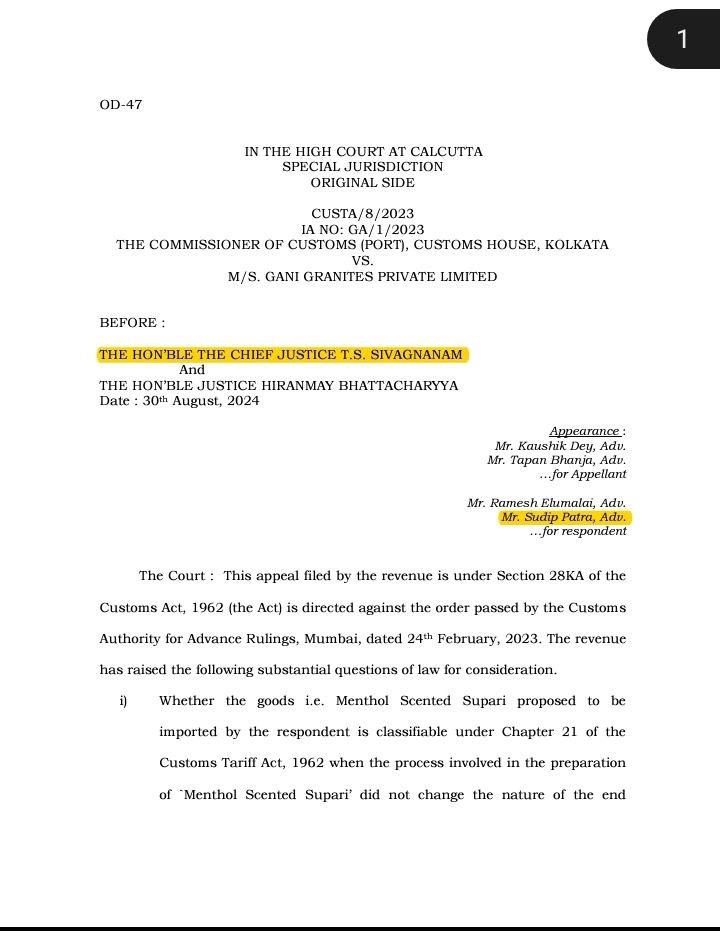

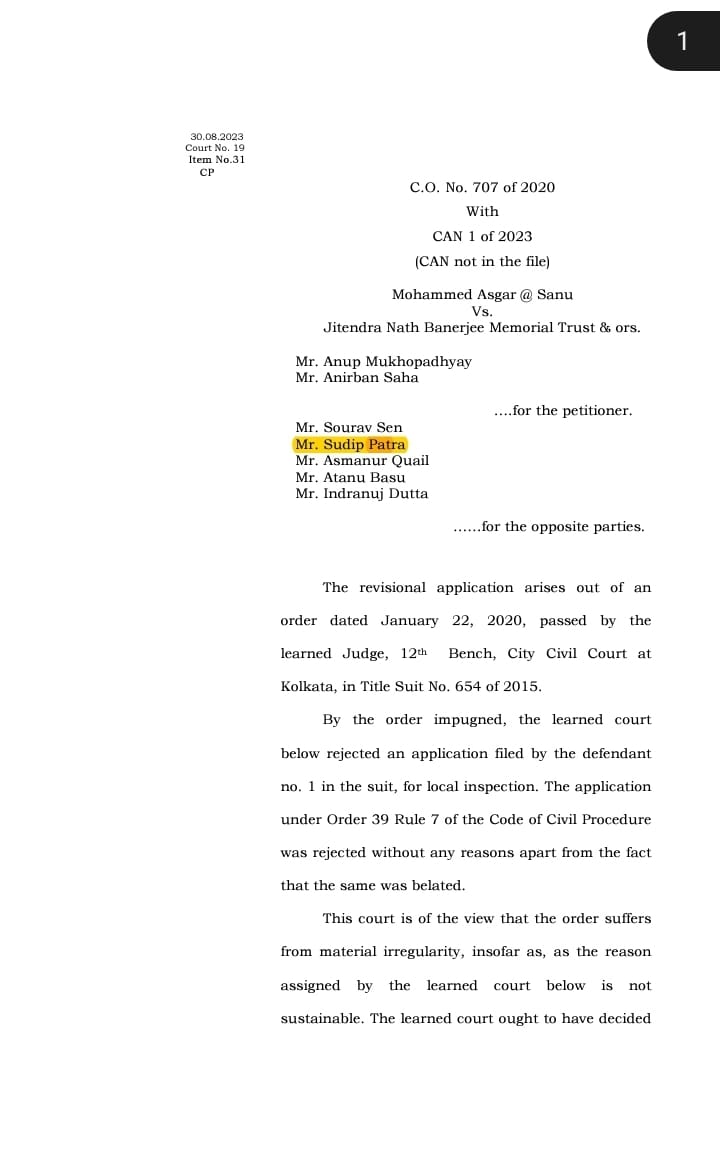

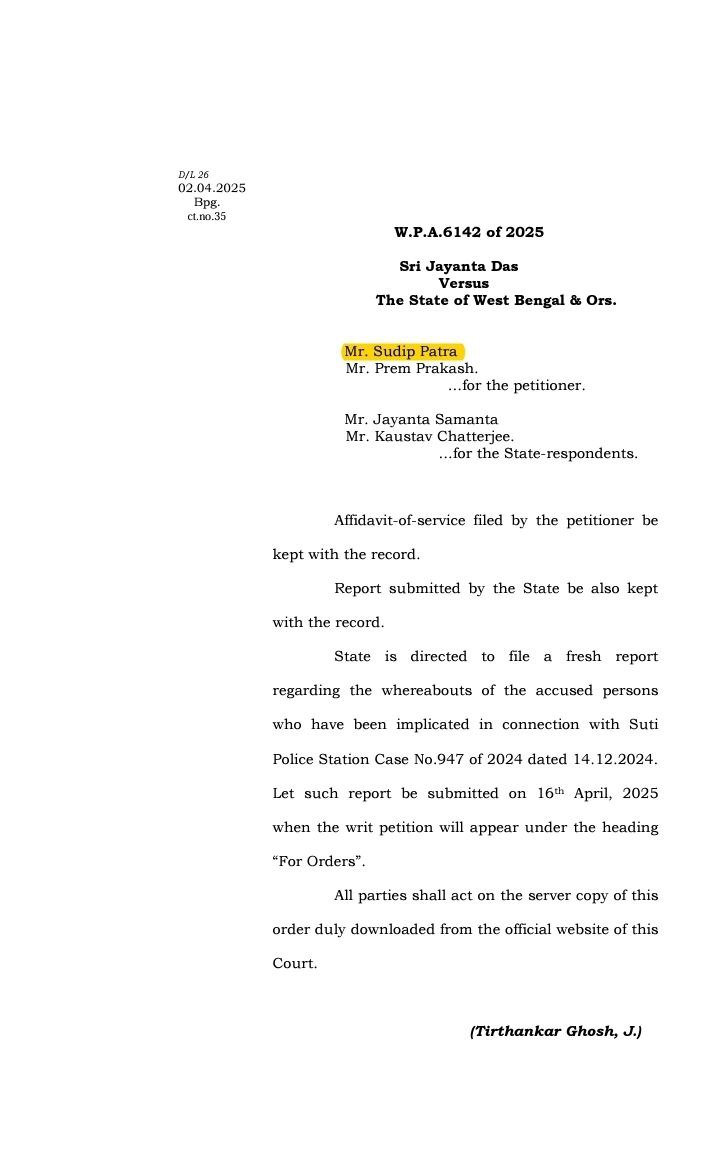

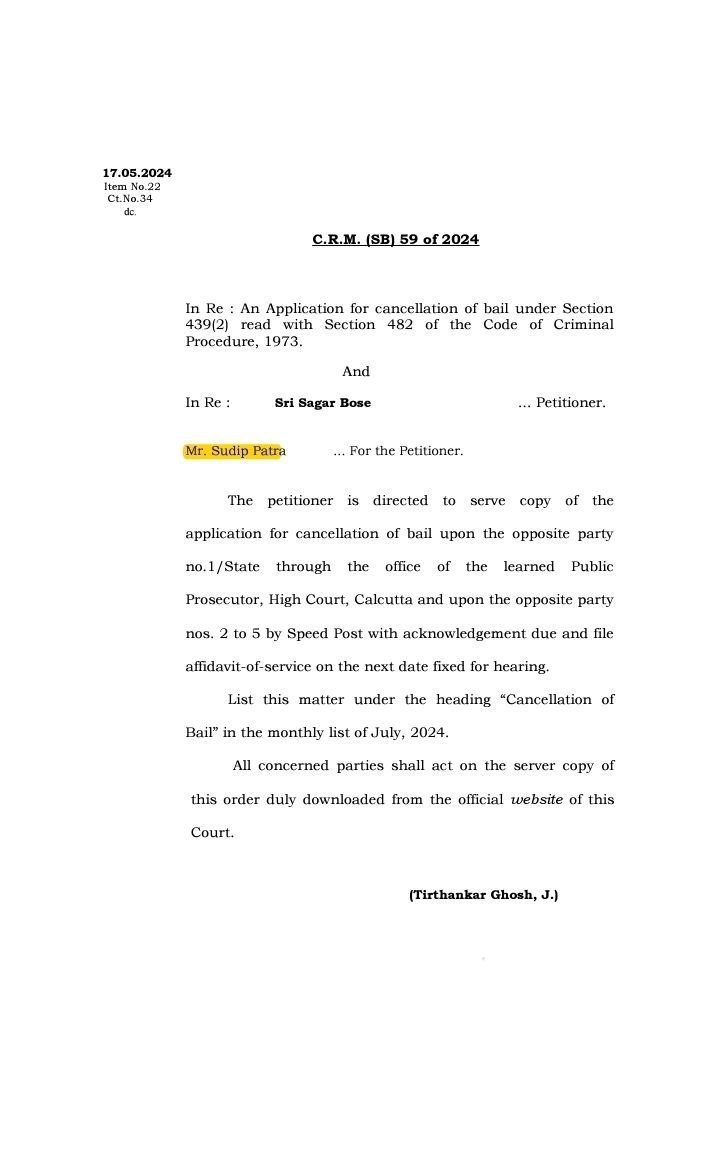

Experienced Calcutta High Court GST Advocate for GST Notice, Tribunal Cases & and Writ matters. Call Now For Free Legal Consultation (+91)890 222 4444 / 7003715325

Advocate Sudip Patra : (+91) 890 222 4444/ 7003715325 (From 7.30 p.m.-10.30 p.m.)

Experienced Advocate with more than 10 years of experience.

GST Notice? Facing an Appeal? Don’t Let Tax Complexities Derail Your Business.

Expert GST Litigation & Advisory to Safeguard Your Enterprise

The Goods and Services Tax (GST) regime, while designed for simplification, has introduced a new landscape of complex compliance requirements, notices, and litigation. A single misstep can lead to show-cause notices, hefty penalties, and protracted legal battles that drain your resources and distract you from your core business.

Patra’s Law Chambers, a premier law firm with offices in Kolkata and Delhi, provides end-to-end legal solutions for all GST-related matters. From proactive compliance to aggressive representation in tribunals and high courts, we are your trusted partner in navigating India’s intricate indirect tax system.

Our Comprehensive GST Legal Services

Our dedicated team, led by Advocate Sudip Patra, offers strategic guidance and robust representation across the entire spectrum of GST law.

1. GST Advisory and Compliance:

GST Registration & Filing: Ensuring your registrations and periodic returns are compliant and accurate.

GST Audits & Health Checks: Proactively reviewing your records to identify and rectify potential non-compliance issues before the authorities do.

Strategic Advisory: Providing expert opinions on complex GST matters, including classification (HSN/SAC), valuation, input tax credit (ITC) claims, and applicability of notifications.

2. Handling Notices and Assessments:

Drafting Replies to Notices: We prepare meticulous, legally sound replies to all departmental communications, including summons, intimations, and Show Cause Notices (SCNs).

Representation during Audits & Assessments: We represent you before GST authorities during departmental audits and assessment proceedings, defending your position and minimizing potential liabilities.

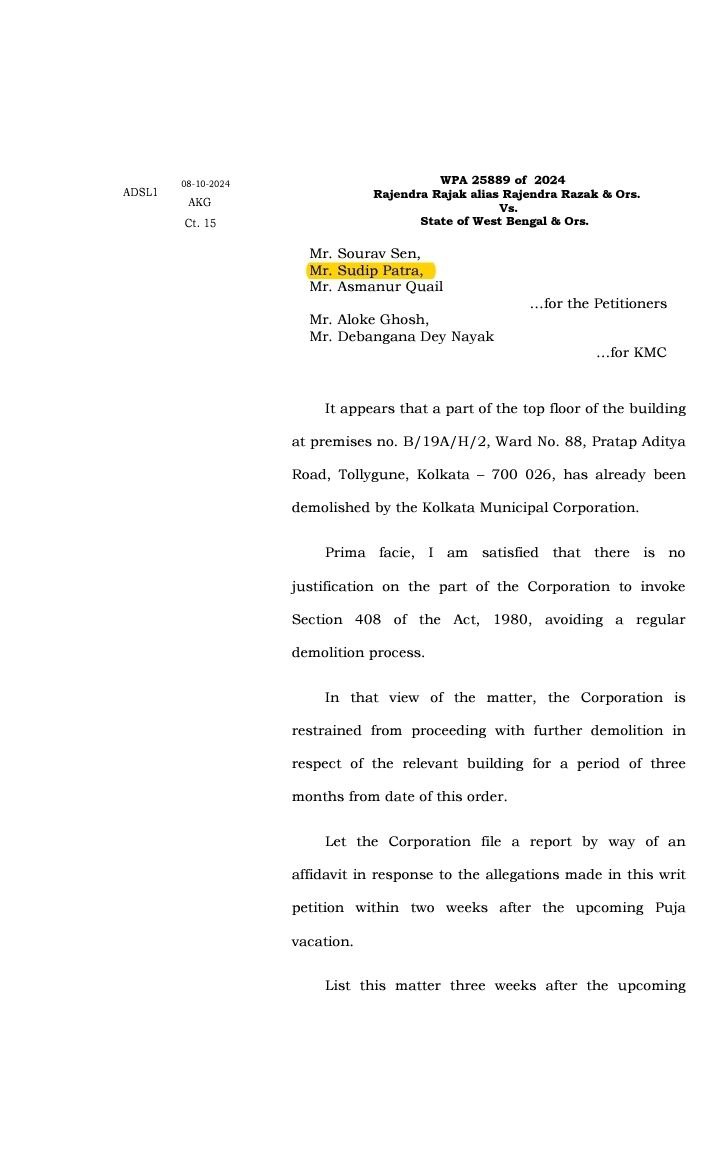

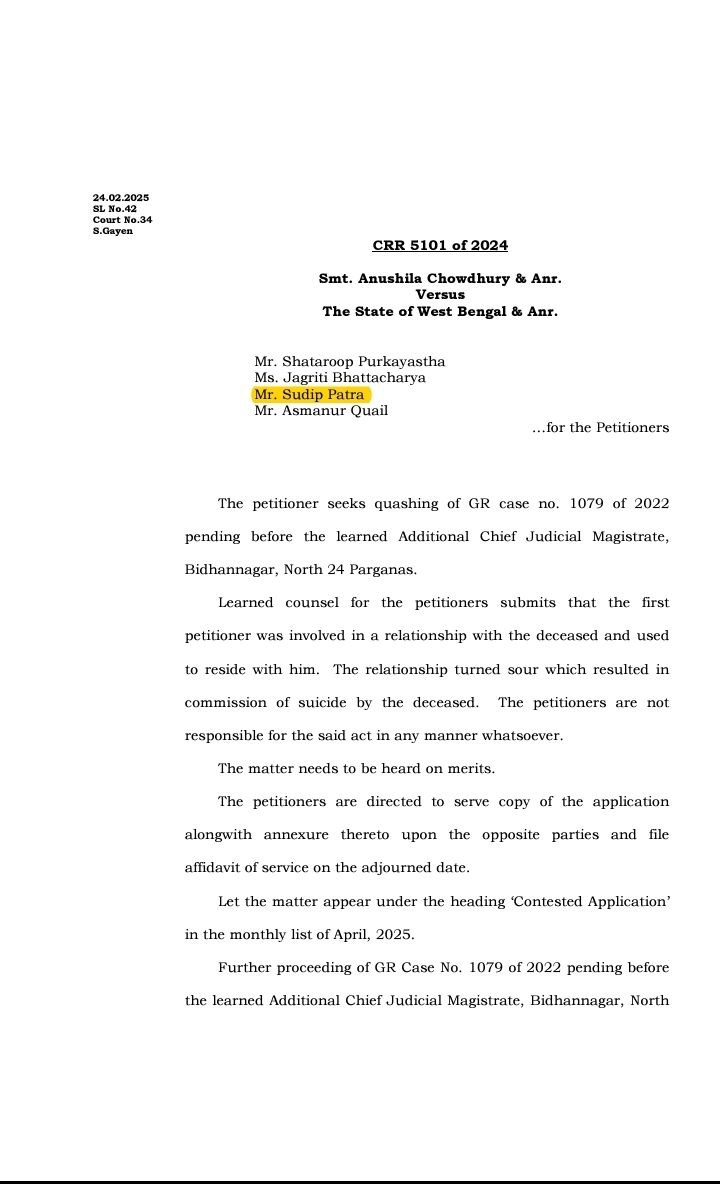

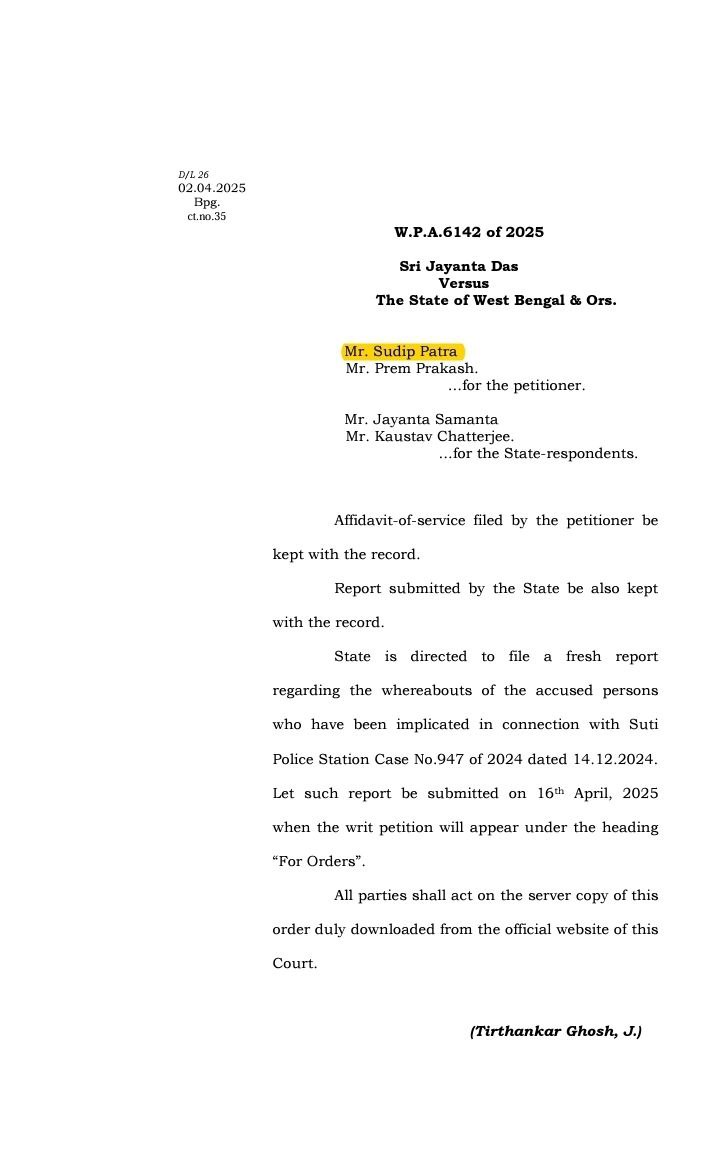

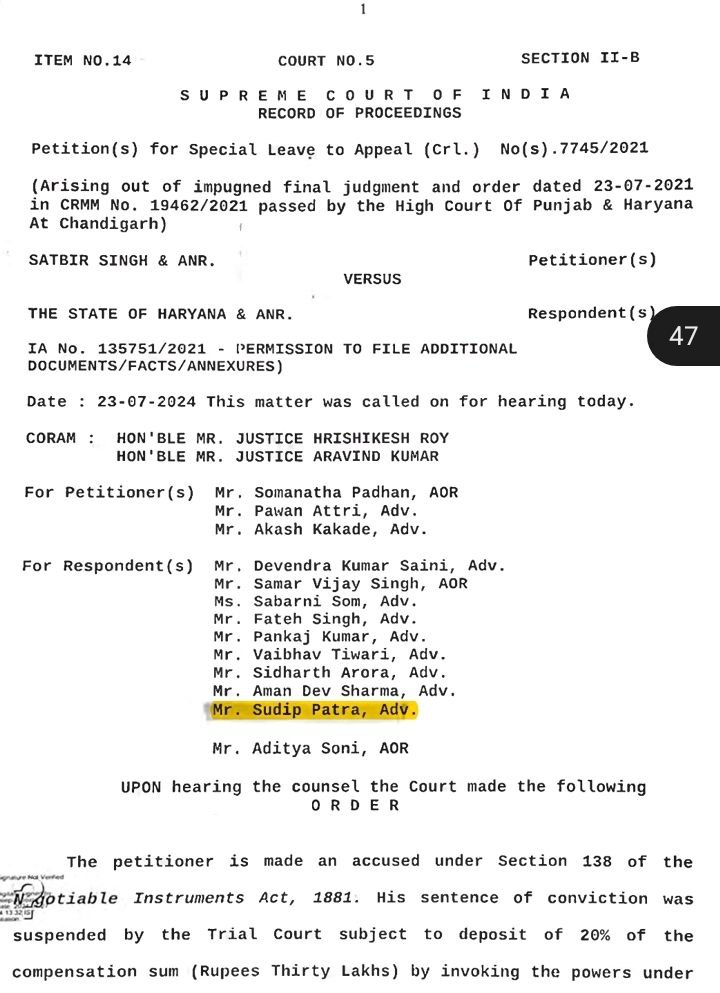

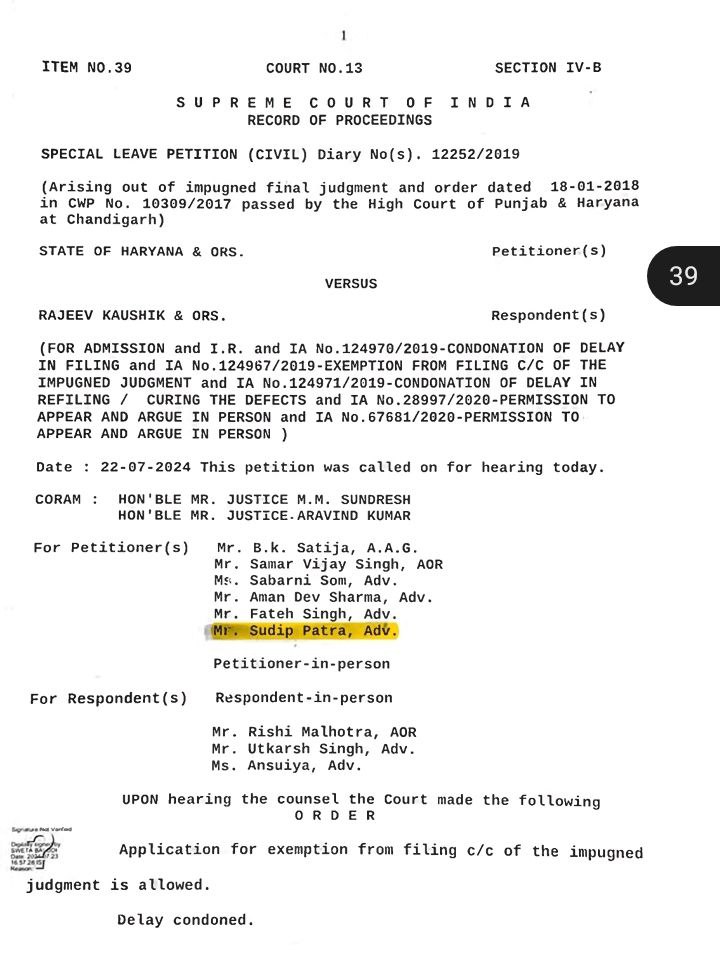

3. GST Litigation: From Tribunal to Supreme Court: This is our core strength. When a dispute escalates, you need formidable legal representation.

Appeals to Commissioner (Appeals): Filing and arguing appeals against Orders-in-Original passed by adjudicating authorities.

Representation before GST Appellate Tribunal (GSTAT/CESTAT): Handling complex appeals before the specialized tax tribunals.

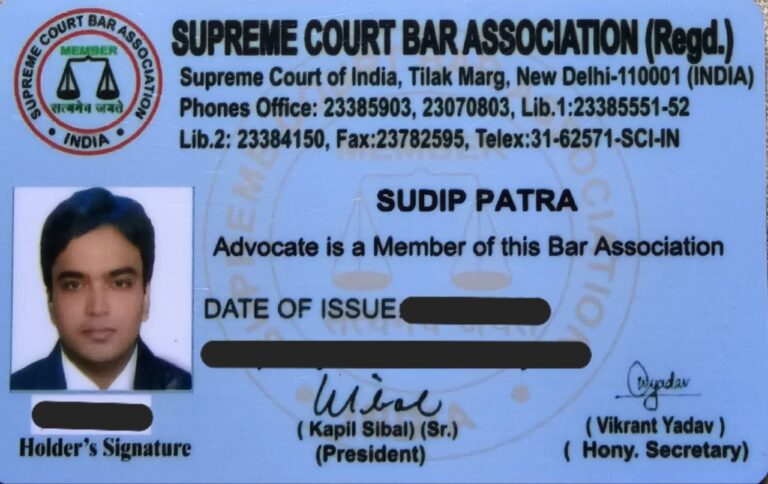

High Court & Supreme Court Litigation: Filing and arguing Writ Petitions and appeals before the High Courts and the Supreme Court on substantial questions of law and constitutional challenges related to GST.

4. Specialized GST Matters:

Refund Claims: Assisting in the preparation, filing, and follow-up of refund applications for inverted duty structures or exports.

E-Way Bill & E-Invoicing Disputes: Resolving issues related to the detention of goods and vehicles, and other E-way bill or E-invoicing discrepancies.

Anti-Profiteering Matters: Defending businesses against allegations of not passing on the benefit of GST rate reductions or input tax credit to consumers.

Frequently Asked Questions (FAQ) about GST Disputes

1. What is the first thing I should do when I receive a GST notice? Do not ignore it. Contact a GST lawyer immediately. The notice will have strict deadlines for response. Your lawyer will help you understand the issue, gather the necessary documents, and draft a legally sound reply to protect your interests.

2. What is a Show Cause Notice (SCN)? An SCN is a formal notice from the tax department asking you to explain (“show cause”) why a certain action (like imposing a tax liability, interest, or penalty) should not be taken against you. A well-drafted reply to an SCN is critical as it forms the basis of your entire defense.

3. Can I challenge an order passed by a GST officer? Yes. If you are aggrieved by an order, you have the right to file an appeal. The first level of appeal is before the Commissioner (Appeals). If you are not satisfied with that order, you can appeal further to the GST Appellate Tribunal (GSTAT), and subsequently to the High Court and Supreme Court on matters of law.

4. How important is legal representation in GST litigation? It is crucial. GST law is complex and constantly evolving. An experienced GST lawyer can identify legal precedents, procedural requirements, and strong grounds of argument that a layperson might miss. Proper representation significantly increases your chances of a favorable outcome.

Why Choose Patra’s Law Chambers for GST Matters?

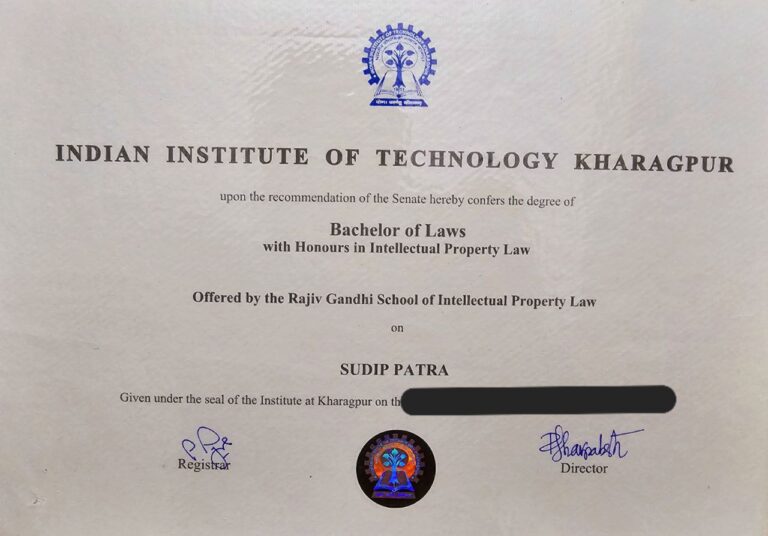

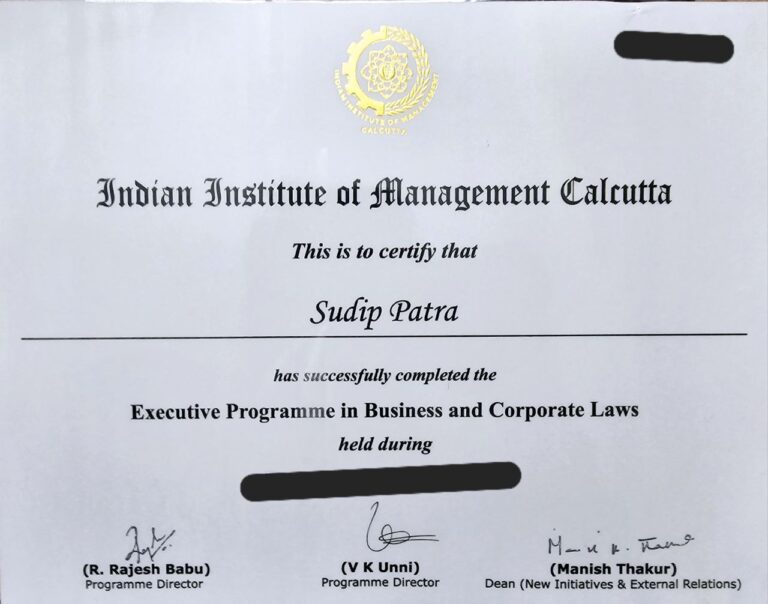

Deep Domain Expertise: Advocate Sudip Patra’s unique blend of technical (B.Tech), legal (LL.M.), and management (IIM Calcutta) education provides a multi-faceted approach to complex tax disputes.

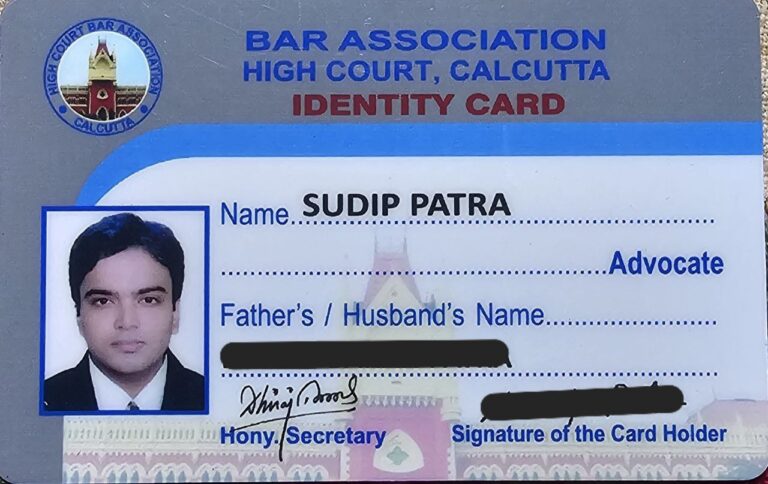

Litigation-Focused: While we assist with compliance, our primary strength lies in litigation. We are seasoned advocates, comfortable and effective in the courtroom environment of tribunals and high courts.

Business-Centric Solutions: We understand that a tax dispute is a business problem. Our advice is not just legally sound but also commercially pragmatic, aiming to resolve issues in a way that aligns with your business objectives.

Strategic Presence: With offices in Kolkata (a major commercial hub) and Delhi (the seat of the Supreme Court and principal benches of tribunals), we are well-positioned to handle your case at any level.

Secure Your Business. Resolve Your GST Disputes.

Don’t let GST complexities become a roadblock to your success. Contact Patra’s Law Chambers for an expert consultation to discuss your case and chart a clear legal path forward.

Contact Us for a Consultation:

Website: www.patraslawchambers.com

Email: [email protected]

Phone: +91 890 222 4444 / +91 9044 04 9044

Kolkata Office: NICCO HOUSE, 6th Floor, 2, Hare Street, Kolkata-700001 (Near Calcutta High Court)

Delhi Office: House no: 4455/5, First Floor, Ward No. XV, Gali Shahid Bhagat Singh, Main Bazar Road, Paharganj, New Delhi-110055