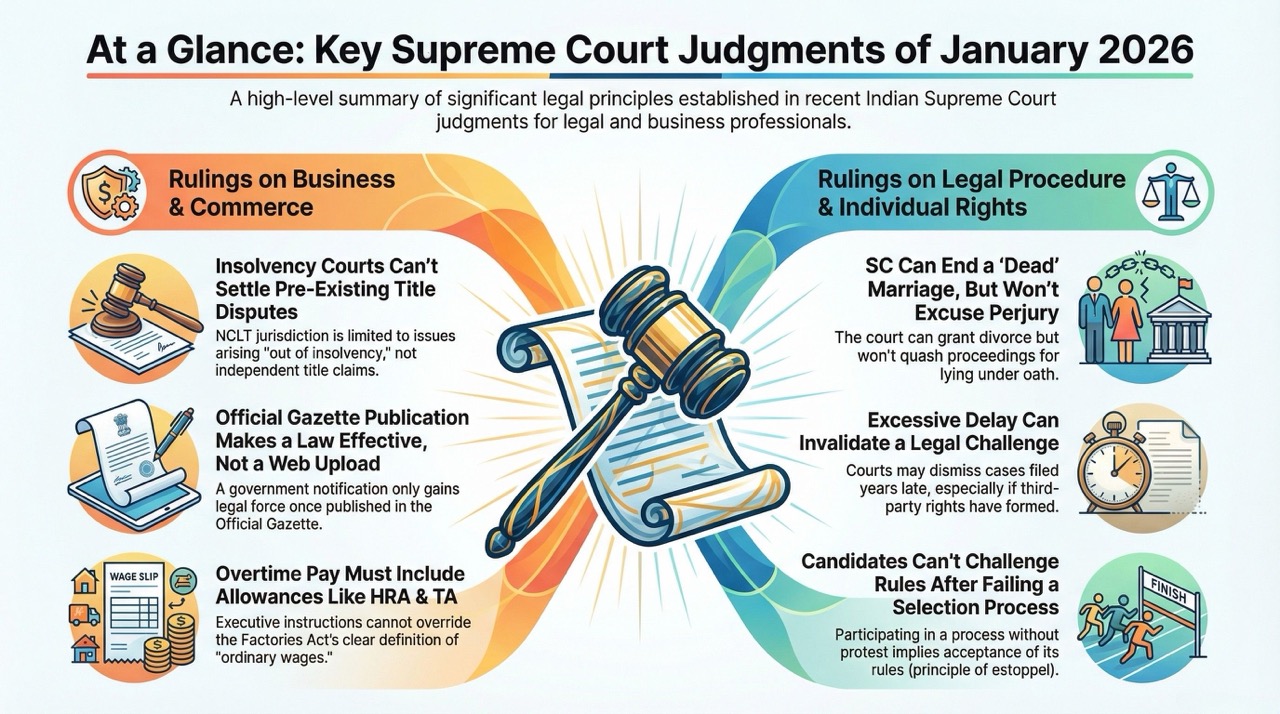

Key takeaways

- Prakash Atlanta v. NHAI: Cess effective only after constitution of Welfare Boards; levy unenforceable before administrative machinery existed.

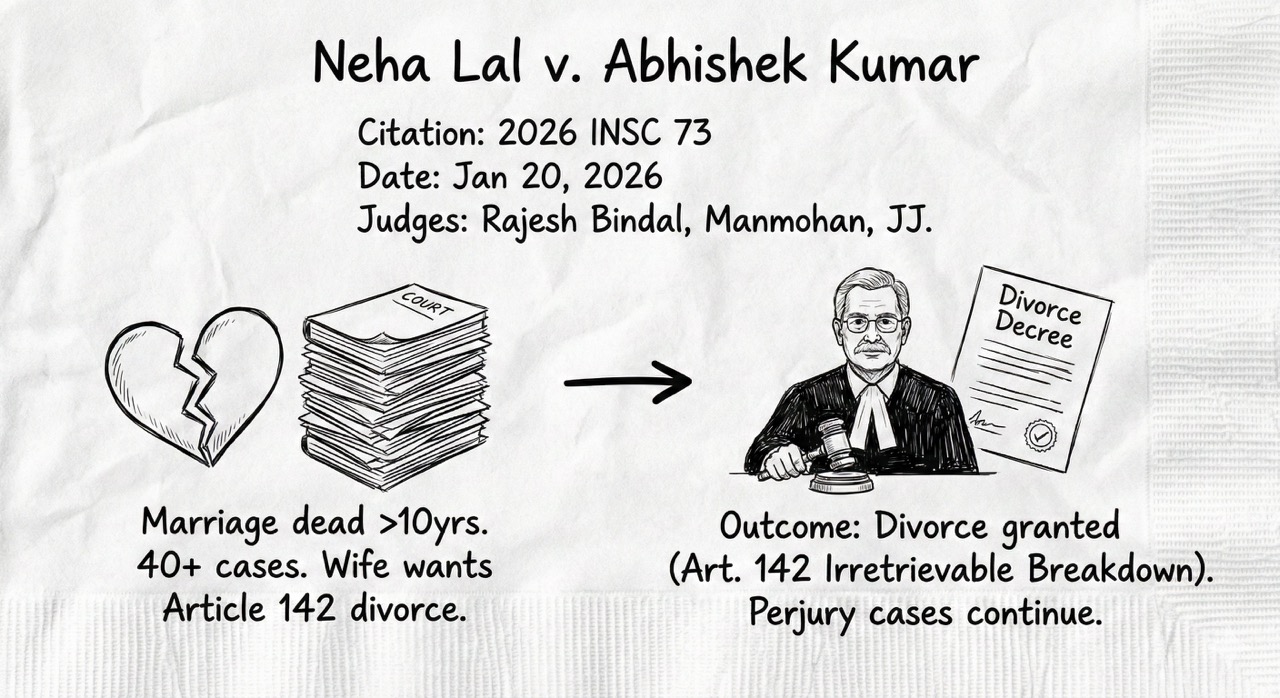

- Neha Lal v. Abhishek Kumar: SC can dissolve marriage under Article 142 despite opposition; perjury proceedings under Section 340 CrPC must continue.

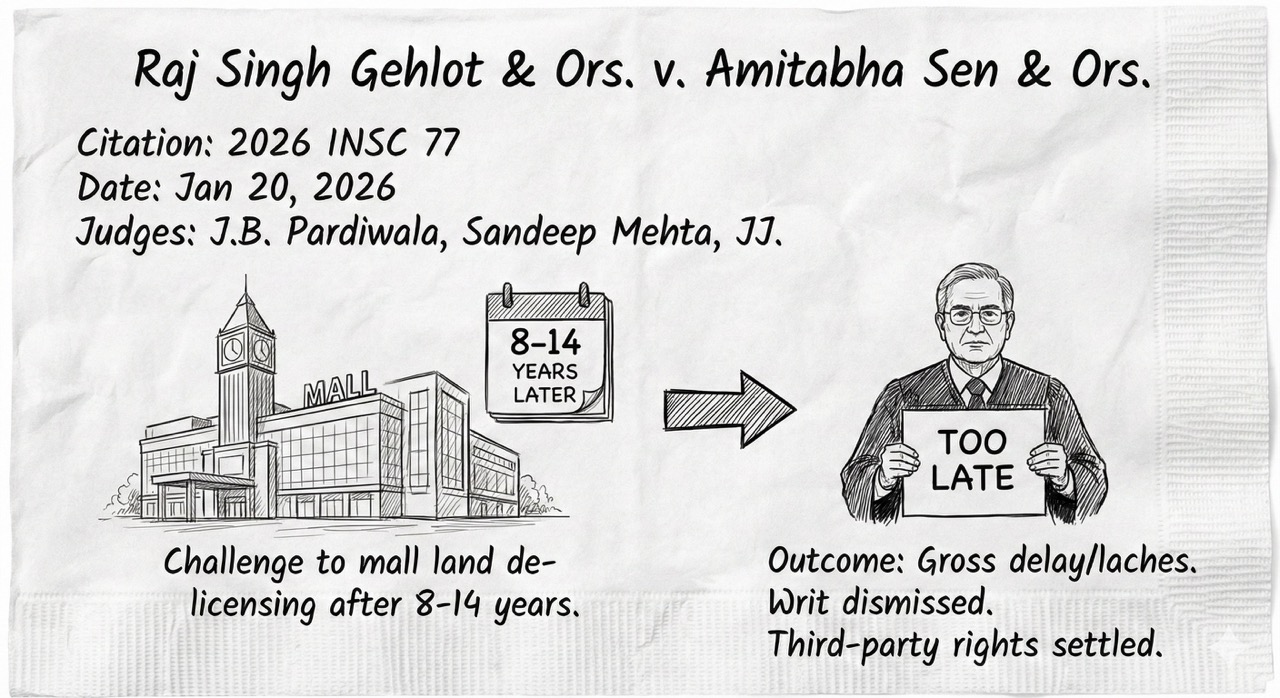

- Raj Singh Gehlot v. Amitabha Sen: Gross delay and laches bar writs once third‑party rights settle; NGT needs substantial environmental question to intervene.

- Hemalatha v. Tukaram: Registered sale presumed valid; mortgage by conditional sale requires the reconveyance condition in the same document (Section 58(c) TP Act).

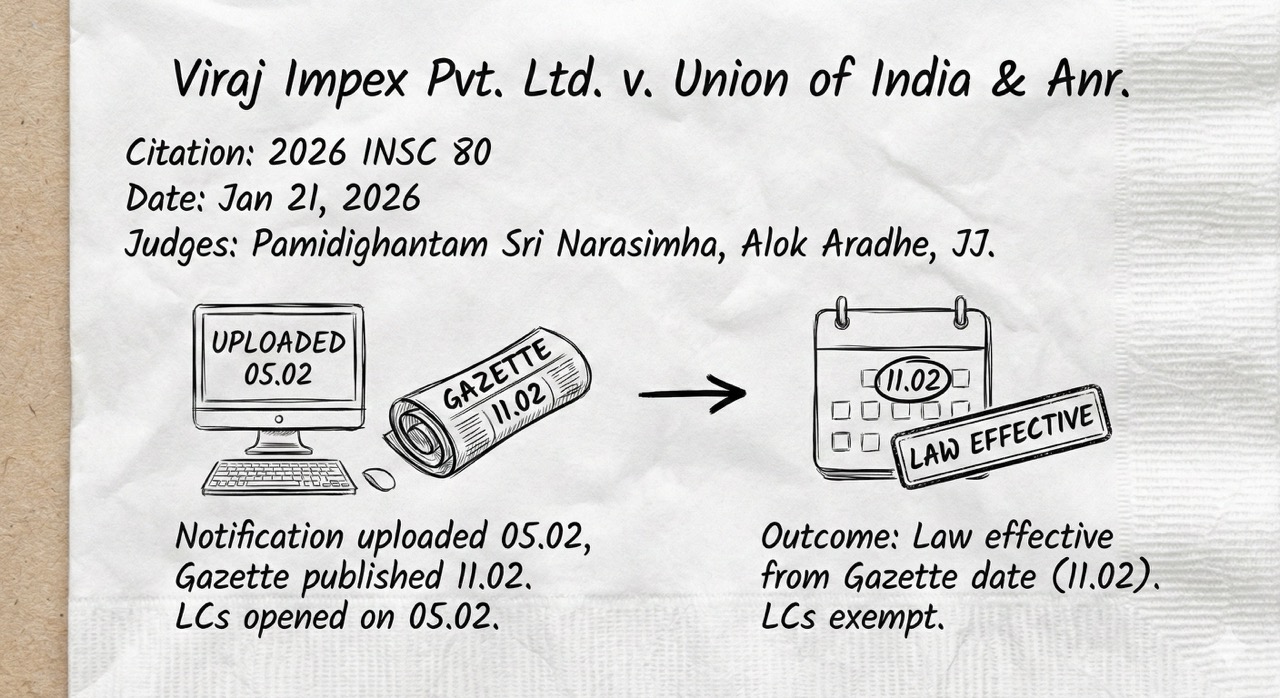

- Viraj Impex v. Union of India: Delegated legislation gains force only on Official Gazette publication; mere uploading/signing is ineffective.

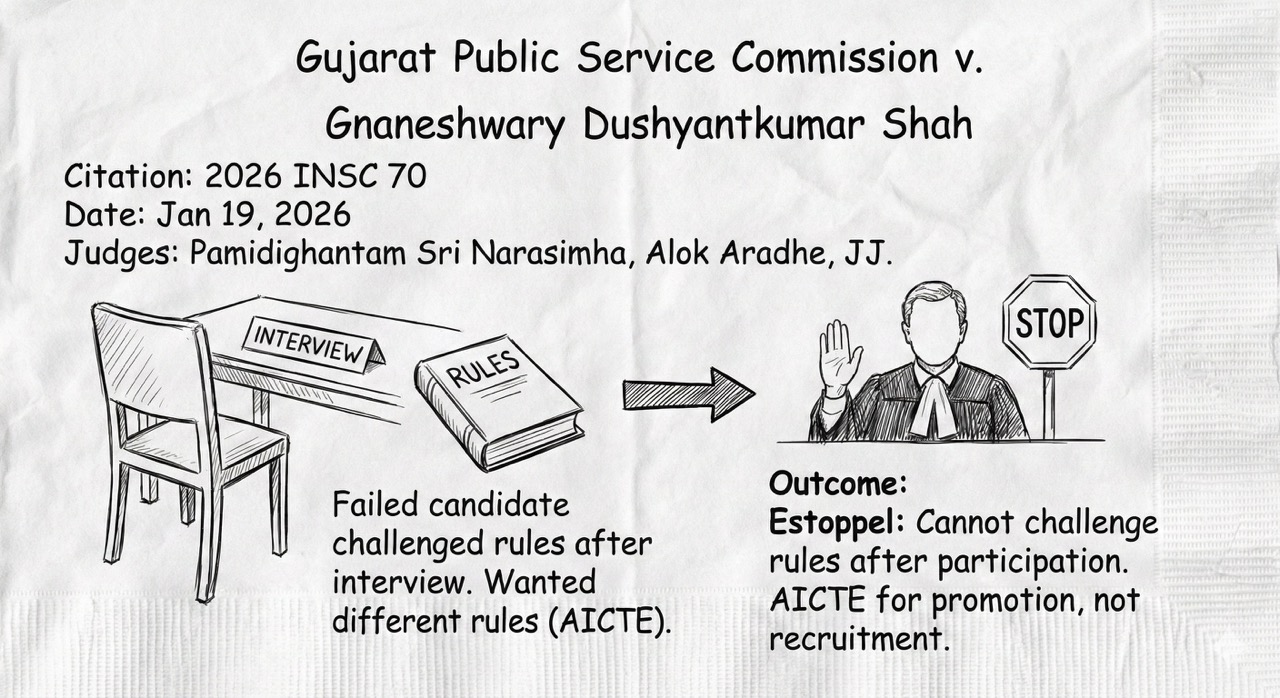

- GPSC v. G.D. Shah: Candidates who participate without protest are estopped from later challenging selection criteria; promotion norms cannot substitute for recruitment rules.

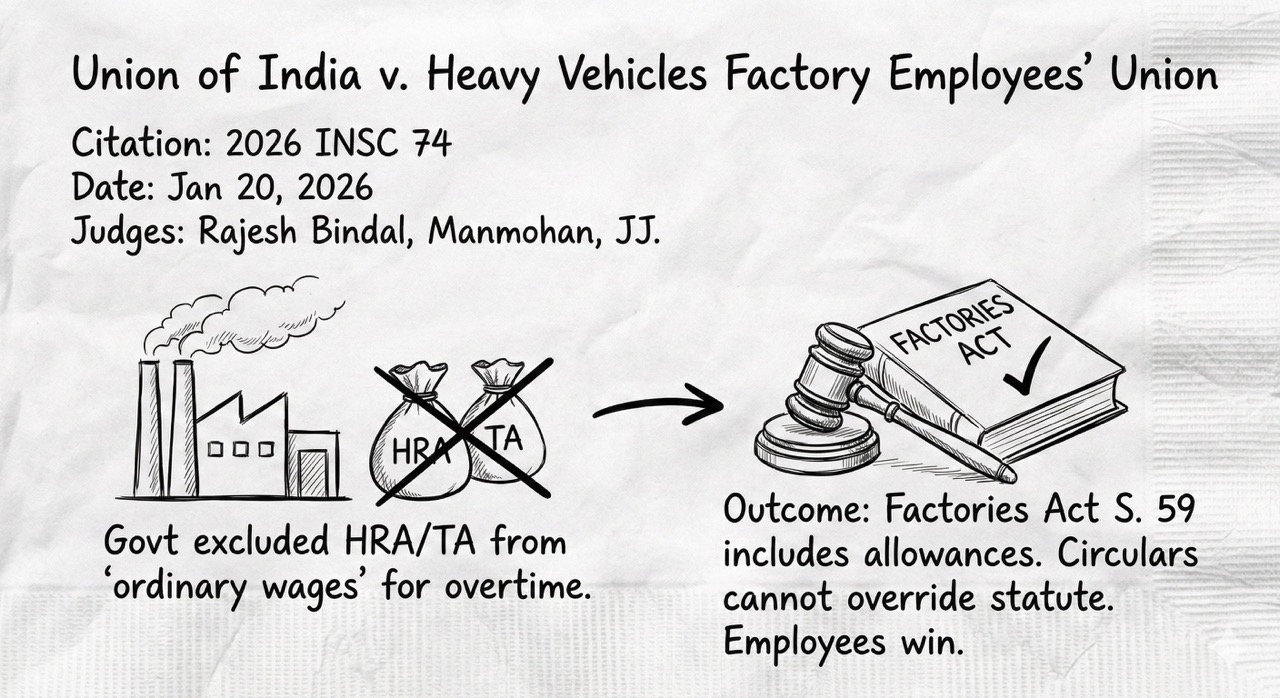

- Union of India v. Heavy Vehicles Factory: "Ordinary rate of wages" for overtime under Section 59 includes allowances like HRA and TA; executive circulars cannot override statute.

Supreme Court Weekly Roundup (Jan 20-23, 2026)

| Case Name | Core Legal Principle |

| Prakash Atlanta v. NHAI | A levy (Cess) is only effective once the administrative machinery (Welfare Boards) is constituted. |

| Neha Lal v. Abhishek Kumar | The SC can grant divorce under Art. 142 despite opposition, but perjury cases (Sec 340 CrPC) cannot be quashed. |

| Raj Singh Gehlot v. Amitabha Sen | Writ petitions filed after gross delay (laches) are liable to be dismissed, especially after third-party rights settle. |

| Hemalatha v. Tukaram | For a mortgage by conditional sale, the condition must be in the same document as the sale (Sec 58(c) TP Act). |

| Viraj Impex v. Union of India | Delegated legislation (Notifications) becomes law only upon Gazette publication, not signing or uploading. |

| GPSC v. G.D. Shah | Candidates are estopped from challenging selection criteria after they have participated in the process. |

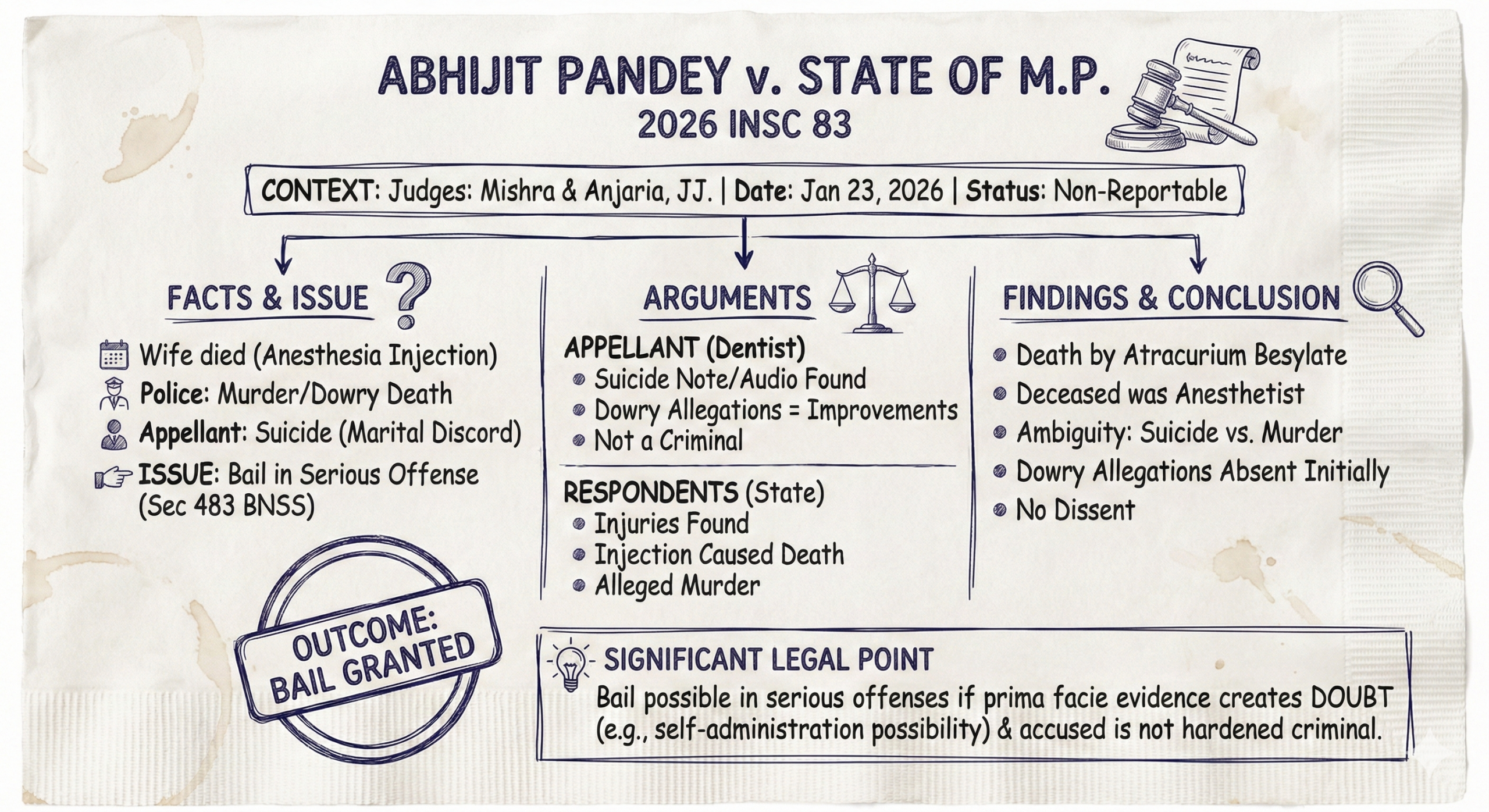

| Abhijit Pandey v. State of MP | Bail may be granted in serious cases if prima facie evidence (like a suicide note) creates doubt in the murder theory. |

| Gloster Ltd. v. Gloster Cables | NCLT cannot decide independent title/trademark disputes that do not “arise out of” the insolvency process. |

| UOI v. Heavy Vehicles Factory | “Ordinary rate of wages” for overtime must include HRA and TA as per Section 59 of the Factories Act. |

Contributor of the article:

Patra’s Law Chambers:

- Kolkata Office: NICCO HOUSE, 6th Floor, 2, Hare Street, Kolkata-700001 (Near Calcutta High Court)

- Delhi Office: House no: 4455/5, First Floor, Ward No. XV, Gali Shahid Bhagat Singh, Main Bazar Road, Paharganj, New Delhi-110055

- Website: www.patraslawchambers.com

- Email: [email protected]

- Phone: +91 890 222 4444 / +91 9044 04 9044

- If you want to get legal consultation regarding any law-related matter please click here.

1. Prakash Atlanta (JV) v. National Highways Authority of India

• Citation: 2026 INSC 76 (Civil Appeal No. 4513 of 2025 with connected matters)

• Status: Reportable

• Judges: Sanjay Kumar and Alok Aradhe, JJ.

• Date of Judgment: January 20, 2026

• Brief Facts: The dispute arose from arbitral awards regarding NHAI contracts. The core issue was whether the Building and Other Construction Workers (Regulation of Employment and Conditions of Service) Act, 1996 (BOCW Act) and the Cess Act constituted “subsequent legislation” under the contract clauses. Although enacted in 1996, the administrative machinery (Welfare Boards) required for implementation was constituted much later in the respective states (after the contractors submitted bids).

• Legal Issue: Whether the BOCW Act and Cess Act qualify as ‘subsequent legislation’ entitling contractors to reimbursement, given they were enacted prior to the contracts but implemented effectively (via Welfare Boards) only after the bid submission dates.

• Arguments:

◦ Appellants (Contractors): Argued that without Welfare Boards, the levy mechanisms were non-existent. The effective enforcement via Board constitution after their bids constituted ‘subsequent legislation’.

◦ Respondent (NHAI): Argued that the Acts came into force in 1995/1996 and the cess rate was notified in 1996, so contractors should have factored it into bids regardless of the Board’s constitution.

• Actual Findings & Conclusions:

◦ Sine Qua Non: The constitution of Welfare Boards is a sine qua non for giving effect to the Acts. Without Boards, cess could not be legally collected or deposited.

◦ Subsequent Legislation: Since Welfare Boards were constituted after the bids, the implementation qualified as ‘subsequent legislation’.

◦ Unjust Enrichment: Contractors could not have factored cess into bids when the collection mechanism did not exist; doing so would have been unjust enrichment.

◦ Arbitral Interference: The arbitral tribunals’ interpretation was plausible and not patently illegal, warranting no interference under Section 34/37 of the Arbitration Act.

◦ Dissenting Opinion: None.

◦ Result: NHAI’s appeals dismissed. Prakash Atlanta’s appeal allowed.

• Significant Legal Point: A statute imposing a levy (cess) cannot be enforced in the absence of the necessary administrative machinery (Welfare Boards); its effective implementation date for contractual purposes is tied to the constitution of such machinery.

• Cited Judgments & Relevance:

◦ Dewan Chand Builders and Contractors v. Union of India (2012) 1 SCC 101: Cited to affirm that the Cess Act became operative in Delhi only after Rules were notified and the Board constituted.

◦ A. Prabhakara Reddy and Company v. State of Madhya Pradesh (2016) 1 SCC 600: Relied upon to establish that the constitution of the Welfare Board is a condition precedent for levy and collection.

◦ Associate Builders v. Delhi Development Authority (2015) 3 SCC 49: Cited regarding the limited scope of interference with arbitral awards.

Prakash Atlanta (JV) v. National Highways Authority of India.pdf

——————————————————————————–

2. Neha Lal v. Abhishek Kumar

• Citation: 2026 INSC 73 (Transfer Petition (Crl.) No. 338 of 2025)

• Status: Reportable

• Judges: Rajesh Bindal and Manmohan, JJ.

• Date of Judgment: January 20, 2026

• Brief Facts: The parties married in 2012 but lived together for only 65 days. They filed over 40 cases against each other (criminal, divorce, domestic violence, perjury). The wife sought dissolution of marriage under Article 142.

• Legal Issue: Whether the Supreme Court should exercise Article 142 power to dissolve a marriage on the ground of irretrievable breakdown despite the husband’s opposition and pending perjury proceedings.

• Arguments:

◦ Petitioner (Wife): Cited irretrievable breakdown due to decade-long separation and multiple litigations.

◦ Respondent (Husband): Opposed divorce, alleging the wife filed false cases and committed perjury. Argued divorce shouldn’t shield her from perjury consequences.

• Actual Findings & Conclusions:

◦ Irretrievable Breakdown: The marriage was dead (separated >10 years, 65 days cohabitation). Continuation was unjustified.

◦ Article 142: The Court exercised discretion to dissolve the marriage to do “complete justice,” overruling the husband’s lack of consent.

◦ Perjury Cases: While matrimonial cases were quashed, the Court held that applications regarding perjury (Section 340 CrPC) must continue to protect the stream of justice.

◦ Dissenting Opinion: None.

◦ Costs: Both parties fined ₹10,000 for using courts to settle scores.

• Significant Legal Point: While dissolving a marriage under Article 142 due to irretrievable breakdown, the Court cannot quash proceedings relating to perjury as no one can be permitted to pollute the stream of justice.

• Cited Judgments & Relevance:

◦ Shilpa Sailesh v. Varun Sreenivasan (2023) 14 SCC 231: Constitution Bench judgment cited as authority that SC can grant divorce under Art. 142 even if one spouse opposes.

◦ Kusha Duruka v. The State of Odisha 2024 INSC 46: Cited to affirm that perjury proceedings cannot be settled/quashed.

Neha Lal v. Abhishek Kumar.pdf

——————————————————————————–

3. Raj Singh Gehlot & Ors. v. Amitabha Sen & Ors.

• Citation: 2026 INSC 77 (Civil Appeal @ SLP (C) No. 11480 of 2020 and connected matters)

• Status: Reportable

• Judges: J.B. Pardiwala and Sandeep Mehta, JJ.

• Date of Judgment: January 20, 2026

• Brief Facts: A developer (Ambience) obtained a license in 1993 for a residential colony on 18.98 acres. In 2001, 8 acres were de-licensed to build a commercial complex (Ambience Mall). Residents challenged this in 2015 (14 years later). The High Court in 2020 quashed the de-licensing and ordered a CBI probe.

• Legal Issue: Validity of the High Court order entertaining a highly belated writ petition and quashing the de-licensing of land.

• Arguments:

◦ Appellants (Developer): The writ was barred by gross delay (laches). De-licensing was valid and retrospectively validated by 2020 Amendment. Layout always showed restricted residential area (10.98 acres).

◦ Respondents (Residents): Developer fraudulently reduced residential area. De-licensing was illegal and authorities connived.

• Actual Findings & Conclusions:

◦ Delay: The High Court erred in ignoring the gross delay. Residents approached the court 8 years after the Mall was operational.

◦ De-licensing Validity: The DTCP passed a reasoned order in 2021 (pursuant to another HC order) upholding the de-licensing. The 2020 Amendment to the 1975 Act retrospectively validated de-licensing powers.

◦ Factual Error: The HC erred in assuming the residential colony was to be on 18.98 acres; the layout plan showed 10.98 acres.

◦ NGT (Civil Appeal 872-874/2021): NGT proceedings stayed/held in abeyance as specific property disputes are not substantial environmental questions.

◦ Dissenting Opinion: None.

• Significant Legal Point: Gross delay and laches are decisive in writ jurisdiction; rights cannot be agitated years after third-party rights have settled. A “substantial question relating to environment” must be involved for NGT jurisdiction, not just property plan deviations.

• Cited Judgments & Relevance:

◦ Bharat Singh v. State of Haryana AIR 1988 SC 534: Cited to emphasize that writ petitioners must plead and prove facts with cogent evidence.

◦ Auroville Foundation v. Navroz Kersasp Mody (2025) 4 SCC 150: Relied upon to limit NGT’s jurisdiction regarding statutory violations of property/planning laws.

Raj Singh Gehlot & Ors. v. Amitabha Sen & Ors.pdf

——————————————————————————–

4. Hemalatha (D) By LRs. v. Tukaram (D) By LRs. & Ors.

• Citation: 2026 INSC 82 (Civil Appeal No. 6640 of 2010)

• Status: Reportable

• Judges: Rajesh Bindal and Manmohan, JJ.

• Date of Judgment: January 22, 2026

• Brief Facts: Plaintiff sold a house via a registered Sale Deed in 1971 and executed a Rental Agreement the same day. He later claimed the transaction was a sham/mortgage for a loan. The High Court allowed his claim relying on Gangabai.

• Legal Issue: Whether a registered Sale Deed can be declared a “sham” based on oral evidence (S. 92 Evidence Act) and if the transaction was a mortgage by conditional sale.

• Arguments:

◦ Appellants: Registered deed presumption applies. Plaintiff paid rent, admitting sale. S. 92 bars oral evidence varying written terms.

◦ Respondents: Transaction was security for a loan. Possession not handed over. Cited Gangabai to allow oral evidence.

• Actual Findings & Conclusions:

◦ Presumption: A registered document carries a strong presumption of validity.

◦ Mortgage by Conditional Sale: Under Section 58(c) of the TP Act, the condition for reconveyance must be in the same document. Here, it wasn’t; thus, it was an outright sale.

◦ Conduct: Plaintiff paid rent and replied to a legal notice admitting arrears, disproving his claim.

◦ Dissenting Opinion: None.

◦ Result: Appeal allowed; suit dismissed.

• Significant Legal Point: A registered document cannot be lightly declared sham. For a mortgage by conditional sale, the condition must be embodied in the document effecting the sale (Proviso to S. 58(c) TP Act).

• Cited Judgments & Relevance:

◦ Gangabai v. Chhabubai (1982) 1 SCC 4: Distinguished. In Gangabai, the document was never intended to be acted upon. Here, parties acted upon it (paid rent).

◦ Prem Singh v. Birbal (2006) 5 SCC 353: Cited for the presumption of validity of registered documents.

Hemalatha (D) By LRs. v. Tukaram (D) By LRs. & Ors.pdf

——————————————————————————–

5. Viraj Impex Pvt. Ltd. v. Union of India & Anr.

• Citation: 2026 INSC 80 (Civil Appeal @ SLP (C) No. 1979 of 2019)

• Status: Reportable

• Judges: Pamidighantam Sri Narasimha and Alok Aradhe, JJ.

• Date of Judgment: January 21, 2026

• Brief Facts: A Notification imposing Minimum Import Price (MIP) on steel was uploaded on 05.02.2016 but published in the Gazette on 11.02.2016. Appellants opened Letters of Credit (LCs) on 05.02.2016. Exemption applied to LCs opened “before the date of this notification”.

• Legal Issue: Whether “date of this notification” refers to the uploading date (05.02) or Gazette publication date (11.02).

• Arguments:

◦ Appellants: Law requires Gazette publication to be effective. Effective date is 11.02.2016. LCs opened on 05.02.2016 are exempt.

◦ Respondents: The text says “date of this notification” which is 05.02.2016.

• Actual Findings & Conclusions:

◦ Effective Date: Delegated legislation is born only upon publication in the Official Gazette. The Notification had no legal force on 05.02.2016.

◦ Dissenting Opinion: None.

◦ Result: “Date of this notification” means 11.02.2016. Appellants entitled to exemption.

• Significant Legal Point: A notification under the Foreign Trade Act acquires the force of law only upon publication in the Official Gazette, not upon mere uploading or signing.

• Cited Judgments & Relevance:

◦ Harla v. State of Rajasthan 1951 SCC 936: Natural justice requires laws to be promulgated/published to be operative.

◦ B.K. Srinivasan v. State of Karnataka (1987) 1 SCC 658: Publication is indispensable for enforceability of subordinate legislation.

Viraj Impex Pvt. Ltd. v. Union of India & Anr.pdf

——————————————————————————–

6. Gujarat Public Service Commission v. Gnaneshwary Dushyantkumar Shah

• Citation: 2026 INSC 70 (Civil Appeal @ SLP (C) No. 27710 of 2025)

• Status: Not Specified

• Judges: Pamidighantam Sri Narasimha and Alok Aradhe, JJ.

• Date of Judgment: January 19, 2026

• Brief Facts: Candidate failed GPSC interview for Professor. She challenged the selection, arguing AICTE Regulations (promotion criteria) should apply instead of State Rules (interview based).

• Legal Issue: Whether AICTE Regulations (2012) apply to direct recruitment conducted under State Rules.

• Arguments:

◦ Appellant (GPSC): Candidate participated without protest and is estopped. AICTE norms were for promotion (CAS), not direct recruitment.

◦ Respondent: AICTE Regulations prevail over State Rules.

• Actual Findings & Conclusions:

◦ Applicability: AICTE Regulations were for “Career Advancement Scheme” (promotion) of incumbents, not direct recruitment. State Rules apply.

◦ Estoppel: A candidate who participates in selection without protest cannot challenge rules after failing.

◦ Dissenting Opinion: None.

• Significant Legal Point: Regulations crafted as a ladder (promotion) cannot be used as a gate (recruitment). Candidates are estopped from challenging selection criteria after participation.

• Cited Judgments & Relevance:

◦ Anupal Singh v. State of Uttar Pradesh (2020) 2 SCC 173: Cited for the principle of estoppel preventing a candidate from challenging the selection process after participation.

Gujarat Public Service Commission v. Gnaneshwary Dushyantkumar Shah.pdf

——————————————————————————–

7. Abhijit Pandey v. The State of Madhya Pradesh

• Citation: 2026 INSC 83 (Criminal Appeal @ SLP (Crl.) No. 16817 of 2025)

• Status: Non-Reportable

• Judges: Prashant Kumar Mishra and N.V. Anjaria, JJ.

• Date of Judgment: January 23, 2026

• Brief Facts: Appellant’s wife died of anesthesia injection. Police alleged murder/dowry death. Appellant claimed suicide due to marital discord/infidelity allegations.

• Legal Issue: Entitlement to bail under Section 483 BNSS (Section 439 CrPC) in serious offence.

• Arguments:

◦ Appellant: Suicide note/audio recording found. Dowry allegations were improvements. Appellant is a dentist, not a criminal.

◦ Respondents: Injuries found. Injection caused death. Alleged murder.

• Actual Findings & Conclusions:

◦ Prima Facie Case: Death by Atracurium Besylate (anesthesia); deceased was anesthetist. Dowry allegations absent in first instance. Ambiguity between suicide and murder.

◦ Dissenting Opinion: None.

◦ Result: Bail granted.

• Significant Legal Point: Bail can be granted in serious offences if prima facie evidence creates doubt regarding the prosecution’s version (e.g., possibility of self-administration of injection) and accused is not a hardened criminal.

——————————————————————————–

8. Gloster Limited v. Gloster Cables Limited

• Citation: 2026 INSC 81 (Civil Appeal No. 2996 of 2024)

• Status: Reportable

• Judges: J.B. Pardiwala and K.V. Viswanathan, JJ.

• Date of Judgment: January 22, 2026

• Brief Facts: Dispute over “Gloster” trademark during CIRP. Resolution Plan acknowledged the dispute. NCLT declared trademark belonged to Corporate Debtor (CD) and SRA. NCLAT set this aside.

• Legal Issue: Whether NCLT has jurisdiction under Section 60(5) IBC to declare title to a trademark or modify a Resolution Plan to grant ownership.

• Arguments:

◦ SRA (Appellant): Transfer to GCL was mala fide/void. NCLT has jurisdiction.

◦ GCL (Respondent): Title dispute does not arise “out of insolvency”. Assignment occurred pre-CIRP. Plan only gave right to use.

• Actual Findings & Conclusions:

◦ Jurisdiction: NCLT jurisdiction is limited to issues “arising out of insolvency.” Independent title disputes based on pre-CIRP agreements do not fall within this.

◦ Resolution Plan: The Plan acknowledged rival claims. NCLT cannot modify an approved plan by granting a definitive declaration of title contrary to the Plan’s text.

◦ Avoidance: NCLT erred in examining transactions under S. 43/45 without an RP application.

◦ Dissenting Opinion: None.

• Significant Legal Point: Section 60(5) IBC does not empower NCLT to adjudicate independent title disputes or modify an approved Resolution Plan to grant rights not contained therein.

• Cited Judgments & Relevance:

◦ Embassy Property Developments Pvt. Ltd. v. State of Karnataka (2020) 13 SCC 308: NCLT cannot decide matters of public law/independent rights under guise of insolvency.

◦ SREI Multiple Asset Investment Trust Vision India Fund v. Deccan Chronicle Marketeers (2023) 7 SCC 295: Direct precedent that NCLT cannot declare ownership of trademarks if Plan only granted right to use.

Gloster Limited v. Gloster Cables Limited.pdf

——————————————————————————–

9. Union of India v. Heavy Vehicles Factory Employees’ Union

• Citation: 2026 INSC 74 (Civil Appeal Nos. 5185-5192 of 2016)

• Status: Reportable

• Judges: Rajesh Bindal and Manmohan, JJ.

• Date of Judgment: January 20, 2026

• Brief Facts: Govt circulars excluded House Rent Allowance (HRA), Transport Allowance (TA), etc., from “ordinary rate of wages” for overtime calculation. Employees challenged this.

• Legal Issue: Whether allowances (HRA, TA) fall within “ordinary rate of wages” under Section 59(2) of the Factories Act, 1948.

• Arguments:

◦ Appellant (UOI): Circulars excluded allowances to ensure uniformity. Disparity in allowances justifies exclusion.

◦ Respondents: Section 59(2) explicitly includes “basic wages plus such allowances.” Only bonus/overtime excluded.

• Actual Findings & Conclusions:

◦ Statutory Interpretation: Section 59(2) includes allowances. Only bonus and overtime wages are excluded. Executive circulars cannot add exclusions not contemplated by the Act.

◦ Beneficial Legislation: Factories Act prevents exploitation; restrictive interpretations must be avoided.

◦ Dissenting Opinion: None.

• Significant Legal Point: Executive instructions cannot override the clear definition in a Statute. “Ordinary rate of wages” for overtime under Factories Act must include allowances like HRA/TA.

• Cited Judgments & Relevance:

◦ Gujarat Mazdoor Sabha v. State of Gujarat (2020) 10 SCC 459: Highlighted Factories Act as beneficial legislation; overtime is a bulwark against exploitation.

◦ Bridge and Roofs Co. Ltd. v. Union of India (1962): Distinguished as it related to PF Act where definition differed.