incidents.

A Complete Legal Guide to Unfreezing Your Bank Account in India After a Cybercrime Complaint

Youtube Video link:

Part I: The Initial Shock – Understanding the Account Freeze

Section 1: Introduction – Caught in the Digital Crossfire

The rapid digitization of India’s economy has brought unprecedented convenience, but it has also opened the floodgates to a torrent of sophisticated cybercrimes. Financial frauds, ranging from phishing and UPI scams to complex investment schemes, have become a pervasive threat, costing citizens crores of rupees monthly.1 In response, the Government of India has established a robust mechanism for immediate reporting and action, spearheaded by the National Cybercrime Reporting Portal (NCRP) and the national helpline number 1930.2 This system is designed for speed, aiming to trace and block the flow of illicit funds before they vanish into the digital ether.

However, this very system, built for swiftness, often casts a wide and indiscriminate net. In the frantic chase to follow the money trail, the accounts of countless innocent individuals—merchants, freelancers, traders, and ordinary citizens—are frequently frozen. These individuals, often guilty of nothing more than receiving a payment for legitimate goods or services, find themselves in a state of financial paralysis, their accounts blocked without warning or clear explanation.1 They become collateral damage in the war against cybercrime, caught in a bewildering maze of inter-state police jurisdictions, uncommunicative banks, and opaque procedures.

This article serves as an exhaustive legal guide for those who find themselves in this predicament. It is a comprehensive roadmap designed to demystify the process of unfreezing a bank account in India that has been attached in connection with a cybercrime investigation. This report will navigate the entire journey, from understanding the initial shock of the freeze to the final steps of reclaiming financial freedom. It will cover the intricate workings of the reporting system, the critical legal provisions and landmark court judgments that define an individual’s rights, and a detailed, step-by-step action plan for engaging with banks, law enforcement, and the judiciary.

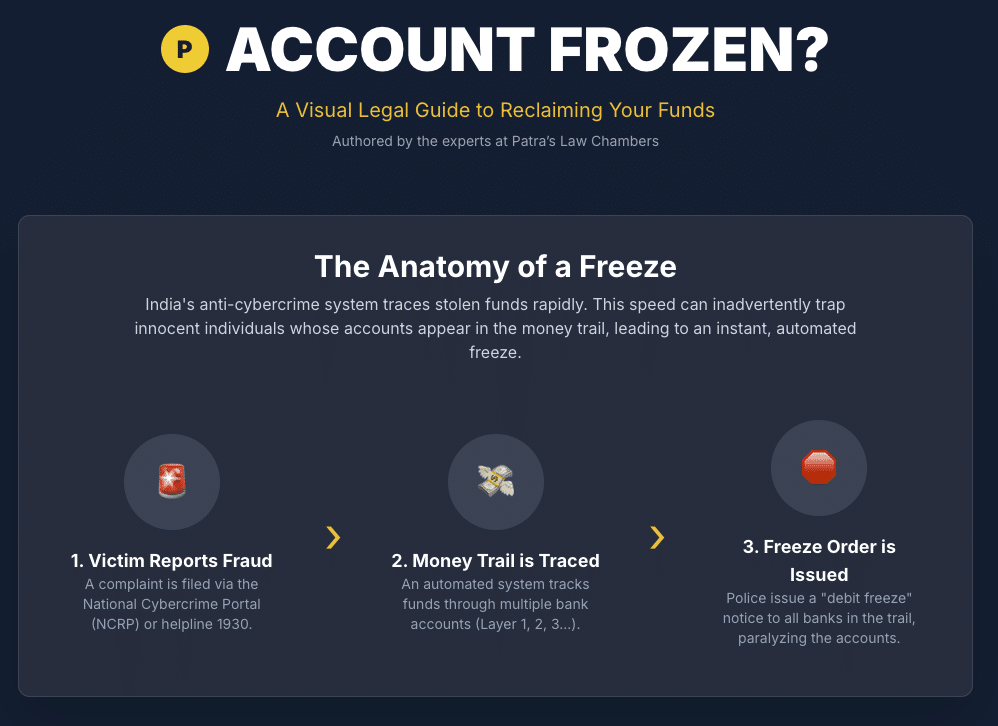

Section 2: The Anatomy of a Freeze – How and Why It Happens

To effectively challenge an account freeze, it is crucial to first understand the mechanics behind it. The process is a direct consequence of the national framework established to combat financial cyber fraud.

The Reporting Mechanism and the Money Trail

The sequence of events typically begins when a victim of financial fraud reports their loss.

- The 1930 Helpline & National Cybercrime Reporting Portal (NCRP): The primary point of contact for a victim is the toll-free helpline number 1930 or the online portal at cybercrime.gov.in.2 This platform, managed by the Indian Cyber Crime Coordination Centre (I4C) under the Ministry of Home Affairs, acts as a central repository for complaints. The moment a complaint is filed, an automated system is triggered to trace the flow of stolen money.7

- Tracing the Money Trail: The system, in coordination with banks and payment gateways, follows the digital footprint of the fraudulent transaction. It identifies the first account (Layer 1) into which the victim’s money was transferred. It then tracks subsequent transfers from that account to other accounts (Layer 2, Layer 3, and so on). This creates a complex web of transactions, often spanning multiple states and banks.7

- The Freeze Instruction: Based on this digital trail, the police in the complainant’s jurisdiction (the “originating LEA”) issue a “debit freeze” instruction to the banks holding these flagged accounts. This is often done via email or through the NCRP portal itself, and banks are legally obligated to comply immediately to prevent the funds from being withdrawn.4 The speed of this process is its core feature, but it is also its greatest weakness. The system is designed to act first and verify later, meaning it flags accounts based on the flow of funds, not on the culpability of the account holder.

Common Scenarios for Innocent Account Holders

An individual’s account can be frozen even if they have no direct connection to or knowledge of the original crime. Common scenarios include:

- Legitimate Business Transactions: A small business owner or online seller receives a payment from a customer. Unbeknownst to the seller, the customer’s account was funded with proceeds of crime. The seller’s account is then frozen as part of the money trail.1

- Peer-to-Peer (P2P) Cryptocurrency Trading: A person selling cryptocurrency on a P2P platform receives payment in INR from a buyer. If the buyer’s bank account is linked to a cyber fraud, the seller’s account is frozen upon receiving the funds.10

- Salary or Freelance Payments: An employee or freelancer receives their legitimate dues from a company whose own accounts have been compromised or inadvertently received fraudulent funds.

- Third-Party Transfers: An individual receives money from a friend or relative who, in turn, received it from a compromised source.

In all these cases, the account holder is an unwitting participant in a larger chain, yet they bear the immediate and severe consequences of a total account freeze, often for transactions that represent a tiny fraction of their account balance.1

Section 3: Decoding the Terminology – “Freeze” vs. “Lien”

Understanding the precise legal terms used by banks and law enforcement is the first step in formulating a response. The distinction between a “debit freeze” and a “lien” is of paramount strategic importance.

- Debit Freeze (or Blanket Freeze): This is the most common, immediate, and damaging action taken by banks upon receiving a police directive. A debit freeze blocks all outgoing transactions from the account. The account holder cannot withdraw cash from ATMs, issue cheques, make online payments, or use their debit card. While incoming credits (like a salary) may still be deposited, these funds also become instantly inaccessible, effectively paralyzing the account holder’s financial life.4 This is the blunt instrument that courts have repeatedly criticized for its disproportionate impact.

- Lien (or Specific Hold): A lien is a far more precise and legally sound measure. Instead of freezing the entire account, the bank places a hold or “lien” on a specific amount of money—typically the exact sum that is suspected to be the proceeds of the crime.12 The account holder remains free to access and transact with the remaining balance in their account. For example, if an account with a balance of ₹5,00,000 is implicated in a fraud of ₹50,000, a lien would block only ₹50,000, leaving the remaining ₹4,50,000 fully accessible.13

The legal discourse has increasingly moved towards advocating for liens over blanket freezes. The Delhi High Court, in the landmark case of Neelkanth Pharma Logistics Pvt Ltd, explicitly stated that marking a lien on the disputed amount should be the “first and foremost option” for law enforcement agencies.11 This is not merely a semantic difference; it is a fundamental shift in approach. For an affected individual, the immediate strategic goal when communicating with the police or petitioning a court should be to argue for the conversion of the debilitating total freeze into a manageable lien on the specific disputed amount. This provides crucial interim relief and restores a semblance of financial normalcy while the investigation continues.

Part II: The Legal Battlefield – Laws and Judgments You Must Know

Navigating an account freeze requires a firm grasp of the legal landscape. The power of the police is not absolute; it is governed by statutes and constrained by the Constitution. An informed individual, armed with knowledge of the law and judicial precedents, is best positioned to defend their rights.

Section 4: The Legal Framework – Your Rights and the Law

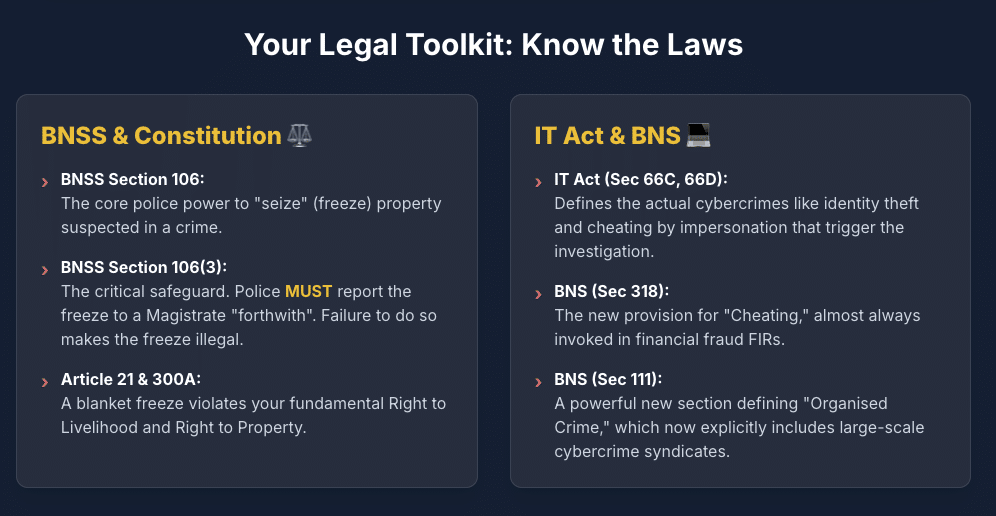

Several key statutes and constitutional articles form the bedrock of an account holder’s rights in this situation.

The Power to Seize: Bharatiya Nagarik Suraksha Sanhita, 2023 (BNSS)

The primary source of police power to freeze a bank account comes from the code of criminal procedure.

- Section 106 of BNSS (Power of police officer to seize certain property): This provision, which replaces the erstwhile Section 102 of the Code of Criminal Procedure, 1973 (CrPC), is the cornerstone of the state’s authority.7 It empowers any police officer to seize any property “which may be alleged or suspected to have been stolen, or which may be found under circumstances which create suspicion of the commission of any offence”.14 The Supreme Court of India, in the foundational case of

State of Maharashtra v. Tapas D Neogy, definitively held that a bank account is a form of “property” and can therefore be seized (frozen) under this section.16 Police and banks will invariably cite this power as the legal basis for their actions. - The Critical Mandate – Section 106(3) of BNSS: This sub-section is the most crucial procedural safeguard for the citizen and a powerful tool for challenging a freeze. It imposes a mandatory, non-negotiable duty on the police officer: “Every police officer acting under sub-section (1) shall forthwith report the seizure to the Magistrate having jurisdiction…”.14 The term “forthwith” implies immediate and without undue delay. A very common lapse in practice is the failure of police, especially in inter-state cybercrime cases, to comply with this mandate. This failure to report the seizure to the competent court renders the continuation of the freeze legally vulnerable and is a primary ground for a writ petition in the High Court.16

The Crimes: Information Technology Act, 2000 & Bharatiya Nyaya Sanhita, 2023 (BNS)

The substantive offences being investigated are typically defined under the IT Act and the new penal code, the BNS.

- Information Technology Act, 2000 (as amended): This is the principal legislation governing cybercrime in India. The First Information Report (FIR) will often cite sections from this Act, such as:

- Section 66: Computer related offences (often read with Section 43 for hacking and data damage).18

- Section 66C: Punishment for identity theft.13

- Section 66D: Punishment for cheating by personation by using computer resource.13

- Section 78: States that investigation of offences under the IT Act shall be carried out by a police officer not below the rank of Inspector.19

- Bharatiya Nyaya Sanhita, 2023 (BNS): Effective from July 1, 2024, the BNS replaces the Indian Penal Code, 1860, and introduces provisions highly relevant to financial frauds.

- Section 111 (Organised Crime): This is a significant new provision that explicitly includes “cyber-crimes” and “economic offences” (like hawala transactions, mass-marketing fraud, or bank fraud) within the definition of organised crime when committed by a syndicate for material benefit.20 This section carries severe penalties, including life imprisonment.

- Section 318 (Cheating): This section, corresponding to the old Section 420 of the IPC, deals with cheating and dishonestly inducing delivery of property and is almost always invoked in financial fraud cases.21

Constitutional Protection

The actions of the police and banks are subject to the fundamental rights guaranteed by the Constitution of India.

- Article 21 (Protection of Life and Personal Liberty): The Supreme Court has, through expansive interpretation, held that the Right to Life under Article 21 includes the Right to Livelihood. High Courts have consistently applied this principle to cases of bank account freezes. A blanket, indefinite freeze of a salary or business account, which effectively cripples a person’s ability to earn a living and meet basic needs, is considered a violation of this fundamental right.11

- Article 300A (Persons not to be deprived of property save by authority of law): This article provides that no person shall be deprived of their property except by authority of law. While Section 106 of the BNSS provides the “authority of law,” the procedure followed must be fair, just, and reasonable. An arbitrary or disproportionate freeze, or one where the mandatory procedure under Section 106(3) is not followed, is not a deprivation “by authority of law” in its true spirit and can be challenged on this ground.9

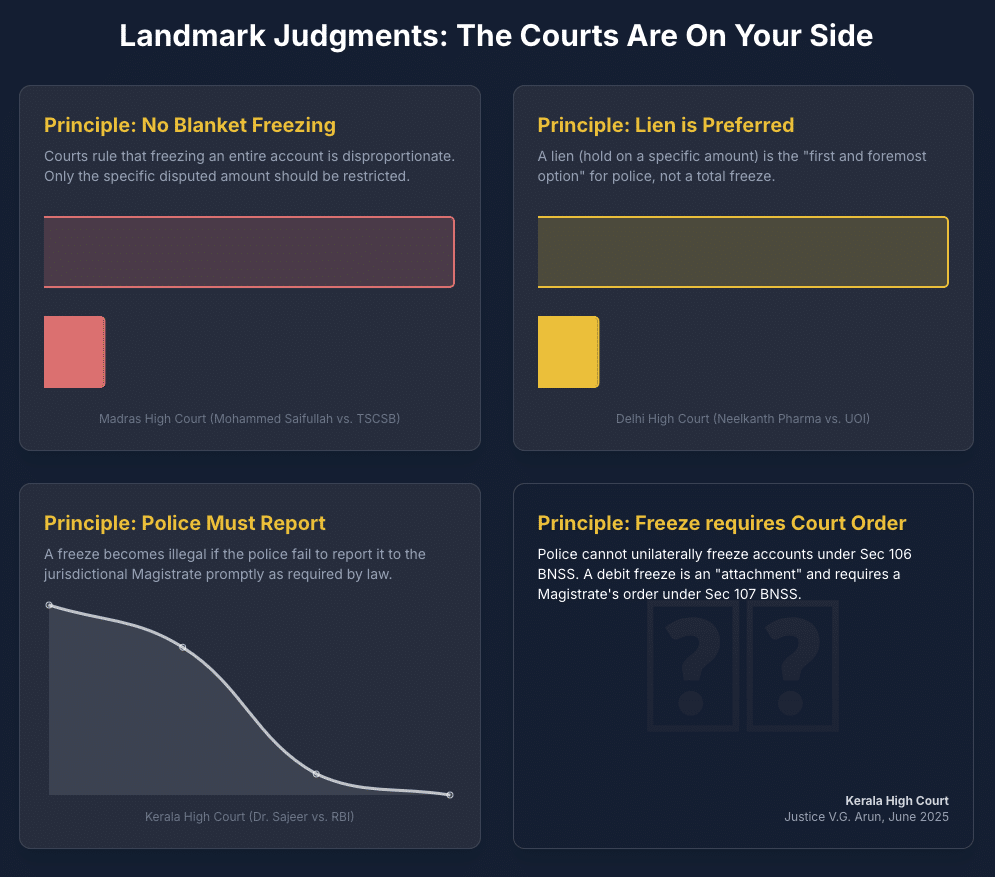

Section 5: Landmark Judicial Pronouncements – The Power of Precedent

In recent years, various High Courts have taken a strong stance against the arbitrary and blanket freezing of bank accounts, creating a body of case law that is highly favorable to innocent account holders. These judgments serve as powerful precedents that can be cited in representations to the police and in court petitions.

The Core Principle: No Blanket Freezing

The judiciary has consistently moved to curb the executive’s overreach, establishing that the power to freeze must be exercised proportionately.

- The Madras High Court Ruling: In a pivotal judgment, the Madras High Court ruled that police cannot freeze an entire bank account during a financial fraud investigation. It held that such an action would deprive the account holder of their right to livelihood. The court clarified that investigating agencies can only freeze the specific quantum of money allegedly involved in the fraud.10 In the case before it, the court permitted the petitioner to operate his account on the condition that he maintain a minimum balance equivalent to the disputed amount, effectively ordering a lien instead of a freeze.10

- The Delhi High Court’s Call for Systemic Reform: In Neelkanth Pharma Logistics Pvt Ltd v. UOI, the Delhi High Court strongly condemned the “indiscriminate freezing” of bank accounts, particularly when based on minuscule transactions. Justice Manoj Jain recommended that the Ministry of Home Affairs formulate a uniform policy and Standard Operating Procedures (SOPs) for all law enforcement agencies. The court emphatically stated that marking a lien on the disputed amount should be the default and preferred measure, as it mitigates hardship while securing the funds.11

- The Kerala High Court’s Procedural Mandate: The Kerala High Court, in a series of cases including Sajeer v. RBI and Nazeer K.T v. Manager, Federal Bank Ltd, established a clear and time-bound procedural remedy. The court directed that the police must inform the bank whether the seizure has been reported to the jurisdictional Magistrate as required by law. If the police fail to provide this intimation (or a proposal to comply) within a stipulated period (typically one or two months from the court’s order), the bank is directed to lift the freeze automatically.9 This places a crucial check on police inaction and prevents accounts from being frozen indefinitely.

The principles laid down in these judgments are not mere suggestions; they are binding directives in their respective jurisdictions and hold strong persuasive value across the country. They collectively establish that:

- A blanket freeze is disproportionate and violates fundamental rights.

- Only the amount linked to the alleged crime should be restricted.

- Police must follow the statutory mandate of reporting the seizure to a Magistrate.

- There must be a time limit to the freeze; it cannot be perpetual.

The “Minuscule Transaction” Problem: No Minimum Amount for a Freeze

A common and distressing feature of these cases is that a freeze can be triggered by any amount, no matter how small. There are no official guidelines or monetary thresholds that must be met for the police to issue a freeze instruction.25 The action is initiated based on a complaint of fraud, and the system automatically traces the money trail, flagging every account it passes through.

This has led to absurd situations, highlighted by the courts, where accounts holding substantial balances are completely frozen over trivially small disputed amounts. For instance, the Delhi High Court intervened in cases where accounts were frozen for amounts as low as ₹200 and even ₹105.11 This practice has been strongly criticized by the judiciary as disproportionate and causing undue hardship.11

The key takeaway is that the amount of the transaction is irrelevant to the initial freeze. However, it is highly relevant when arguing for relief. The legal principle, reinforced by guidelines from bodies like the Rajasthan Police and various High Court rulings, is that only the specific disputed amount should be restricted via a lien, not the entire account.27

Table 1: Key High Court Judgments on Bank Account Freezing

The following table summarizes these critical judicial precedents for easy reference.

| Case Name/Reference | Court | Key Ruling/Principle | Legal Justification | Actionable Outcome for Account Holder |

| Mohammed Saifullah v. TSCSB 10 | Madras High Court | Police cannot freeze an entire bank account, only the specific amount involved in the alleged fraud. | A blanket freeze violates the Right to Livelihood under Article 21 of the Constitution. | Argue for converting the freeze to a lien, allowing use of the remaining balance. |

| Neelkanth Pharma Logistics Pvt Ltd v. UOI 11 | Delhi High Court | Law enforcement should use a lien on the disputed amount as the “first and foremost option” instead of a blanket freeze. Recommended a national SOP. | Blanket freezes are disproportionate and cause undue hardship, especially for minuscule transaction amounts. | Cite this to argue that a lien is the legally preferred and more reasonable measure. |

| Dr. Sajeer v. RBI & Nazeer K.T. v. Federal Bank 9 | Kerala High Court | Police must inform the bank if the seizure has been reported to the Magistrate. If no intimation is received within a set time, the bank must lift the freeze. | Failure to follow the mandatory procedure under Section 102 CrPC (now 106 BNSS) makes the continued freeze illegal. | Puts a time-bound obligation on the police to act, creating a clear path to resolution if they remain inactive. |

| Prem Bhalla v. State of Telangana 13 | Telangana High Court | Acknowledged the police’s power to mark a lien under Section 102 CrPC but directed the petitioner to seek remedy by filing an application before the concerned Magistrate under Sections 451/457 CrPC. | The statutory remedy lies with the Magistrate’s court for release of seized property. | Provides the specific legal sections under which a petition can be filed in the Magistrate’s court. |

Part III: The Action Plan – A Step-by-Step Guide to Unfreezing Your Account

Armed with legal knowledge, the next phase involves a structured, persistent, and well-documented approach to secure the release of the account. The process can take anywhere from a few weeks to several months, and patience is key.23

Section 6: Step 1 – Engage with Your Bank (The First 48 Hours)

The immediate objective is to move from a state of confusion to one of clarity by obtaining official information from the bank.

Action Steps:

- Immediate Contact: As soon as the freeze is discovered, the account holder should contact their bank’s branch manager or the official customer service helpline. Verbal assurances or explanations are insufficient.4

- Demand Written Proof: The most critical action at this stage is to request a formal written communication—either a printed letter on the bank’s letterhead or an official email from a designated bank ID. This document is the cornerstone of all subsequent legal actions.4

- Key Information to Obtain: The written notice from the bank must be insisted upon and should clearly specify:

- The fact that the account is under a “debit freeze” or has a “lien” marked on it.

- The name of the law enforcement agency that issued the instruction (e.g., Cyber Crime Police Station, Solapur, Maharashtra).30

- The specific FIR number, Crime number, or Complaint reference number associated with the investigation (e.g., Crime No. 666 of 2023).13

- The date the instruction was received by the bank.

- The specific amount that has been put on hold or lien, if the police have provided this detail.

The “No FIR” Scenario: What to Do When a Complaint is Lodged but No FIR is Registered

It is a very common procedure for police to issue a freeze instruction based solely on a complaint lodged on the NCRP, often before a formal First Information Report (FIR) is registered.31 This is a measure taken to act swiftly and prevent the dissipation of funds while a preliminary inquiry is conducted.

If the bank informs you that the freeze is based on a complaint number from the NCRP portal but cannot provide an FIR number, the initial steps remain the same. You must obtain the complaint reference number and the details of the originating police station.32

The absence of an FIR can become a strategic advantage. The police’s power to freeze an account under Section 106 of the BNSS is an investigative tool. If no FIR is registered after a reasonable period, it weakens the legal justification for the continued freeze. If the police are unresponsive, filing an RTI application to formally ask if an FIR has been registered against you in connection with the complaint number is a powerful step.33 A formal response confirming “No FIR” is compelling evidence to present to senior police officers and the bank, strengthening the demand to lift the freeze as no formal criminal case is proceeding against you.

What if the Bank Refuses to Provide Information?

Occasionally, bank officials may be uncooperative, citing confidentiality or lack of information. This is unacceptable. If the bank refuses to provide the details in writing, the account holder should immediately take the following steps:

- Send a Formal Legal Notice: Through a lawyer, send a formal letter or legal notice to the Branch Manager and the bank’s designated Nodal Officer for grievance redressal. The notice should demand the aforementioned information as a right of the customer and state that failure to provide it constitutes a “deficiency in service”.28

- Create a Paper Trail: This written communication creates a crucial paper trail that can be used later if an escalation to the Banking Ombudsman becomes necessary.23

Section 7: Step 2 – Dealing with Law Enforcement (The First Two Weeks)

Once the origin of the freeze is identified, the focus shifts to engaging with the police. The objective is to demonstrate innocence and persuade the Investigating Officer (IO) to issue a “No Objection Certificate” (NOC) or a letter to the bank instructing them to lift the freeze.

Action Steps:

- Identify the Investigating Officer (IO): Using the FIR/Complaint number obtained from the bank, the specific police station and, if possible, the name of the IO handling the case must be identified.9

- Engage a Lawyer: At this stage, engaging a lawyer with experience in cybercrime and financial litigation is highly recommended. A lawyer can draft legally sound communications, represent the account holder professionally, and navigate the complexities of dealing with the police.4

- Prepare a Formal Representation: The lawyer will assist in drafting a detailed representation to be submitted to the IO. This document is a formal request to unfreeze the account and should be structured as a clear, evidence-backed argument of innocence.4

- Comprehensive Documentation Checklist: The representation must be supported by a comprehensive set of documents to substantiate the claims 2:

- A covering letter clearly explaining the account holder’s position, the nature of their business/profession, and a declaration of innocence regarding the alleged fraud.

- A copy of the freeze notification received from the bank.

- Identity Proof: Aadhar Card, PAN Card.

- Address Proof: Aadhar Card, Passport, Utility Bill.

- Bank Statements: At least the last six months to one year of statements to show the pattern of legitimate transactions.

- Proof of Legitimate Income: Salary slips, Income Tax Returns (ITRs) for the last 2-3 years, business registration documents, GST returns, etc.

- Evidence for the Disputed Transaction: This is the most critical piece of evidence. It could be an invoice for goods sold, a service agreement, a screenshot of the product listing, or any communication with the party that made the payment.

- A self-declaration affidavit, notarized, summarizing the facts and affirming the legitimacy of the account holder’s transactions.

- Submission and Follow-Up: The complete set should be submitted to the IO and a copy should also be sent to their superior officer, such as the Superintendent of Police (SP) or Deputy Commissioner of Police (DCP), via registered post or hand-delivery to ensure a record of submission. Professional and persistent follow-up by the lawyer is essential.23

The police’s role in this process is often dual-natured. While their legal mandate is to investigate and present facts to a court, in practice, they become the de facto decision-makers, as the freeze is lifted only upon their instruction to the bank.9 This informal, extra-judicial process of “representation” is aimed at convincing the IO of the account holder’s innocence. Therefore, the strategy must be to cooperate fully while simultaneously building a meticulous record of all communications and the police’s response (or lack thereof), which will be vital if the matter proceeds to court.

Section 8: Step 3 – Overcoming Inaction: Escalation and Alternative Remedies

One of the most frustrating aspects of this ordeal is the lack of response from authorities. Both the police and the bank can be slow to act, necessitating a clear escalation strategy.

When the Police are Uncooperative

If the IO does not respond to the representation within a reasonable period (e.g., 15-30 days), the following steps should be taken:

- Escalate to Senior Police Officers: A formal grievance letter should be sent to the Superintendent of Police (SP) or Deputy Commissioner of Police (DCP) of the concerned district or city. This letter should reference the original representation submitted to the IO, highlight the lack of response, and detail the hardship being faced due to the continued freeze.36

- Utilize the Right to Information (RTI) Act, 2005: Filing an RTI application is a powerful strategic tool to compel accountability. The application should be filed with the Public Information Officer (PIO) of the relevant police department.4 The questions should be precise and targeted:

- Please provide a certified copy of the complaint or FIR (mentioning the number obtained from the bank) based on which my bank account was directed to be frozen.

- Please inform me of the date on which the seizure of the aforementioned bank account was reported to the jurisdictional Magistrate, as mandated under Section 106(3) of the Bharatiya Nagarik Suraksha Sanhita, 2023.

- Please provide a certified copy of the intimation/report submitted to the jurisdictional Magistrate regarding the seizure of the said bank account.

The response to these questions, particularly question #2, is critical. An admission that the seizure was not reported, or an evasive answer, provides direct evidence of a statutory violation, which forms a strong basis for a writ petition in the High Court.

When the Bank is Uncooperative or Delays after Receiving an NOC

If the bank refuses to provide initial freeze details, or more commonly, fails to act promptly after receiving an NOC from the police, the account holder has recourse through the Reserve Bank of India’s grievance redressal mechanism.

- The RBI Integrated Ombudsman Scheme, 2021: This scheme provides a single, cost-free platform to resolve customer grievances against regulated entities like banks for “deficiency in service”.41

- Procedure for Filing a Complaint 34:

- Prerequisite: The complainant must first give the bank a written complaint and wait for 30 days. If the bank rejects the complaint or fails to provide a satisfactory resolution within this period, a complaint can be filed with the Ombudsman.

- How to File: The complaint can be lodged online through the RBI’s Complaint Management System (CMS) portal: https://cms.rbi.org.in. Alternatively, a physical complaint can be mailed to the Centralised Receipt and Processing Centre (CRPC) established by the RBI in Chandigarh. A toll-free number, 14448, is also available for assistance.

- Grounds for Complaint: The complaint would be for “deficiency in service,” citing the bank’s failure to provide information about the freeze or its unreasonable delay in unfreezing the account despite receiving a lawful instruction (NOC) from the police. This is an effective, no-cost mechanism to compel action from a delinquent bank.

Section 9: Step 4 – The Ultimate Recourse: Approaching the Courts

When representations and escalations fail to yield results, judicial intervention becomes the final and most definitive remedy.

The Magistrate’s Court: A Detailed Procedural Approach

Filing an application before the jurisdictional Magistrate is the primary statutory remedy to challenge the seizure of property, including a frozen bank account. This is often the next logical step if the police are unresponsive to direct representations.23

- Legal Basis for the Application: The application is filed under the provisions for disposal of property in Chapter XXXVI of the Bharatiya Nagarik Suraksha Sanhita (BNSS). Specifically:

- Section 505 of BNSS (formerly Section 457 CrPC): This is the most relevant provision. It applies when property seized by the police is not produced before a criminal court during an inquiry or trial. A frozen bank account fits this description perfectly. The Magistrate is empowered to make an appropriate order for the disposal or delivery of such property.53

- Section 499 of BNSS (formerly Section 451 CrPC): This section deals with the custody and disposal of property that is produced before the court during an inquiry or trial. While less directly applicable to a bank account, it is often cited alongside Section 505.53

- The Step-by-Step Procedure:

- Drafting the Application: A formal application must be drafted by a lawyer. It should be titled, for instance, “Application under Section 505 of the BNSS, 2023, for De-freezing of Bank Account.” 56

- Content of the Application: The application must be comprehensive and include a detailed narrative of the facts, supported by evidence.57 Key elements include:

- Details of the applicant (the account holder).

- Details of the frozen bank account.

- The FIR or NCRP complaint number and the name of the police station.

- A chronological account of events leading to the freeze.

- Strong legal grounds for relief, such as the applicant’s innocence, the legitimate nature of the transaction, the disproportionate hardship caused by the freeze, and, critically, the failure of the police to report the seizure to the Magistrate as required by Section 106(3) of the BNSS.49

- A clear prayer asking the court to direct the police to issue an NOC to the bank to de-freeze the account or, alternatively, to convert the freeze into a lien on the specific disputed amount.

- Annexures: All supporting documents, including the bank’s freeze notification, the representation made to the police, and evidence of the transaction’s legitimacy, must be attached.59

- Filing and Hearing: The application is filed in the Magistrate’s court that has jurisdiction over the case. The court will then issue a notice to the Investigating Officer (IO) and the prosecution, asking them to file a reply or status report.58

- The Magistrate’s Decision: After hearing arguments from both sides, the Magistrate will pass an order. The Magistrate has wide discretion and can 60:

- Order a full de-freeze: If the Magistrate is convinced that the freeze is unjustified or illegal.

- Order a partial de-freeze: The court may direct the bank to secure the disputed amount (e.g., by creating a fixed deposit) and release the remaining balance to the account holder. This is a common and practical interim relief.61

- Impose Conditions: The release may be subject to the account holder executing a bond or providing a guarantee to produce the funds if required during the trial.62

- Dismiss the Application: If the Magistrate finds merit in the police’s arguments for continuing the freeze.

- Timeline and Appeal: This process typically takes between two to four weeks.23 If the Magistrate dismisses the application, the account holder is not without recourse. The next step is to challenge this order by filing a

Revision Application before the Sessions Court.48

The High Court

Filing a writ petition in the High Court under Article 226 of the Constitution is often the most potent and expeditious remedy against arbitrary state action.

- Writ Petition under Article 226: This petition is filed against the police department, the concerned bank, and sometimes the Union/State government, seeking the court’s intervention to protect fundamental rights.4

- Grounds for the Petition: The petition is built upon strong legal and constitutional arguments, including:

- Violation of Fundamental Rights: The blanket freeze violates the Right to Livelihood (Article 21) and the Right to Property (Article 300A).

- Arbitrary and Disproportionate Action: The police action is arbitrary, as it freezes an entire account for a potentially small disputed amount without any evidence of the account holder’s complicity.

- Violation of Statutory Procedure: The police have failed to comply with the mandatory requirement of reporting the seizure to the Magistrate under Section 106(3) of the BNSS. Evidence from an RTI response can be annexed here.

- Indefinite Freeze: The account has been frozen for an unreasonable period without the investigation being concluded or a charge sheet being filed.

- Reliefs (Prayers) to Seek from the High Court: The petition should seek specific orders from the court 48:

- A Writ of Mandamus (a command) directing the police to issue an NOC and directing the bank to de-freeze the account.

- A Writ of Certiorari (to quash) to set aside the illegal freeze instruction issued by the police.

- Crucially, an interim order directing the bank to immediately convert the total freeze into a lien on the specific disputed amount, thereby allowing the petitioner to operate the rest of the account while the main petition is being decided. This provides immediate relief.10

- Petition Elements: A well-drafted writ petition will contain a clear synopsis of the facts, the legal grounds for the challenge, copies of all correspondence with the bank and police, the RTI application and response, and citations of the landmark High Court judgments discussed in Section 5.48

Part IV: Proactive Measures and Final Deliverables

Section 10: Conclusion – Reclaiming Financial Freedom and Preventing Future Incidents

The journey to unfreeze a bank account entangled in a cybercrime investigation is undoubtedly arduous, testing one’s patience and resolve. It is a battle fought on multiple fronts—with the bank, the police, and potentially the courts. Success hinges on a strategy of persistence, meticulous documentation, and the assertion of legal rights. The most effective path involves a polite but firm demand for written information from the bank, followed by a comprehensive and evidence-backed representation to the police. Strategic use of the RTI Act can expose procedural lapses, while timely escalation to senior officers and the Banking Ombudsman can break through bureaucratic inertia. Ultimately, the High Court, through its writ jurisdiction, stands as the most powerful guardian of a citizen’s rights against arbitrary state action.

While the ordeal is stressful, it is not insurmountable. By following a structured legal process, innocent individuals can navigate the maze and reclaim control over their financial lives.

Preventive Measures for the Future

To minimize the risk of such an incident recurring, individuals and businesses should adopt proactive financial hygiene 3:

- Maintain Meticulous Records: Keep detailed records, including invoices and communication, for all business and significant personal transactions.

- Verify Sources: Be cautious when dealing with new or unknown parties. If possible, verify the legitimacy of the source before accepting large payments.

- Secure Digital Access: Enable two-factor authentication on all banking and financial accounts. Use strong, unique passwords and change them regularly.

- Monitor Account Activity: Regularly review bank statements for any suspicious or unauthorized transactions and report them to the bank immediately.

- Guard Sensitive Information: Never share OTPs, PINs, passwords, or CVV numbers with anyone. Banks or law enforcement will never ask for this information.

- Report Suspicious Communication: Immediately report any suspicious emails, SMS messages, or calls claiming to be from a bank or government agency.

#UnfreezeBankAccount #CybercrimeIndia #BankAccountFreeze #LegalAdviceIndia #NCRP1930 #BNSS #ITAct2000 #HighCourtIndia #BankingOmbudsman #CyberLaw #FinancialFraud #PoliceComplaint #LienOnAccount #RightToInformation #IndianLaw #Article226 #DebitFreeze #CyberSecurity #RBI #LegalHelp

Works cited

Resources:Navigating the Maze_ A Complete Legal Guide to Unfreezing Your Bank Account in India After a Cybercrime Complaint.pdf

- My Bank Account Was Frozen After Filing a Cyber Fraud Complaint, and ₹1000 Disappeared from my account while it was Debit frozen! What Should I Do? : r/india – Reddit, accessed on August 13, 2025, https://www.reddit.com/r/india/comments/1ifrqol/my_bank_account_was_frozen_after_filing_a_cyber/

- Cyber Crimes Police Station – Hyderabad Police, accessed on August 13, 2025, https://hyderabadpolice.gov.in/cyber_crimes_hyderabad_police_station.html

- Safe Banking | Threat Control & Security Guideline – BOI – Bank of India, accessed on August 13, 2025, https://bankofindia.co.in/safe-banking

- What to Do if Your Bank Account is Frozen Due to a Cyber Complaint, accessed on August 13, 2025, https://thelawbrigade.com/general-research/what-to-do-if-your-bank-account-is-frozen-due-to-a-cyber-complaint/

- Report Suspected Fraud Communication – Sanchar Saathi, accessed on August 13, 2025, https://sancharsaathi.gov.in/sfc

- Grievances Redressal Mechanism | IOB, accessed on August 13, 2025, https://www.iob.in/Grievances_Redressal_mechanism

- Why Is My Bank Account Frozen By Police? What To Do Next? – CYBER MITHRA, accessed on August 13, 2025, https://cybermithra.in/2025/03/05/bank-account-frozen/

- Procedure+of+CyberCrime+complaint+on+Cyber+ … – Bank of India, accessed on August 13, 2025, https://bankofindia.co.in/documents/20121/0/Procedure+of+CyberCrime+complaint+on+Cyber+Crime+Portal.pdf

- How to Unfreeze Your Bank Account Through Rajasthan Cyber Cell – Adarsh Singhal, accessed on August 13, 2025, https://advocateadarsh.com/how-to-unfreeze-your-bank-account-through-rajasthan-cyber-cell/

- Police cannot freeze an entire bank account; only quantum of money …, accessed on August 13, 2025, https://www.thehindu.com/news/national/tamil-nadu/police-cannot-freeze-an-entire-bank-account-only-quantum-of-money-involved-in-financial-fraud-can-be-frozen-rules-madras-high-court/article68641919.ece

- Delhi High Court slams blanket freezing of bank accounts …, accessed on August 13, 2025, https://www.scconline.com/blog/post/2025/03/01/delhi-high-court-freezing-bank-accounts-cyber-crime-policy-reform-legal-news/

- Terms of Service – State Bank of India, accessed on August 13, 2025, https://retail.onlinesbi.sbi/sbijava/retail/html/Terms_of_Use.html

- Prem Bhalla vs The State Of Telangana on 26 March, 2024, accessed on August 13, 2025, https://indiankanoon.org/doc/11742097/

- Section 106 in Bharatiya Nagarik Suraksha Sanhita, 2023 – Indian Kanoon, accessed on August 13, 2025, https://indiankanoon.org/doc/44870458/

- Devendra Kumar vs State Of U.P. Thru. The Prin. Secy. Home … on 7 February, 2025, accessed on August 13, 2025, https://indiankanoon.org/doc/77519230/

- Akhil M V vs State Bank Of India on 21 January, 2025 – Indian Kanoon, accessed on August 13, 2025, https://indiankanoon.org/doc/124618320/

- IN THE HIGH COURT OF MADHYA PRADESH AT JABALPUR – mphc.gov.in, accessed on August 13, 2025, https://mphc.gov.in/upload/jabalpur/MPHCJB/2020/WP/19771/WP_19771_2020_FinalOrder_02-Sep-2023.pdf

- CYBER CRIME INVESTIGATION – JUDICIAL ACADEMY JHARKHAND, accessed on August 13, 2025, https://jajharkhand.in/wp/wp-content/uploads/2019/10/02_sop_english.pdf

- THE INFORMATION TECHNOLOGY ACT, 2000 … – India Code, accessed on August 13, 2025, https://www.indiacode.nic.in/bitstream/123456789/13116/1/it_act_2000_updated.pdf

- The Bharatiya Nyaya Sanhita, 2023 – PRS India, accessed on August 13, 2025, https://prsindia.org/billtrack/the-bharatiya-nyaya-sanhita-2023

- THE BHARATIYA NYAYA SANHITA, 2023 NO. 45 OF 2023 An Act to …, accessed on August 13, 2025, https://www.mha.gov.in/sites/default/files/250883_english_01042024.pdf

- Corresponding Section Table Of Bharatiya Nyaya Sanhita 2023, (BNS), accessed on August 13, 2025, https://uppolice.gov.in/site/writereaddata/siteContent/Three%20New%20Major%20Acts/202406281710564823BNS_IPC_Comparative.pdf

- How to Unfreeze a Bank Account from Cybercrime – Fast Guide – Prashastha Legal, accessed on August 13, 2025, https://prashasthalegal.com/how-to-unfreeze-a-bank-account-from-cybercrime/

- Debit Freeze On Bank Account Is Illegal in India Madras High Court Judgement – Scribd, accessed on August 13, 2025, https://www.scribd.com/document/769951022/Debit-Freeze-on-Bank-Account-is-illegal-in-India-Madras-High-Court-Judgement

- Can A Bank Account Be Frozen Even For 1 Rupee? – Online Legal Center, accessed on August 14, 2025, https://onlinelegalcenter.com/can-a-bank-account-be-frozen-even-for-1-rupee/

- Delhi HC tells probe agencies to exercise caution on blanket freezing of bank accounts, accessed on August 14, 2025, https://www.newindianexpress.com/cities/delhi/2025/Feb/28/delhi-hc-tells-probe-agencies-to-exercise-caution-on-blanket-freezing-of-bank-accounts

- Freeze only disputed amount in cyber fraud cases: New guidelines | Jaipur News, accessed on August 14, 2025, https://timesofindia.indiatimes.com/city/jaipur/freeze-only-disputed-amount-in-cyber-fraud-cases-new-guidelines/articleshow/121837877.cms

- How To Unfreeze Bank Account in India | Advocate Ayush Garg | 8273682006, accessed on August 13, 2025, https://onlinelegalcenter.com/how-to-unfreeze-bank-account-in-india/

- Step-by-Step Guide to Unfreezing a Bank Account in India – 2025 – Legalkart, accessed on August 13, 2025, https://www.legalkart.com/legal-blog/step-by-step-guide-to-unfreezing-a-bank-account-in-india-2025

- IN THE HIGH COURT OF MADHYA PRADESH AT INDORE – mphc.gov.in, accessed on August 13, 2025, https://mphc.gov.in/upload/indore/MPHCIND/2025/WP/375/WP_375_2025_FinalOrder_08-01-2025.pdf

- Bank A/Cs can be frozen for no fault of yours: What UPI users learned in Kerala, accessed on August 14, 2025, https://www.thenewsminute.com/kerala/bank-acs-can-be-frozen-no-fault-yours-what-upi-users-learned-kerala-175940

- How to Unfreeze Your Bank Account in 2025? Step-by-Step Guide – Online Legal Center, accessed on August 14, 2025, https://onlinelegalcenter.com/how-to-unfreeze-your-bank-account/

- How I got my frozen bank account unfreezed : r/LegalAdviceIndia – Reddit, accessed on August 14, 2025, https://www.reddit.com/r/LegalAdviceIndia/comments/1jgljwj/how_i_got_my_frozen_bank_account_unfreezed/

- Banking Ombudsman How to file a Complaint – RBL Bank, accessed on August 13, 2025, https://www.rblbank.com/static-pages/banking-ombudsman-how-to-file-a-complaint

- How to Unfreeze Your Bank Account: A Guide with Real-Life Cases – Adarsh Singhal, accessed on August 13, 2025, https://advocateadarsh.com/how-to-unfreeze-your-bank-account-a-guide-with-real-life-cases/

- Citizen Corner – BPR&D, accessed on August 13, 2025, https://bprd.nic.in/page/citizen_corner

- What can you do against Police Inaction? – Nyaaya, accessed on August 13, 2025, https://nyaaya.org/nyaaya-weekly/what-can-you-do-against-police-inaction/

- Exploring Legal Remedies for police inaction in India, accessed on August 13, 2025, https://xpertslegal.com/blog/exploring-legal-remedies-for-police-inaction-in-india/

- RTI Online :: Online RTI Information System, accessed on August 13, 2025, https://rtionline.delhi.gov.in/

- How to File RTI in CYBER CRIME POLICE STATION BENGALURU @filertionline.in, accessed on August 13, 2025, https://www.filertionline.in/how-to-file-rti-in-cyber-crime-police-station-bengaluru-in-karnataka

- Grievance Redressal under the RBI Integrated Ombudsman Scheme, 2021 – Google Help, accessed on August 13, 2025, https://support.google.com/pay/india/answer/15721344?hl=en

- RBI guidelines ensure multilingual customer communication and a quicker grievance redressal by banks – PIB, accessed on August 13, 2025, https://www.pib.gov.in/PressReleasePage.aspx?PRID=2155543

- RBI guidelines ensure multilingual customer communication, quicker grievance redressal: Minister – The Hans India, accessed on August 13, 2025, https://www.thehansindia.com/news/national/rbi-guidelines-ensure-multilingual-customer-communication-quicker-grievance-redressal-minister-996302

- The Reserve Bank – Integrated Ombudsman Scheme, 2021 (RB-IOS, accessed on August 13, 2025, https://www.rbi.org.in/commonperson/english/scripts/FAQs.aspx?Id=3407

- the reserve bank – integrated ombudsman scheme, 2021 – PNB, accessed on August 13, 2025, https://www.pnbindia.in/document/Banking_ombudsman.pdf

- Online Complaint process to Banking Ombudsman | Digital governance – Vikaspedia, accessed on August 13, 2025, https://egovernance.vikaspedia.in/viewcontent/e-governance/online-citizen-services/government-to-citizen-services-g2c/grievance-redressal-1/online-complaint-process-to-banking-ombudsman?lgn=en

- The Reserve Bank – Integrated Ombudsman Scheme, 2021 – Cloudfront.net, accessed on August 13, 2025, https://drws17a9qx558.cloudfront.net/document/banking-ombudsman/banking-ombudsman-scheme-faq.pdf

- unfreezing of Bank Account – Legal Formats India | One Stop …, accessed on August 14, 2025, https://legalformatsindia.com/product-tag/unfreezing-of-bank-account/

- F.R. High Court of Judicature at Allahabad (Lucknow) ************ Court No. – 10 Case :- CRIMINAL MISC. WRIT PETITION No., accessed on August 14, 2025, https://elegalix.allahabadhighcourt.in/elegalix/WebDownloadOriginalHCJudgmentDocument.do?translatedJudgmentID=6810

- HC-Unfrozen bank account – affidavit, accessed on August 13, 2025, https://www.judiciary.hk/doc/en/court_services_facilities/hc/unfrozen_bank_account_affidavit.pdf

- Application For Unfreeze Bank Account – Request L 2 | PDF – Scribd, accessed on August 13, 2025, https://www.scribd.com/document/584656937/Application-for-Unfreeze-Bank-Account-Request-L-2

- Internet Banking : Frequently Asked Questions – Axis Bank, accessed on August 13, 2025, https://www.axisbank.com/bank-smart/internet-banking/faqs

- Bharatiya Nagarik Suraksha Sanhita, 2023 – PRS India, accessed on August 14, 2025, https://prsindia.org/files/bills_acts/bills_parliament/2023/Bharatiya_Nagarik_Suraksha_Sanhita,_2023.pdf

- CrPC Section 457 – Procedure by police upon seizure of property – Devgan.in, accessed on August 14, 2025, https://devgan.in/crpc/section/457/

- CrPC Section 451 – Order for custody and disposal of property pending trial in certain cases, accessed on August 14, 2025, https://devgan.in/crpc/section/451/

- APPLICATION FOR DE-FREEZING/UNFREEZING OF BANK ACCOUNT FREEZE BY INVESTIGATING AGENCY. – – Legal Formats India, accessed on August 14, 2025, https://legalformatsindia.com/shop/criminal-law/application-for-de-freezing-unfreezing-of-bank-account-freeze-by-investigating-agency/

- APPLICATION UNDER 457 CRPC | PDF | Banks – Scribd, accessed on August 14, 2025, https://www.scribd.com/document/838863230/APPLICATION-UNDER-457-CRPC

- Guruprasath vs State – Indian Kanoon, accessed on August 14, 2025, https://indiankanoon.org/doc/65093368/

- IN THE COURT OF JUDGE SMALL CAUSES SRINAGAR Reg. No. :3856/2023 CNR No: JKSG030061972023 D.O.I – app.ecourts.gov.in, accessed on August 14, 2025, https://app.ecourts.gov.in/ecourt_mobile_encrypted_DC/display_pdf.php?filename=Sq9gkTDwlbeFlPocqLfFSbs%2BfuJE1j6mhtxHwIyOANlwMOVvHmDA%2Fw7odTgqLwCv&caseno=zVVqWMbS3iEx18TnzQ7BCPFWj%2F6meHD6yjiTmZDfH6TVX8ZbKd4DtfpXjHSbKisN&cCode=xanPvB72cu3mDXaUiV95AA%3D%3D&appFlag=&state_cd=hl8DvJDJyqZdJzlihfQ4cQ%3D%3D&dist_cd=SZ7Oem46NPGlntDbiOv3oA%3D%3D&court_code=xanPvB72cu3mDXaUiV95AA%3D%3D&bilingual_flag=0

- Release cyber fraud funds based on NCRP plaint: HC – The Times …, accessed on August 14, 2025, https://timesofindia.indiatimes.com/city/kolkata/release-cyber-fraud-funds-based-on-ncrp-plaint-hc/articleshow/118989925.cms

- 1 IN THE SUPREME COURT OF INDIA CRIMINAL APPELLATE JURISDICTION CRIMINAL APPEAL NO. 1099 OF 2017 (Arising out of SLP(Crl.) No. – MP SJA, accessed on August 14, 2025, https://mpsja.mphc.gov.in/Joti/pdf/LU/seize.pdf

- The High Court Of Madhya Pradesh Bench Gwalior – mphc.gov.in, accessed on August 14, 2025, https://mphc.gov.in/upload/gwalior/MPHCGWL/2021/MCRC/52626/MCRC_52626_2021_FinalOrder_28-Jan-2022.pdf

Amazing and most methodical work & guidance to common man on defreezing of Bank accounts frozen unscrouplusly cybercrime police

Thank you so much sir for your encouragement. I hope it helped!!