Dedicated Income-Tax Lawyers for Every Notice, Demand & Appeal Call Now For Free Legal Consultation (+91) 890 222 4444 / 7003715325

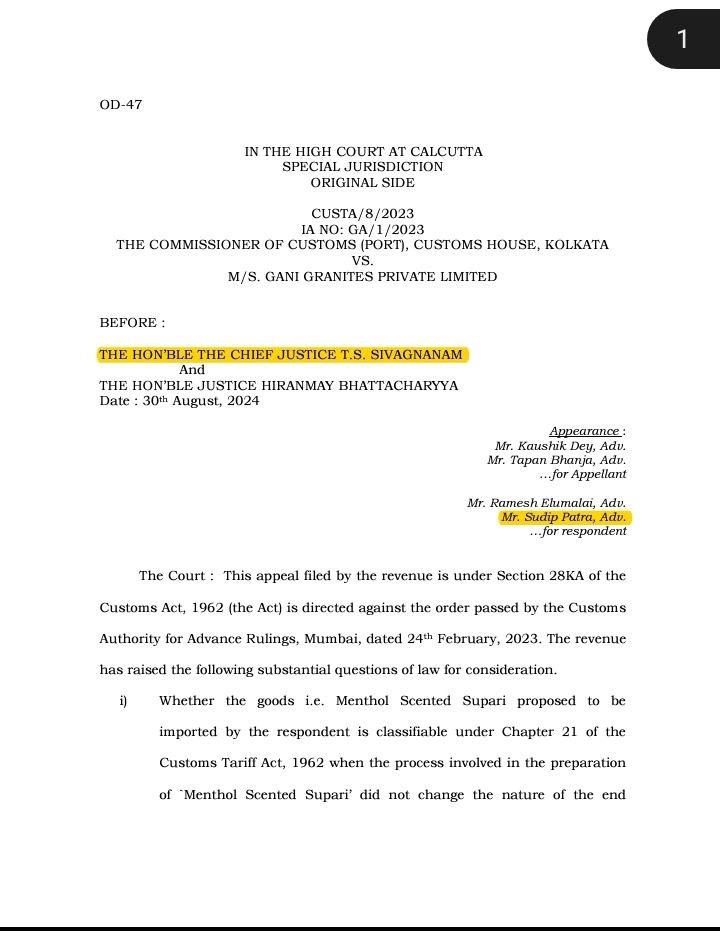

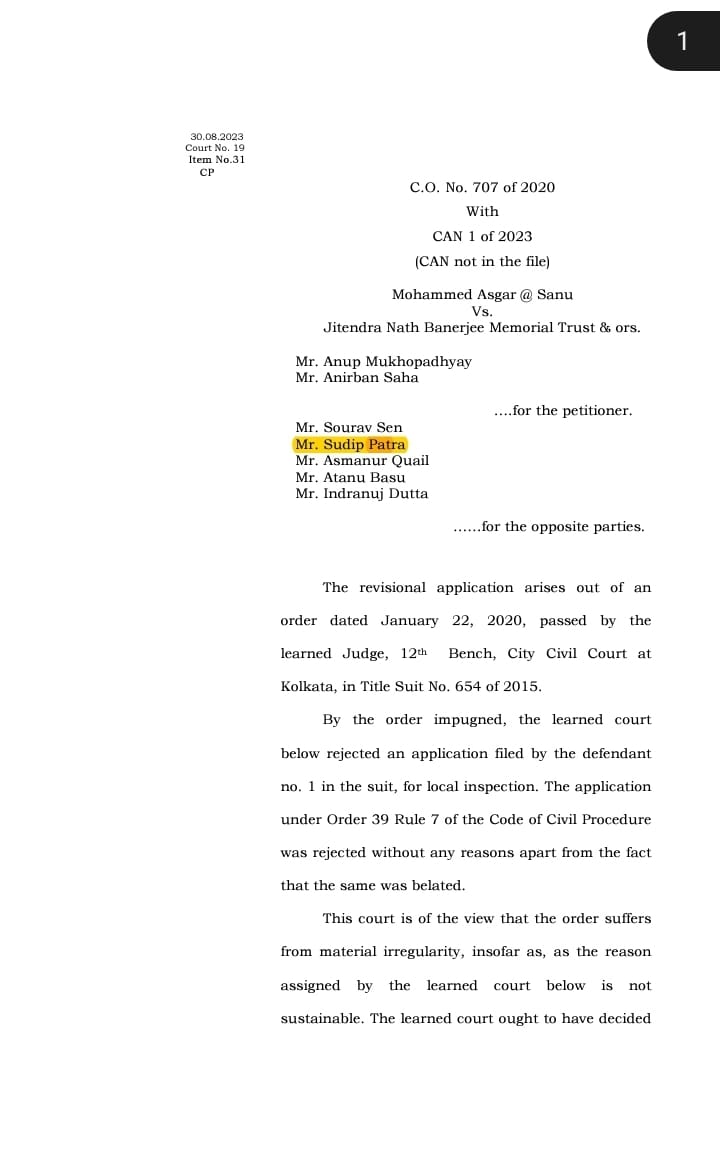

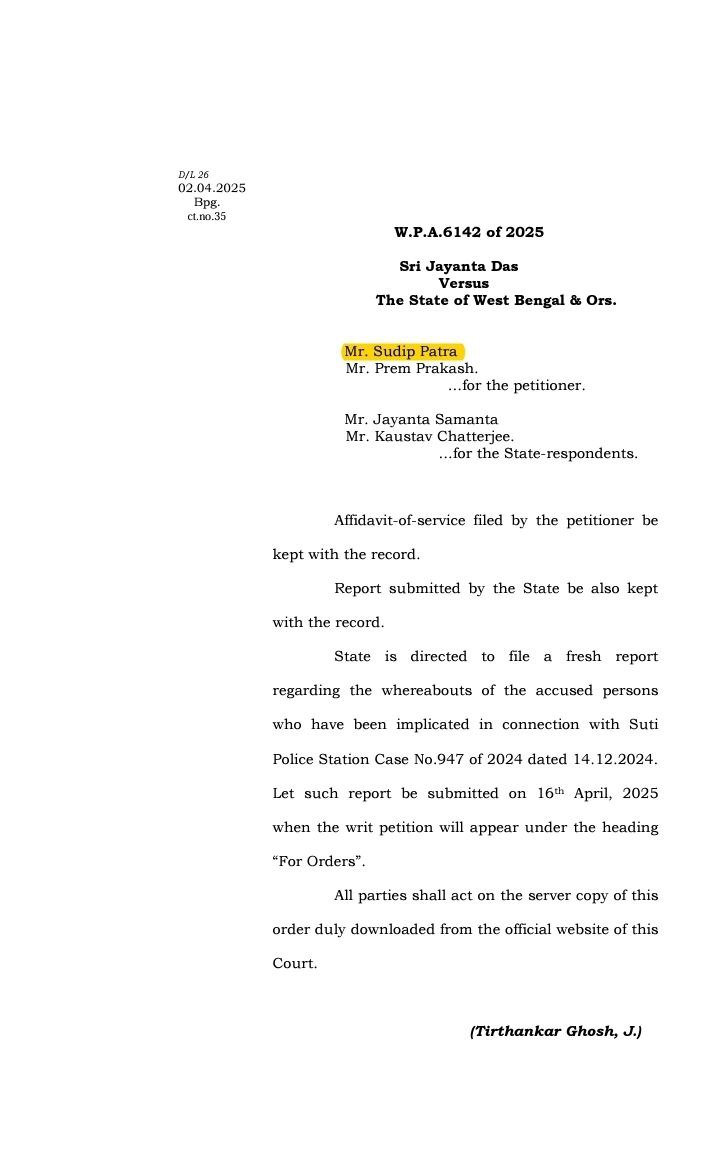

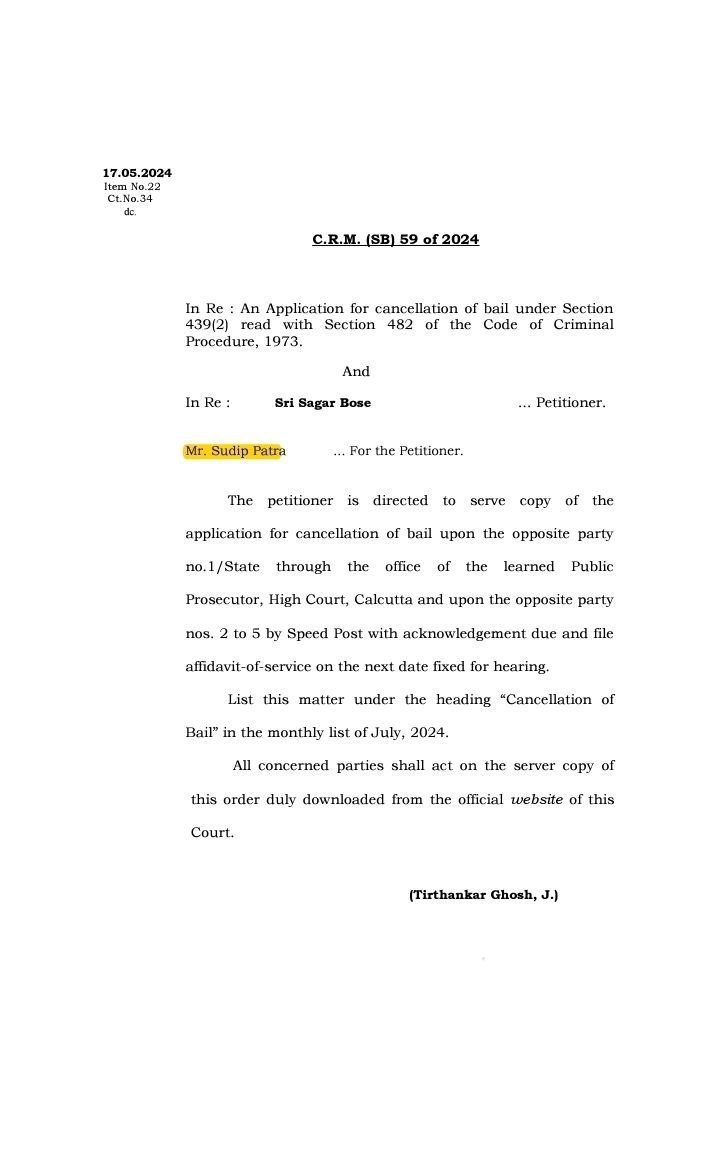

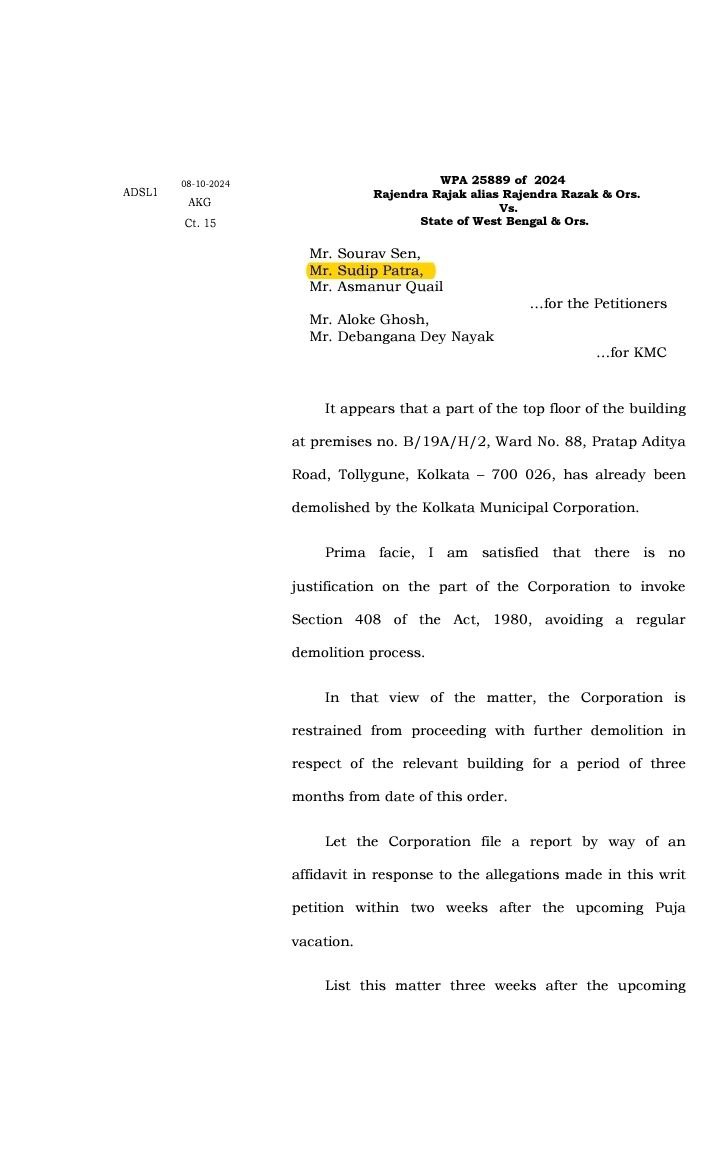

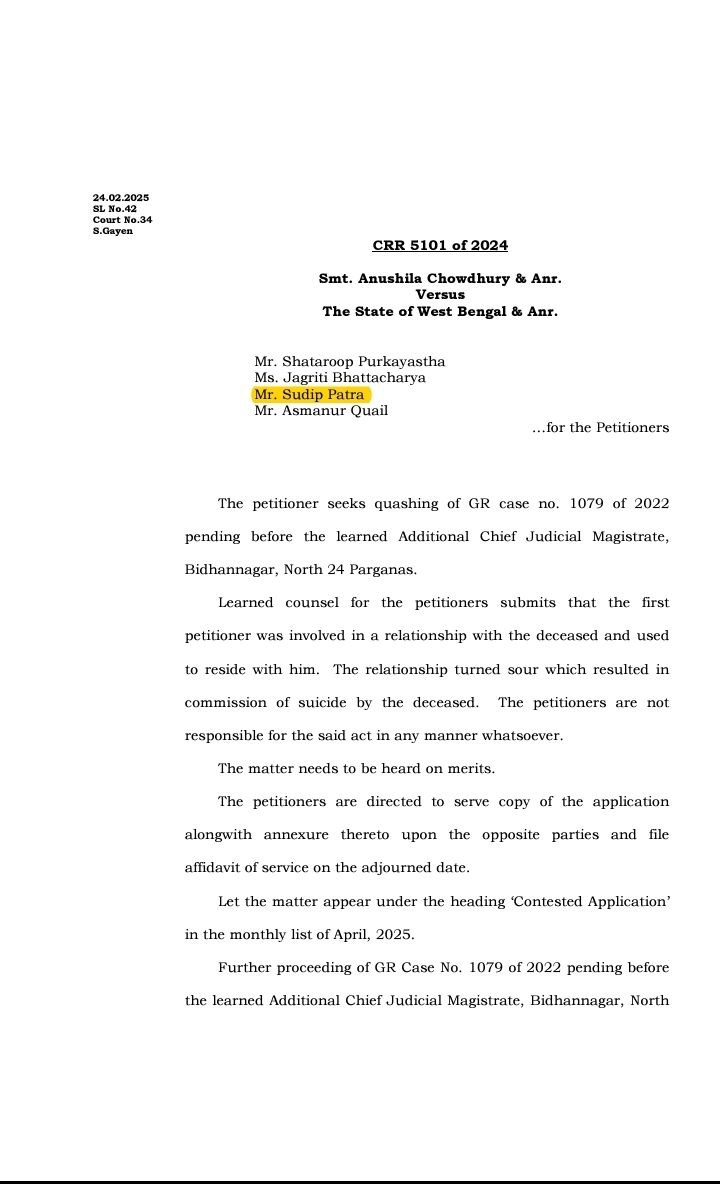

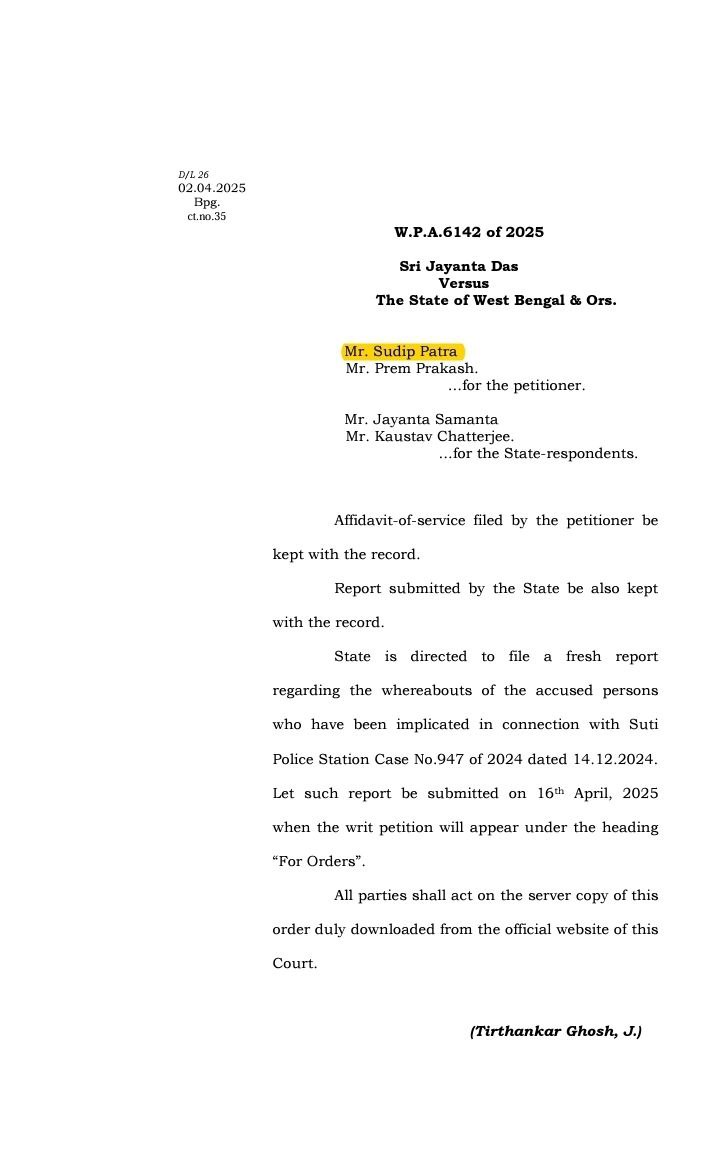

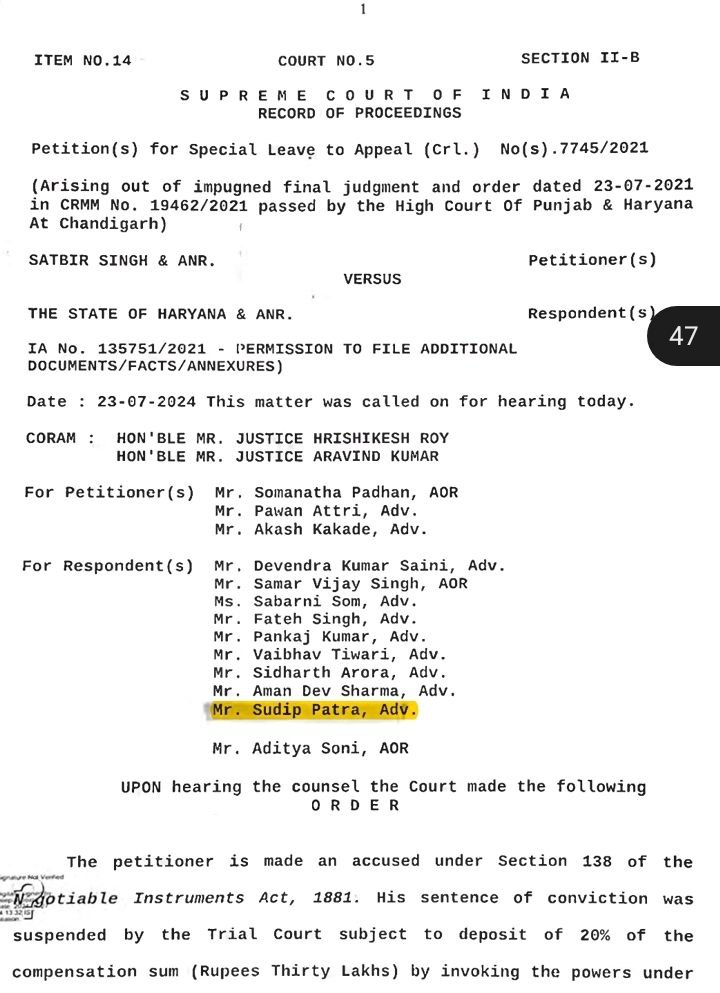

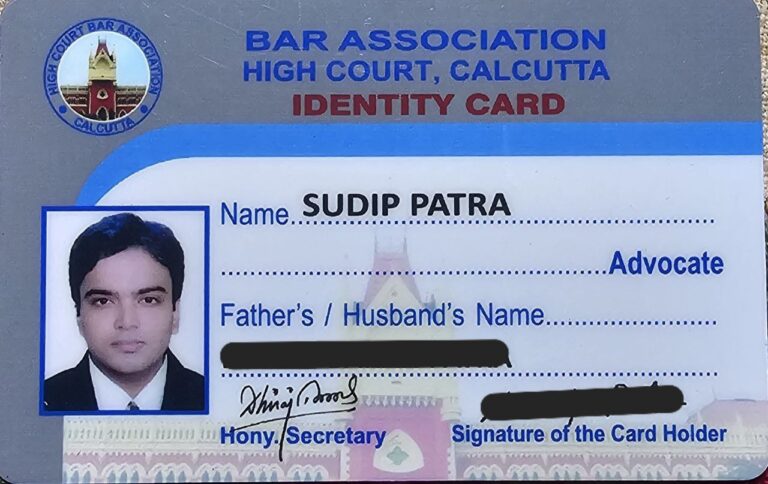

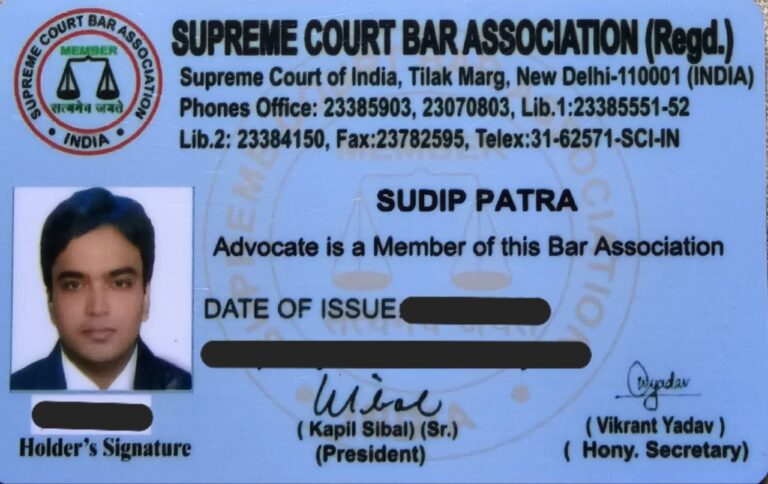

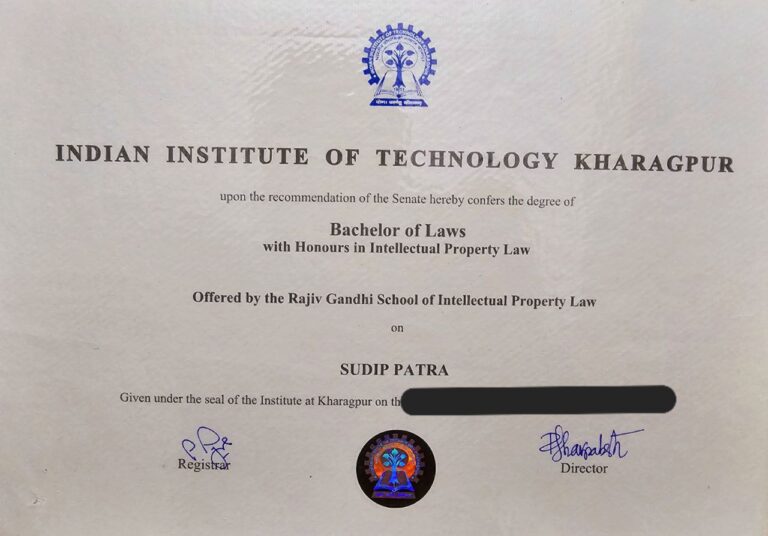

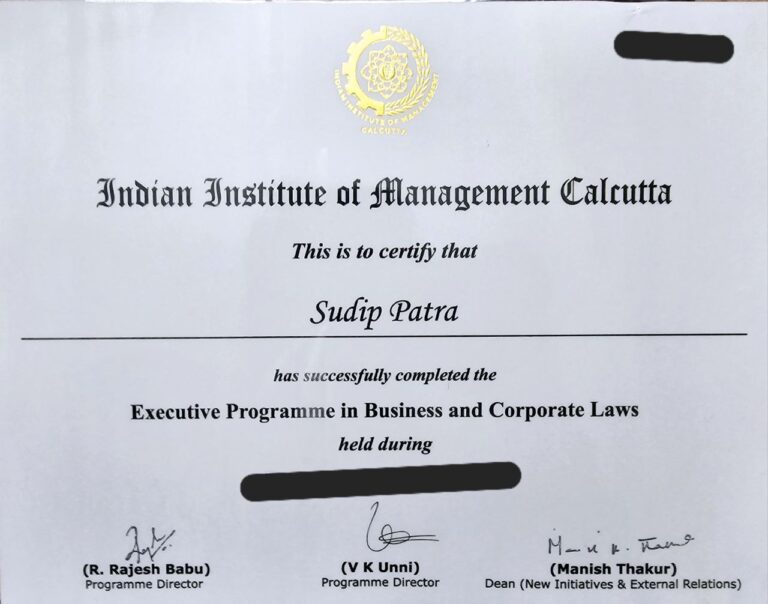

Advocate Sudip Patra : (+91) 890 222 4444/ 9044 09 9044 (From 7.30 p.m.-10.30 p.m.)

Experienced Advocate with more than 10 years of experience.

Patra’s Law Chambers – Experienced Military Lawyers Dedicated to Protecting Your Rights

Facing an income-tax notice? From a simple Section 142 (1) enquiry to a complex Section 148A re-assessment, our experienced advocates draft replies, represent you before the Commissioner (Appeals), ITAT and High Courts, and secure swift resolution of outstanding demands.

📞 Talk to an Income-Tax Advocate Now

Kolkata Office: NICCO HOUSE, 6th Floor, 2 Hare Street, Kolkata 700001

Delhi Office: 1st Floor, House No 4455/VI, Main Bazar Road, Paharganj, New Delhi 110055

Phone: +91 890 222 4444 | +91 9044 04 9044

E-mail: [email protected]

Book a consultation—same-day slots available for urgent Sec 148A or Sec 143 (2) hearings.

Why thousands of taxpayers trust us

What you get | How it helps |

|---|---|

| Rapid 48-hour notice reply draft for Sec 133 (6), 139 (9), 142 (1), 143 (2), 148/148A, 156 | Avoid penalties & ex-parte assessments |

| End-to-end e-filing & portal support | Correct technical errors in ITR, upload annexures, track case status |

| Strategic appeals—CIT (A), ITAT, High Court & SLP | Challenge high-pitched additions, protective assessments & time-barred demands |

| In-depth legal research & past tax judgments | Strengthen arguments with precedents on taxpayer rights |

| Transparent fee plans | No hidden costs; stage-wise billing |

1️⃣ Notice Defence Desk

We handle every code & clause

Sec 133 (6) information requisition

Notice u/s 139 (9) (ITR defects / e-verification failure)

Sec 142 (1) inquiry & document call

Notice u/s 143 (2) (scrutiny assessment)

Sec 148 / 148A income-escaping assessments & show-cause replies

Sec 156 demand notice & adjustment of refunds

Intimations u/s 143 (1) (tax, interest, fee mismatches)

ITR notice for outstanding demand reconciliation.To know more details about an income tax notice and how to reply to them, please click here.

Our team drafts point-by-point, evidence-backed replies that address the Assessing Officer’s questionnaires, mitigate additions, and preserve your appeal rights under Section 250.

2️⃣ Multi-Tier Appeal Practice

Commissioner (Appeals) – CIT (A)

File Form 35 within the statutory 30-day limit

Seek stay on demand under Rule 46A

Income Tax Appellate Tribunal (ITAT)

Argue on facts & law; cite landmark rulings on Sec 148A procedural lapses, Sec 143(2) jurisdiction, Sec 263 revisions, etc.

Draft condonation petitions for delay in filing

High Court Writs & Second Appeals

Challenge natural-justice violations, lack of Sec 148A enquiry, high-pitched assessments (>15× returned income)

Obtain interim stay on coercive recovery

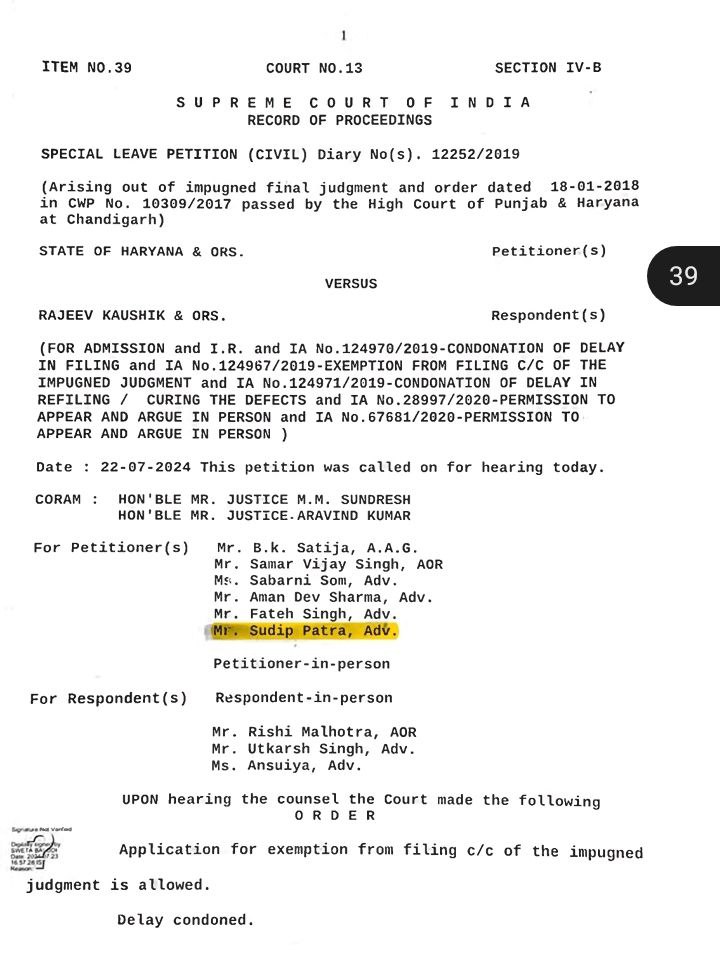

Supreme Court SLP (where warranted)

Frequently Asked Questions

Q. My portal shows an “outstanding demand in income tax”—what now?

A. We verify the CPC computation, file a Rectification u/s 154 or contest through Sec 246A appeal, and request stay of recovery.

Q. Can I challenge a time-barred Sec 148 notice?

A. Yes. Post-Finance Act 2021, Sec 148A mandates prior show-cause & approval— non-compliance is grounds for quash in writ.

Q. I missed the 30-day limit for CIT (A).

A. We draft a detailed condonation affidavit citing reasonable cause under Rule 45(3) and relevant jurisprudence.