- SARFAESI notices do not strip borrowers of rights; law, RBI circulars, and recent judgments provide defensive remedies.

- RBI OTS circular (June 8, 2023) allows board‑approved settlements, including limited settlement options for alleged wilful defaulters.

- Penal charges ban (Aug 18, 2023) prohibits capitalizing penal interest; banks cannot charge interest on separate penal charges.

- Immediate return of deeds rule (Sept 13, 2023) requires banks to hand back property documents within 30 days, with daily compensation for delays.

- Key precedents: Mardia (2004), Mathew Varghese (2014), ITC vs Blue Coast (2018) protect challenge rights and mandate procedural compliance.

- DRT tactics: file a Section 13(3A) representation, seek stay via Securitisation Application, audit statement of account, and challenge valuation.

- Practical tips: act promptly, avoid frivolous delays, consider deposits for stays, and retain a specialized banking lawyer for DRT work.

Defend Section 13(2) and 13(4) SARFAESI notice and stay order from DRT

Category: Banking Law / SARFAESI Act / Debt Recovery

Author: Patra’s Law Chambers

Introduction: You Are Not Defenseless

Receiving a Possession Notice or a Demand Notice under the SARFAESI Act is one of the most stressful experiences a person can face. The fear of losing your home to a bank auction is real, but so are your legal rights.

Many borrowers believe that once a loan turns into a Non-Performing Asset (NPA), the bank has absolute power. This is false. The law in India, specifically the SARFAESI Act read with recent Supreme Court judgments and RBI circulars, provides a robust framework for borrowers to defend themselves.

At Patra’s Law Chambers, we believe that financial distress is a civil issue, not a criminal one. This detailed guide will hand you the “Regulatory Toolkit” and “Legal Strategies” you need to pause arbitrary bank actions, buy time for repayment, and save your property.

Part 1: Your Regulatory Toolkit (Key RBI Circulars)

The Reserve Bank of India (RBI) frequently issues circulars that are binding on all banks. If your bank has violated any of these, it is a strong ground for a Stay Order in the DRT.

1. The Right to Compromise Settlement (OTS)

-

Circular: Framework for Compromise Settlements and Technical Write-offs

-

Reference:

RBI/2023-24/40 DOR.STR.REC.20/21.04.048/2023-24(Dated June 8, 2023) -

The Power: This circular mandates that banks must have a Board-approved policy for settlements. Crucially, it clarifies that even borrowers classified as “Wilful Defaulters” or “Fraud” are not automatically barred from settlement negotiations (under specific strict conditions). This opens the door for One-Time Settlements (OTS) where previously banks might have said “No.”

2. The Ban on “Penal Interest” (Stopping the Ballooning Debt)

#image_title

-

Circular: Fair Lending Practice – Penal Charges in Loan Accounts

-

Reference:

RBI/2023-24/53 DoR.MCS.REC.28/01.01.001/2023-24(Dated August 18, 2023) -

The Power: Effective Jan 1, 2024, banks cannot capitalize penal charges.

-

Old Practice: Bank charges 2% penalty, adds it to the principal, and charges interest on the new total. (Debt explodes).

-

New Rule: Bank can only charge a “Penal Charge.” It must be kept separate and no interest can be charged on this penalty amount. If your bank has violated this, their claim amount is illegal.

-

3. Immediate Release of Property Documents

-

Circular: Responsible Lending Conduct – Release of Property Documents

-

Reference:

RBI/2023-24/60 DoR.MCS.REC.38/01.01.001/2023-24(Dated September 13, 2023) -

The Power: Once you pay off your loan (or settle it), the bank must return your original deed within 30 days. If they delay, they must compensate you ₹5,000 for every day of delay.

Part 2: Landmark Supreme Court Judgments (The Case Law Shield)

When you approach the DRT, you need to cite precedents. These three judgments have shifted the balance of power in favor of the borrower.

1. Mardia Chemicals Ltd. vs. Union of India (2004)

-

The Ruling: This is the case that upheld the constitutional validity of the SARFAESI Act but struck down the harsh condition that required borrowers to deposit 75% of the debt just to file a case.

-

How it Helps You: It established your fundamental right to approach the Debts Recovery Tribunal (DRT) under Section 17 to challenge the bank’s action without paying a massive amount upfront (though deposits are still needed for Stay Orders).

2. Mathew Varghese vs. M. Amritha Kumar (2014)

-

The Ruling: The Supreme Court held that the Right to Property is a constitutional right (Article 300A). The bank cannot sell your property secretly. They must give you a clear 30-day notice before the sale. If the sale is postponed, they must notify you again.

-

How it Helps You: If the bank auctioned your property without a proper 30-day notice or after a long adjournment without fresh notice, the entire sale can be set aside.

3. ITC Limited vs. Blue Coast Hotels Ltd. (2018)

-

The Ruling: The Court ruled that Section 13(3A) of the SARFAESI Act is mandatory, not optional. This section requires the bank to consider your “Representation/Objection” to their demand notice and reply within 15 days.

-

How it Helps You: If you sent an objection letter to the bank’s Section 13(2) notice and they ignored it or sent a vague reply, their subsequent actions (possession/auction) are illegal. This is one of the strongest grounds to get a stay.

Part 3: DRT Strategies – How to Legally Buy Time & Regularize

Many borrowers ask: “How can I delay the process to arrange funds?” Legal Warning: You cannot file frivolous cases just to delay. However, by demanding Strict Procedural Compliance, you inevitably gain time because banks often make procedural errors.

Step 1: The “Representation” Strategy (Pre-Court)

-

Action: Immediately upon receiving the Section 13(2) Notice, file a detailed Objection under Section 13(3A).

-

The Hook: Raise disputes about the NPA date, interest calculation, and penal charges.

-

Result: The bank must reply. If they don’t, or if they reply late, the 60-day clock technically resets or becomes open to challenge.

Step 2: Filing the Securitisation Application (SA)

-

Venue: Debts Recovery Tribunal (DRT).

-

Timing: You must file this within 45 days of the bank taking any “measure” (like issuing a Possession Notice).

-

The “Regularization” Plea: Instead of fighting the debt, ask the court to allow “Regularization.” You state: “I am willing to pay the overdue EMIs (say, ₹5 Lakhs) right now. Please stay the auction and let me continue the loan.” Courts often favor this for residential homes.

Step 3: The “Statement of Account” Audit

-

Strategy: In the DRT, file an IA (Interlocutory Application) demanding the bank produce the Memorandum of Interest.

-

The Goal: Banks often use software that calculates interest incorrectly on NPAs or capitalizes penal interest (banned by RBI). Finding a generic error here can force the bank to recalculate, buying you precious months.

Step 4: Challenging the Valuation

-

Strategy: If the Reserve Price is low, challenge it by submitting your own valuation report from a government-approved valuer.

-

Result: The DRT may order a fresh valuation, delaying the auction process.

Part 4: 30 Frequently Asked Questions (FAQ)

1. What is the difference between Section 13(2) and 13(4) notices? Section 13(2) is a warning (Demand Notice) giving you 60 days to pay. Section 13(4) is the action (Possession Notice) where they take control of the asset.

2. Can the bank take physical possession without a court order? No. To physically evict you, they must get an order from the District Magistrate (CMM/DM) under Section 14. They cannot use private recovery agents to throw you out.

3. What is the minimum amount for SARFAESI to apply? The total debt must be more than ₹1 Lakh, and the remaining debt must be more than 20% of the principal and interest.

4. Can I sell the property myself to pay the loan? Yes, but you need the bank’s permission (NOC). The bank usually agrees as it saves them legal costs.

5. Does the DRT always grant a Stay Order? No. They usually grant a stay only if you agree to deposit a portion of the debt (typically 10% to 30%) to prove you are serious.

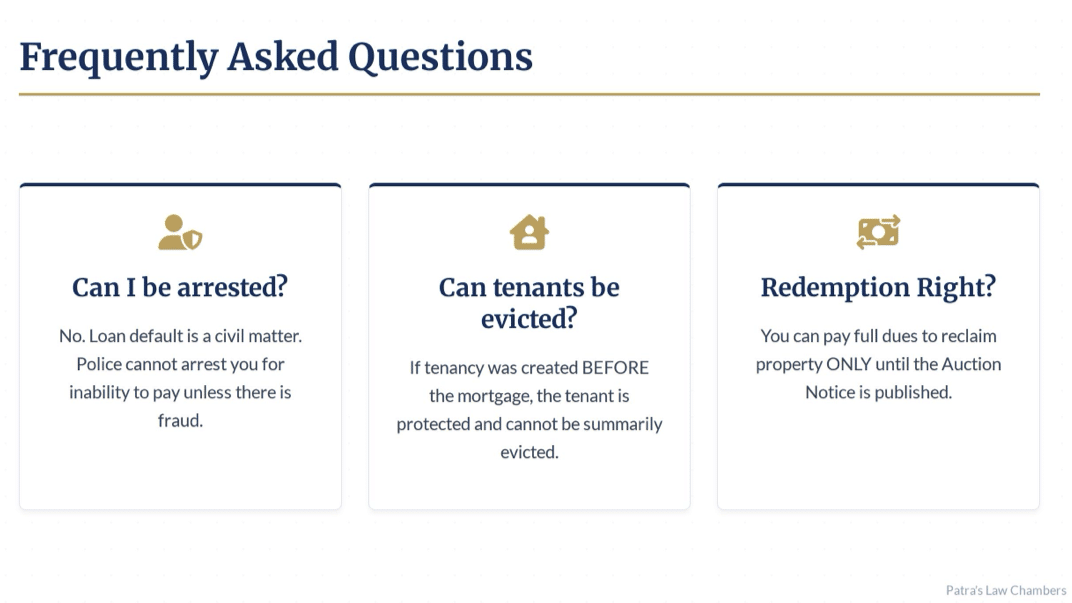

6. What is the “Redemption” right? It is your right to pay the full debt and take your property back. You can exercise this only until the auction notice is published.

7. Can agricultural land be sold under SARFAESI? No. Section 31(i) specifically exempts agricultural land.

8. Is a “Wilful Defaulter” banned from settlement? Not anymore. The June 2023 RBI circular allows settlements with wilful defaulters under strict review.

9. What happens if the bank sells the house for more than the loan amount? The bank must return the excess money to you. They cannot keep the surplus.

10. Can I appeal against the DRT order? Yes, to the DRAT (Appellate Tribunal), but you usually have to deposit 50% of the debt to file an appeal.

11. Does a SARFAESI notice affect my CIBIL? Yes, the NPA status itself severely damages your CIBIL score.

12. Can the police arrest me for loan default? No. Loan default is a civil matter. Police can only intervene if there is fraud or cheating involved.

13. What if I never received the notice? If the bank cannot prove they served the notice (via Registered Post), the entire process can be quashed by the DRT.

14. Can I challenge the auction after it is done? It is very difficult. You must act before the sale is confirmed.

15. What are “Penal Charges”? Fixed charges for late payment. They cannot be added to the principal to generate further interest.

16. How long does a DRT case take? The law says 60-120 days, but in reality, it can take 1 to 3 years depending on the backlog.

17. Can tenants be evicted under SARFAESI? If the tenancy was created before the mortgage, the tenant is protected. If created after without bank consent, they can be evicted.

18. What is an “Interlocutory Application” (IA)? A secondary application filed within the main case to ask for specific urgent relief (like asking for documents or a temporary stay).

19. Can the bank publish my photo in the newspaper? Yes, they often publish photos of “Wilful Defaulters,” but publishing photos of regular defaulters can be challenged as a violation of privacy rights.

20. What if the bank undervalued my property? You must file a valuation objection in the DRT immediately with proof of higher market value.

21. Can I pay just the missed EMIs to stop the auction? Legally, the bank can demand full payment. However, the DRT often allows you to pay missed EMIs + penalty to “regularize” the account.

22. Do I need a lawyer for DRT? Technically no, but SARFAESI law is highly technical. Representing yourself is risky.

23. What is the limitation period for the bank to recover debt? Generally, 3 years from the date of NPA or the last payment made.

24. Can the bank sell my household furniture? They can technically attach movable assets (hypothecated), but they usually focus on the immovable property (House/Land).

25. What is “Symbolic Possession”? When the bank sticks a notice on your door saying “We have taken possession” but you still live inside.

26. What is “Physical Possession”? When the bank (via Magistrate order) physically takes the keys and locks the property.

27. Can I get a One Time Settlement (OTS) after the auction notice? Yes, but the bank has the upper hand. You will likely have to pay a higher amount to stop the auction.

28. Are Co-operative banks covered under SARFAESI? Yes, a 2020 Supreme Court judgment confirmed Co-op banks can use SARFAESI.

29. What happens to the Guarantor? The Guarantor is equally liable. The bank can sell the Guarantor’s property even before the Borrower’s property.

30. Who can help me draft the Section 13(3A) objection? A specialized banking lawyer should draft this to ensure no legal grounds are missed.

Conclusion & Next Steps

The banking system is powerful, but it is not above the law. By leveraging the RBI Circulars and Landmark Judgments listed above, you can turn a hopeless situation into a negotiable one.

Do not ignore the notices. Action is your only remedy.

Need Specialized Legal Help? If you are facing foreclosure or need to file an application in the DRT, Patra’s Law Chambers is here to protect your assets. We specialize in spotting procedural violations that others miss.

-

Patra’s Law Chambers

Kolkata Office:

NICCO HOUSE, 6th Floor, 2, Hare Street, Kolkata-700001 (Near Calcutta High Court)

Delhi Office: House no: 4455/5, First Floor, Ward No. XV, Gali Shahid

Bhagat Singh, Main Bazar Road, Paharganj, New Delhi-110055

Website: www.patraslawchambers.com

Email: [email protected]

Phone: +91 890 222 4444/ +91 9044 04 9044

Disclaimer: This blog is for educational purposes and does not constitute binding legal advice. Each case is unique.

Resources:

1.Borrower Defense Guide

2.RBI Recovery Agents engaged by banks notification

3.RBI Fair Lending Practice – Penal Charges in Loan Accounts notification

4. RBI Framework for Compromise Settlements and Technical Write notification

6.INFOGRAPHICS Facing Foreclosure-Your SARFAESI Act Defense Kit