- SARFAESI Act empowers secured creditors to recover dues extra-judicially once account becomes an NPA.

- Section 13(2) notice gives borrower a 60-day window; notice must state exact amount and secured assets.

- Section 13(3A) lets borrower file a representation; bank must give a reasoned reply—failure is a fatal procedural flaw.

- After 60 days, Section 13(4) measures (possession, sale, takeover) enable borrower to file Section 17 SA before the DRT.

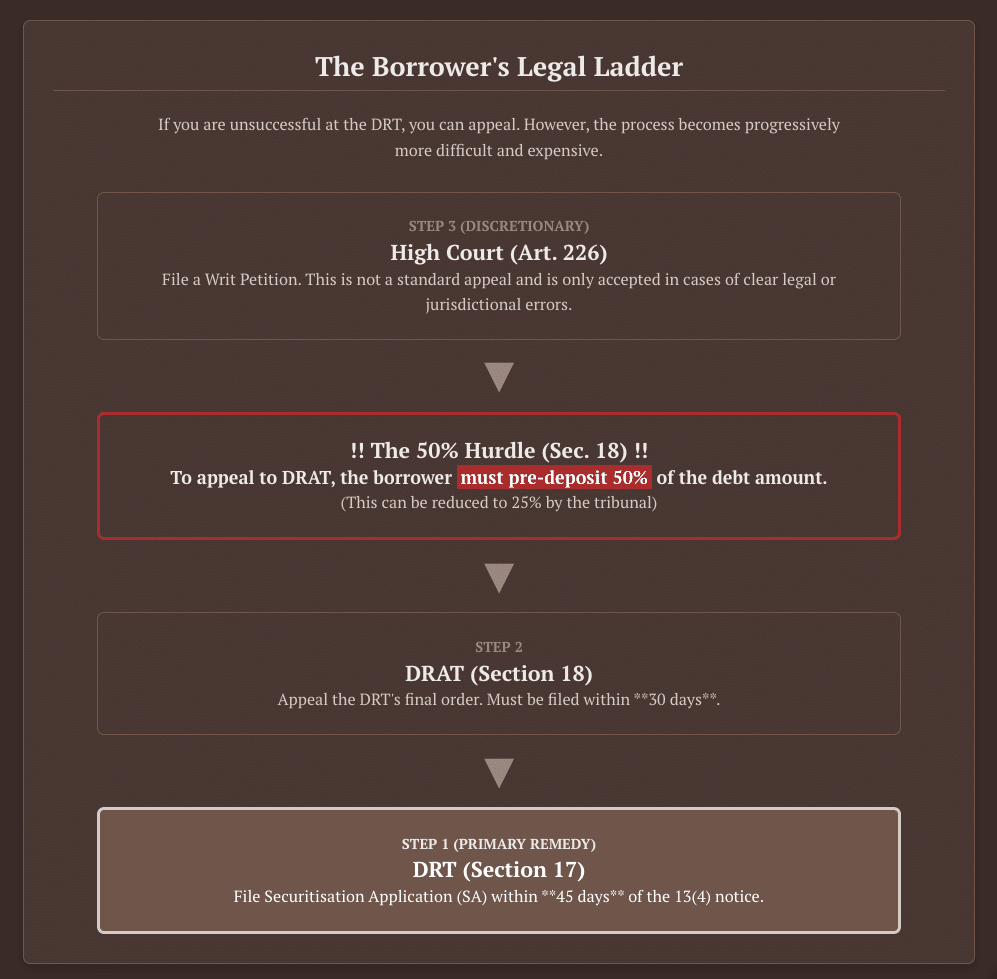

- Section 17 SA has a 45-day limitation (DRT can condone delay per Seshnath Singh); SA can secure interim stay and remedies.

- Appeal to DRAT under Section 18 requires 25–50% pre-deposit of "debt due", a major financial hurdle for borrowers.

- Use the SA as leverage for commercial settlement (OTS/rescheduling); note OTS is a bank concession, not a borrower's right.

Navigating the SARFAESI Gauntlet: A Borrower’s Definitive Guide to Challenging Section 13 Notices and Crafting a Successful Defense

1. The Opening Salvo: Deconstructing the Section 13(2) and 13(4) Notices

The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, is a formidable piece of legislation that empowers banks and financial institutions (termed “secured creditors”) to recover their dues without the intervention of a court or tribunal.1 This power is triggered when a borrower’s account is classified as a Non-Performing Asset (NPA) as per the prudential norms of the Reserve Bank of India.1

This “enforcement of security interest” is a powerful, extra-judicial remedy, and the law’s only counterbalance is that the secured creditor must follow the prescribed procedure strictly. For a borrower, understanding this procedure is the first step in building a defense.

1.1 Understanding the Section 13(2) Demand Notice: The 60-Day Lifeline

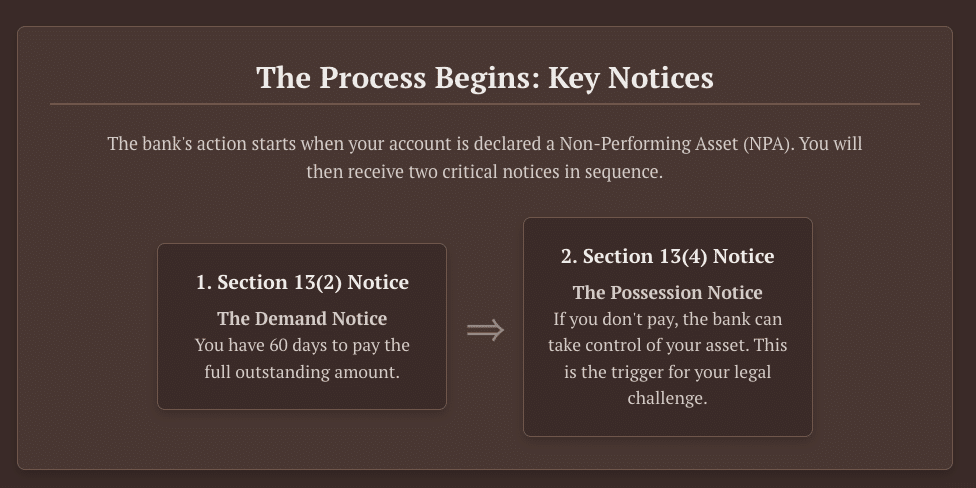

The entire SARFAESI action commences with the issuance of a written notice under Section 13(2) of the Act.1 This notice is the bank’s formal demand, requiring the borrower to discharge their full liabilities within 60 days from the date of the notice.7

This notice is not a mere formality. To be legally valid, it must contain specific details 1:

- The Amount Payable: The notice must clearly state the total outstanding amount claimed by the bank.10

- The Secured Assets: It must provide precise details of the secured assets (e.g., the mortgaged property) that the bank intends to enforce if the borrower fails to pay.1

A notice that is vague, miscalculates the amount, or incorrectly describes the asset is legally defective and forms a strong ground for challenge.10

1.2 The Section 13(3A) Representation: The Borrower’s Most Critical Right

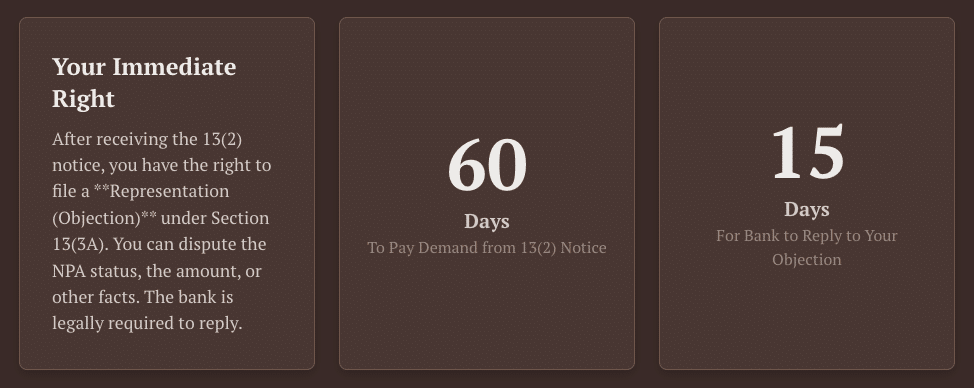

This is, without question, the most critical and often overlooked right available to a borrower. Upon receiving the Section 13(2) notice, the borrower has the right to make a representation or raise objections.1

The bank’s duty in response is not optional. Section 13(3A) mandates that the secured creditor must consider this objection. If the bank finds the objection “not acceptable or tenable,” it is legally bound to communicate the reasons for this decision to the borrower within 15 days of receiving the representation.1

The Supreme Court, in the landmark case of ITC Limited v. Blue Coast Hotels Ltd., held that this duty to consider and respond with reasons is mandatory.12 A bank’s failure to reply, or a reply that is non-speaking, vague, or fails to address the specific objections raised, is a fatal procedural flaw. This violation alone can vitiate the entire subsequent SARFAESI action, including any possession or sale.12

Therefore, a borrower must file a detailed Section 13(3A) objection, challenging everything from the NPA classification to the calculation of interest. This sets a legal “trap” that banks often fall into, providing the borrower with their strongest preliminary defense.

Furthermore, this 60-day period is not just a deadline; it serves as a statutory window for negotiation. It allows the borrower to “consider various options such as negotiating with the lender, restructuring their loans, or seeking refinancing options”.8 A savvy borrower will use this time to simultaneously file a robust legal objection under 13(3A) while also submitting a “without prejudice” proposal for a One-Time Settlement (OTS) or loan rescheduling.13

1.3 The “Measures”: Responding to a Section 13(4) Notice

If the borrower fails to pay the full amount within the 60-day period, Section 13(4) empowers the bank to take “measures” to recover its debt.1 These measures are the “teeth” of the Act and include 7:

- Taking Possession: The bank can take possession of the secured assets.9 This can be “symbolic” possession (affixing a notice and publishing in newspapers 15) or “physical” possession.16

- Sale or Lease: The bank can sell, lease, or assign the asset to recover its dues.8

- Takeover of Management: In the case of a company, the bank can take over the management of the borrower’s business.7

Crucially, it is only after the bank takes or initiates one of these measures under Section 13(4) that the borrower’s right to challenge the action before a legal forum is triggered.2 A borrower cannot challenge the Section 13(2) notice directly; they must wait for the bank to act on it with a Section 13(4) measure, such as issuing a possession notice.

1.4 The Role of the District Magistrate (DM/CMM) under Section 14

Often, a bank has symbolic possession but is resisted when it attempts to take physical possession. In such cases, the bank will apply to the District Magistrate (DM) or Chief Metropolitan Magistrate (CMM) under Section 14 for assistance in taking possession.5

It is vital to understand that the DM/CMM’s role is purely administrative and ministerial, not judicial.21 They do not adjudicate the dispute. Their only function is to verify the bank’s affidavit and, if it is in order, provide the necessary administrative or police assistance to help the bank secure the asset.22

A borrower or any third party (like a tenant) cannot challenge the bank’s claim before the DM/CMM. The Supreme Court has repeatedly held, including in Balkrishna Rama Tarle v. Phoenix ARC, that the only remedy for any person aggrieved by a Section 14 order is to file a Securitisation Application (SA) under Section 17 before the Debts Recovery Tribunal (DRT).24

2. The Primary Counter-Offensive: The Securitisation Application (SA) under Section 17

2.1 The Borrower’s Sole Statutory Remedy

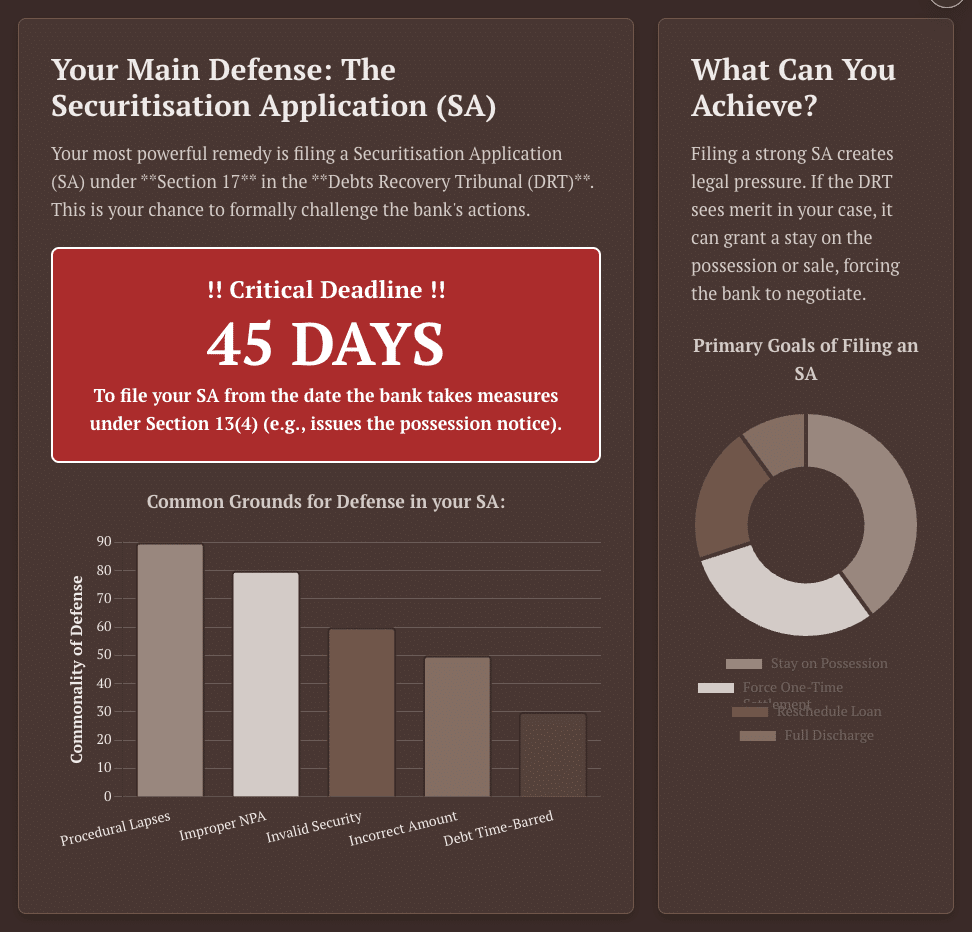

Section 17 of the SARFAESI Act is the heart and soul of the borrower’s defense.20 It provides that “any person” (including a borrower, guarantor, or mortgagor) who is aggrieved by any of the measures taken by the secured creditor under Section 13(4) can file an application before the Debts Recovery Tribunal (DRT).11

This application, known as a Securitisation Application (SA), is not an “appeal.” It is an original application.28 This distinction is critical because it means the DRT will conduct a full, trial-like inquiry into the facts of the case and the legality of the bank’s actions.

2.2 The Critical 45-Day Limitation Period: A Strict Deadline?

The SA must be filed within 45 days from the date on which the bank’s measure (e.g., the date of the possession notice) was taken.2 This is a notoriously strict deadline.

For years, a significant legal conflict existed on whether a delay beyond these 45 days could be condoned. Many courts held the 45-day limit to be absolute and mandatory, believing that Section 5 of the Limitation Act (which allows for condonation of delay) did not apply, in order to ensure the “quick enforcement” of securities.33

However, this conflict was decisively settled by the Supreme Court in Seshnath Singh v. Baidyabati Sheoraphuli Co-Operative Bank Ltd..32 The Court held that by virtue of Section 24 of the RDDBFI Act, the provisions of the Limitation Act (Sections 4 to 24) are applicable to DRT proceedings.30 Therefore, the DRT does have the power to condone a delay in filing a Section 17 SA, provided the borrower can demonstrate “sufficient cause” for the delay.34

While this provides a safety net, a borrower must not be complacent. They must file an Interlocutory Application (IA) explaining every day of the delay.32

A crucial strategy arises from the fact that the SARFAESI process is a series of measures (e.g., possession notice, then sale notice, then sale confirmation).19 This creates a “continuing cause of action.” Even if a borrower misses the 45-day window to challenge the possession notice, they get a fresh 45-day period to challenge the sale notice when it is issued.19 The SA challenging the sale notice can, and should, also attack the legality of all preceding steps (the 13(2), 13(3A) violation, etc.) as the foundation for the illegal sale.

2.3 Filing Procedure and Powers of the DRT

The SA is filed in the prescribed form (often via the government’s e-DRT portal 28) along with the required fees and all supporting documents (loan agreements, notices received, the 13(3A) representation, and the bank’s reply).6

The borrower’s first and most important prayer is for an interim stay on the bank’s actions, particularly to halt any impending auction or dispossession. The DRT has wide powers to grant such a stay.

If the DRT concludes that the bank’s actions were not in accordance with the Act or its Rules, it has the power to 17:

- Set Aside the Action: Declare the possession notice or sale null and void.38

- Restore Possession: Order the secured creditor to return the asset to the borrower.2

- Grant Compensation: Order the bank to pay compensation and costs to the borrower for its wrongful actions.2

3. A Borrower’s Arsenal: Key Defenses to Raise in the Securitisation Application

A successful SA is built on demonstrating the bank’s non-compliance with the strict procedures of the Act. The primary defenses are:

3.1 Procedural Defenses (Attacking the Bank’s Process)

- Invalid NPA Classification: The bank’s entire action is baseless if the account was improperly classified as an NPA. This can be argued if, for example, the borrower made payments that were not recorded or if the classification violates RBI’s master circulars.10

- Violation of Section 13(3A): This is the strongest defense. The borrower must show that they filed a 13(3A) objection and the bank either (a) did not reply at all, or (b) sent a non-speaking, cryptic reply that did not address the specific objections raised.10

- Defective Section 13(2) Notice: The notice is invalid if it is vague, fails to specify the exact amount due, claims an inflated or un-reconciled amount, or fails to correctly identify the secured assets.10

- Violation of Possession Rules (Rule 8): The bank must follow Rule 8 of the Security Interest (Enforcement) Rules, 2002. Common violations include:

- Failure to properly serve the possession notice on the borrower.42

- Failure to publish the possession notice in two leading newspapers (one in a vernacular language) with wide circulation in the locality.15

- Violation of Sale Rules (Rule 8 & 9):

- Failure to serve the mandatory 30-day sale notice to the borrower before auctioning an immovable property.5

- Wrongful Valuation: The bank is required to get a valuation from an approved valuer. A common defense is that the bank used a “distress” valuation far below the fair market value to facilitate a quick sale.43 The borrower should counter this by submitting an independent valuation report.

3.2 Substantive & Jurisdictional Defenses (Attacking the Bank’s Right)

Debt is Time-Barred: The SARFAESI Act cannot be used to recover a “dead” debt. If the limitation period (typically 3 years from the date of default or last acknowledgment) has expired, the bank’s action is barred by limitation.42

- Agricultural Land: This is a total jurisdictional bar. Section 31(i) of the SARFAESI Act explicitly states that its provisions do not apply to agricultural land.3 If the secured asset is classified as agricultural land, the DRT must quash the entire SARFAESI proceeding.

- Amount Below Threshold: The Act does not apply if 3:

- The outstanding due is less than Rs. 1 Lakh.

- The amount due is less than 20% of the original principal and interest.42

3.3 Special Defense: Rights of Tenants in Secured Assets

A tenant lawfully occupying the secured property can also file an SA under Section 17. However, their success depends entirely on the timing and nature of their lease. The law in this area has been clarified by several Supreme Court judgments.

- Initially, in Harshad Govardhan Sondagar and Vishal N. Kalsaria, the Supreme Court held that the SARFAESI Act cannot “bulldoze” the statutory rights of tenants under State Rent Control Acts.24

- However, this position was significantly refined by the judgment in Bajarang Shyamsunder Agarwal v. CBI.24 The Court clarified that to claim protection, a tenant must establish their bona fides by producing strong documentary evidence (such as a registered lease deed, rent receipts, or utility bills) proving that their tenancy was created before the date the mortgage was created in favor of the bank.49

- The established rule is:

- Valid, Registered Lease Before Mortgage: The tenant is protected. The bank can only sell the asset “subject to tenancy,” and the DM/CMM cannot evict the tenant.47

- Unregistered/Oral Lease: Provides no protection, as it is presumed to be a collusive arrangement between the borrower and tenant to frustrate the bank’s recovery.17

- Lease Created After S.13(2) Notice: Such a lease is explicitly invalid under Section 13(13) of the Act unless the bank gave prior written consent.17

4. The Appellate Hierarchy: Challenging a DRT Order

4.1 Part A: The Appeal to the DRAT (Section 18)

Any person (borrower or bank) aggrieved by a final order of the DRT under Section 17 can file an appeal to the Debts Recovery Appellate Tribunal (DRAT) under Section 18 of the Act.20

- Limitation Period: The appeal must be filed within 30 days from the date of receipt of the DRT’s order.2

- The Financial Hurdle: The Mandatory Pre-Deposit: This is the single greatest obstacle for a borrower. Section 18 provides that the DRAT shall not entertain an appeal from a borrower unless the borrower deposits 50% of the “amount of debt due” as claimed by the bank or as determined by the DRT, whichever is less.29

- Discretion to Reduce: The DRAT has the discretion, for reasons to be recorded in writing, to reduce this amount to a minimum of 25%.50

- No Waiver: The DRAT has no power to waive this 25% minimum. This pre-deposit is mandatory, and an appeal filed without it is incompetent.56

What constitutes the “amount of debt due”? Borrowers often argue that if the asset has been sold, the debt due is the remaining amount. The Supreme Court rejected this in M/s Sidha Neelkanth Paper Industries v. Prudent ARC.53 The Court held that:

- “Debt due” includes the interest as claimed in the original Section 13(2) notice.62

- A borrower cannot take the benefit of the sale (by deducting the sale proceeds) if they are simultaneously challenging the legality of that very sale.63

Therefore, the borrower must deposit 25-50% of the original debt claimed, a sum that is often prohibitively expensive.

It is important to note that this pre-deposit is security for the appeal, not a payment. As held in AXIS Bank v. SBS Organics, if the borrower wins the appeal, or even if the appeal is withdrawn, the deposited amount is refunded to the borrower.29

4.2 Part B: The High Court (Article 226) and Supreme Court (Article 136)

A borrower cannot directly approach the High Court to stop a Section 13(2) or 13(4) notice. The Supreme Court in United Bank of India v. Satyawati Tondon 65 and subsequent cases has repeatedly held that High Courts should not entertain writ petitions under Article 226 when a detailed and effective alternative statutory remedy (i.e., the Section 17 application) is available to the borrower.2

A writ petition is maintainable only in exceptional circumstances, such as:

- The bank’s action is patently without jurisdiction (e.g., seizing agricultural land).67

- There is a clear violation of the principles of natural justice.67

- The statutory forum (DRT/DRAT) is non-functional, for example, due to a vacancy of the Presiding Officer.69

After the DRAT has passed its final order, an aggrieved party can then challenge that order before the jurisdictional High Court via a writ petition under Article 226 or 227.68 The final appeal from the High Court’s judgment lies with the Supreme Court of India by way of a Special Leave Petition (SLP) under Article 136.71

5. The Strategic Endgame: Leveraging the SA for OTS and Rescheduling

As the query correctly identifies, the legal process is often a tool to achieve a commercial settlement.

5.1 Using the SA as a Bargaining Chip

Filing a strong, well-drafted Section 17 SA is the primary way to bring a bank to the negotiating table.73 The moment an SA is filed and the DRT grants an interim stay on the sale, the secured asset becomes a “litigated asset.” This freezes the bank’s recovery process. Banks are under immense pressure to resolve NPAs, and a long, drawn-out legal battle in the DRT is expensive and time-consuming.73

Therefore, banks often prefer a quick, assured (even if reduced) payment through a One-Time Settlement (OTS) or a restructured payment plan.73 The SA, and the legal flaws it exposes, is the leverage a borrower uses to force the bank to offer a favorable OTS or reschedule the loan.38

5.2 The Legal Reality of One-Time Settlement (OTS)

It is a common and dangerous misconception that a borrower is “entitled” to an OTS. This is legally incorrect.

The Supreme Court, in the recent and definitive case of SBI v. Tanya Energy Enterprises, has settled the law.78 The Court held that:

- An OTS scheme is a concession offered by the bank, not a matter of right for the borrower.78

- A High Court cannot issue a writ of mandamus to force a bank to grant an OTS.81

- To avail an OTS, the borrower must strictly comply with all its conditions, such as paying the mandatory upfront deposit (e.g., 5% or 10% of the OTS amount). Failure to do so renders the application incomplete and justifies the bank’s rejection.79

The strategy, therefore, is not to legally compel an OTS, but to use the SA to create sufficient commercial pressure that the bank voluntarily offers a settlement.

5.3 The Extinguished Right of Redemption (Section 13(8))

Another critical reality check for borrowers concerns the “right of redemption”—the right to pay the full outstanding dues and save the property.

- The Old Law (Pre-2016): The unamended Section 13(8), as interpreted in Mathew Varghese v. M. Amritha Kumar, allowed the borrower to redeem the property at any time “before the date fixed for sale or transfer,” which was held to mean until the sale was confirmed or registered.83

- The New Law (Post-2016 Amendment): The 2016 amendment drastically curtailed this right. The new Section 13(8) states that the right of redemption is available only “at any time before the date of publication of notice for public auction”.5

The Supreme Court confirmed this new, harsh reality in Celir LLP v. Bafna Motors (2023) and M. Rajendran v. KPK Oils (2025).84 The moment the auction notice is published in the newspaper, the borrower’s right to redeem the property by paying the full dues is extinguished.87

This means a borrower who wishes to save their property must arrange the full payment before the bank escalates the matter to a sale notice.

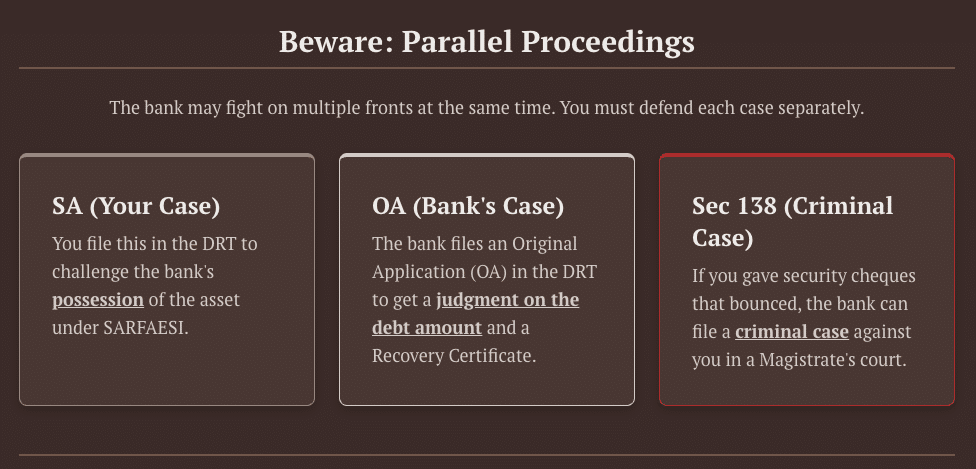

6. Parallel Proceedings: The Bank’s Other Lines of Attack

A bank is not limited to the SARFAESI Act. It can, and often does, initiate parallel proceedings to maximize pressure and recovery.

6.1 Part A: The Original Application (OA) under the RDDBFI Act, 1993

This is a key point of confusion. An OA and an SA are filed in the same forum (DRT) but are completely different.

- SARFAESI (SA): An enforcement action by the bank (S.13) and the borrower’s defense (S.17) against it. It is for secured assets only.3

- Original Application (OA): This is a civil suit filed by the bank in the DRT under the Recovery of Debts Due to Banks and Financial Institutions (RDDBFI) Act, 1993, for a judicial adjudication of the total debt.28

Banks file an OA for two main reasons:

- For Unsecured Loans: SARFAESI does not apply to unsecured loans (e.g., personal loans, credit card debt).45 The bank’s only remedy in the DRT for such loans is to file an OA.45

- To Recover the Shortfall: After selling a secured asset via SARFAESI, if the sale proceeds are not enough to cover the total debt, the bank must file an OA (or an application under S.13(10)) to get a “Recovery Certificate” (RC) for the remaining balance.29

In an OA, the borrower files a “Written Statement” (the equivalent of a defense in a civil suit) and can raise all civil defenses, such as time-barred debt, incorrect interest, or fraud.40 A key right in an OA, not available in an SA, is that the borrower can file a Counter-Claim against the bank for damages (e.g., for illegal actions or lost business) under Section 19(8) of the RDDBFI Act.40

6.2 Part B: The Negotiable Instruments (NI) Act, 1881 (The Check Bounce Case)

Banks often use a “check bounce” case under Section 138 of the NI Act as a parallel criminal proceeding.93 This is filed when a cheque given by the borrower (e.g., for an EMI) is dishonored.

The law is unequivocally settled: a bank can initiate SARFAESI proceedings and a Section 138 NI Act case simultaneously for the same debt.94

The reasoning, as held in cases like Madhusudan Garai v. State of West Bengal, is that the two proceedings have different objects.94 The SARFAESI Act is a civil proceeding for recovery of the asset. The NI Act case is a criminal proceeding to punish the offence of issuing a dishonored cheque, which can result in a fine and/or imprisonment.94

The borrower must therefore fight on two fronts. However, this does not entitle the bank to “double recovery.” Any amount actually recovered by the bank under the SARFAESI auction must be adjusted against the total compensation or fine imposed by the criminal court in the S.138 case.99

6.3 Part C: Applicability – Secured vs. Unsecured Loans

This is the fundamental distinction:

- SARFAESI Act: Applies only to Secured Loans, where a “security interest” (like a mortgage or hypothecation) has been created over a “secured asset”.3

- SARFAESI Does Not Apply to:

- Unsecured Loans.45

- Agricultural Land.3

- Debts below Rs. 1 Lakh.3

- Loans where more than 80% of the principal and interest has been repaid.3

For Unsecured Loans, the bank’s only recourse is to file a civil suit in a regular court or, for amounts over Rs. 20 lakhs, an Original Application (OA) in the DRT.45

7. Summary of Processes and Key Statutes (Tabular Charts)

Table 1: The SARFAESI Challenge: Borrower’s Defensive Roadmap

| Stage | Action / Proceeding | Legal Provision | Forum | Limitation Period | Key Strategic Note |

| 1 | Bank issues Demand Notice | Sec. 13(2) | N/A | 60-day payment window | Do NOT ignore. This is the start. |

| 2 | Borrower’s Objection | Sec. 13(3A) | Send to Bank | Within the 60 days | MANDATORY TO FILE. Creates the best legal defense if bank fails to reply. |

| 3 | Bank’s Reply to Objection | Sec. 13(3A) | N/A | 15 days (directory) | Bank’s reply must be reasoned. If not, this is a winning ground in the SA. |

| 4 | Bank takes “Measure” | Sec. 13(4) | N/A | After 60 days | e.g., Possession Notice. This is the “cause of action” for the DRT. |

| 5 | Borrower’s Challenge (SA) | Sec. 17 | Debts Recovery Tribunal (DRT) | 45 Days from measure | CRITICAL DEADLINE. Delay can be condoned (per Seshnath Singh), but is high-risk. |

| 6 | Bank seeks Physical Possession | Sec. 14 | DM / CMM | N/A | Borrower’s remedy is still only Sec. 17. DM is not an adjudicator. |

| 7 | Borrower’s Appeal | Sec. 18 | DRAT | 30 Days from DRT order | Financial Trap: Requires mandatory 25% to 50% pre-deposit of the entire debt. |

| 8 | Borrower’s Writ Petition | Art. 226/227 | High Court | No set limit | Very high bar. HC will only interfere if DRAT order is perverse or no jurisdiction. |

| 9 | Borrower’s Final Appeal | Art. 136 (SLP) | Supreme Court | 90 days | Final legal remedy. |

Table 2: Parallel Proceedings: A Comparative Analysis (SARFAESI vs. OA vs. NI Act)

| Feature | SARFAESI Act, 2002 | RDDBFI Act, 1993 (OA) | NI Act, 1881 (S.138) |

| Primary Purpose | Enforcement of Security [90] | Adjudication of Debt [90] | Punishment for Offence 94 |

| Nature | Civil (Quasi-Judicial) 1 | Civil (Quasi-Judicial) [28] | Criminal [100] |

| Applicability | Secured Loans Only [3, 45] | Secured & Unsecured Loans [90] | Dishonour of Cheque 93 |

| Who Initiates? | Secured Creditor (Bank) 1 | Bank / FI [28, 101] | Payee (Bank) 93 |

| Key Action | S.13(4) Measures (Possession/Sale) | Filing Original Application (OA) | Filing Criminal Complaint |

| Borrower’s Remedy | Securitisation Application (SA) | Written Statement & Counter-Claim 40 | Defend the criminal trial |

| Outcome | Recovery of Asset | Recovery Certificate (RC) [90] | Fine and/or Imprisonment 94 |

| Simultaneous? | Yes, can run with OA & NI Act [41, 95] | Yes, can run with SARFAESI [41] | Yes, can run with SARFAESI [94, 97] |

8. Compendium of 40 Landmark Judgments

A borrower’s defense is built on legal precedent. The following 40 judgments form the bedrock of SARFAESI law in India.

- On Constitutional Validity & Scope

- Mardia Chemicals Ltd. v. Union of India (2004) 4 SCC 311: Upheld the constitutional validity of the SARFAESI Act, but read down Section 17 to establish it as a robust forum for appeal after S.13(4) measures are taken.29

- Transcore v. Union of India (2008) 1 SCC 125: Held that a bank can simultaneously pursue remedies under SARFAESI and the RDDBFI Act (OA). Also clarified that the Act does not distinguish between symbolic and physical possession.72

- On Section 13(2) & 13(3A) (Demand & Representation)

- ITC Ltd. v. Blue Coast Hotels Ltd. (2018) 15 SCC 99: (Mandatory Reply) Held that the bank’s duty to reply with reasons to a borrower’s S.13(3A) representation is mandatory. Failure to do so is a fatal flaw.12

- Kannu Aditya India Ltd. v. SBI (2018) SCC OnLine Del 12208: (Timeline Directory) Clarified ITC, holding that while the act of replying is mandatory, the 15-day timeline is directory, not mandatory.104

- Arce Polymers (P.) Ltd. v. Alpine Pharmaceuticals (2021) 133 taxmann.com 42 (SC): Held a borrower who neither repays nor replies to the 13(2) notice may be estopped from later challenging a 13(3A) violation.13

- On Section 13(4) & 14 (Possession & DM’s Role)

- R.D. Jain and Co. v. Capital First Ltd. (2022) SCC OnLine SC 931: Confirmed that Additional District Magistrates (ADM) and Additional Chief Metropolitan Magistrates (ACMM) are empowered to exercise jurisdiction under Section 14.105

- Balkrishna Rama Tarle v. Phoenix ARC (2022) SCC OnLine SC 1272: (DM’s Role) Defined the S.14 role of a DM/CMM as purely administrative. They cannot adjudicate disputes; the only remedy for any aggrieved party is S.17.24

- Avdhesh-Sumitra v. State of U.P. (2021): An order passed by a DM/CMM under S.14 without a proper, verifying affidavit from the bank is invalid.

- NKGSB Cooperative Bank Ltd. v. Subir Chakravarty (2022) ibclaw.in 13 SC: Held that a DM/CMM can appoint an advocate commissioner to assist in taking possession under S.14.106

- Prime Co-operative Bank Ltd. v. District Magistrate 106: Held that once a DM/CMM passes a S.14 order, they become functus officio (i.e., their function is complete) and they cannot review their own order.

- On Section 17 (SA Application & Limitation)

- Seshnath Singh v. Baidyabati Sheoraphuli Co-Operative Bank Ltd. (2021) AIR 2021 SC 2637: (Condonation of Delay) Settled the conflict by holding that Section 5 of the Limitation Act is applicable to S.17 applications. The DRT can condone a delay beyond 45 days for “sufficient cause”.32

- Bank of Baroda v. Parasaadilal Tursiram Sheetgrah (2022) ibclaw.in 100 SC: Stated the 45-day limit under S.17 is to ensure quick enforcement of security.33 (This case shows the judicial thinking before the Seshnath Singh clarification).

- Aniruddh Singh v. Authorized Officer, ICICI Bank (2024): A recent case reinforcing that delay beyond 45 days (S.17) can be condoned, following Seshnath Singh.35

- Indian Bank v. N. Sundara Reddy 107: Emphasized that due process must be followed by the bank before enforcing possession.

- CFM Asset Reconstruction v. Tamilnad Mercantile Bank (2022) SCC OnLine DRAT 305: Clarifies that inter-se disputes between two secured creditors are to be resolved via arbitration under S.11, not an S.17 application.108

- On Section 18 (DRAT Appeal & Pre-Deposit)

- Narayan Chandra Ghosh v. UCO Bank (2011) 4 SCC 548: Established that the 50% pre-deposit under S.18 is mandatory and a condition precedent to entertaining the appeal.60

- Union Bank of India v. Rajat Infrastructure (2020) SCC OnLine SC 262: Confirmed that the DRAT cannot waive the pre-deposit. It can only reduce it to a minimum of 25%.56

- M/s Sidha Neelkanth Paper Industries v. Prudent ARC (2023) 2023 SCC OnLine SC 12: (Calculation of Deposit) Held that “debt due” for pre-deposit includes interest and cannot be set-off against challenged sale proceeds.53

- AXIS Bank v. SBS Organics (2016) 12 SCC 18: (Refundable Deposit) Clarified that the S.18 pre-deposit is refundable to the borrower if the appeal succeeds or is withdrawn, and the bank has no lien on it.29

- Sterlite Technologies Ltd. v. Union of India 54: Outlined the principles (prima facie case, undue hardship) a borrower must show to seek a reduction of the pre-deposit from 50% to 25%.

- On Section 13(8) (Right of Redemption)

- Mathew Varghese v. M. Amritha Kumar (2014) 5 SCC 610: (Old Law) The landmark pre-amendment case. Held the borrower’s right of redemption exists until the sale is confirmed or registered.83

- Celir LLP v. Bafna Motors (Mumbai) Pvt. Ltd. (2023) 2023 SCC OnLine SC 1208: (The New Law) The SC held that the 2016 amendment to S.13(8) extinguishes the borrower’s right of redemption on the date of publication of the auction notice.83

- M. Rajendran v. KPK Oils (2025) 2025 INSC 1137: (Confirmation of New Law) Re-affirmed Bafna Motors. The right to redeem is drastically curtailed to the date of the auction notice publication.86

- S. Karthik v. N. Subhash Chand Jain (2021) 84: An SC case reiterating the pre-amendment position, which is now primarily used to contrast the effect of the 2016 amendment.

- On OTS (One-Time Settlement)

- SBI v. Tanya Energy Enterprises (2025) 2025 SCC OnLine SC 1979: (OTS is Not a Right) The definitive judgment. An OTS is a concession, not a right. Borrowers must strictly comply with all scheme conditions. Courts cannot force a bank to grant an OTS.78

- Bijnor Urban Cooperative Bank v. Meenal Agarwal (2021) SCC OnLine SC 1255: No writ of mandamus can be issued by a High Court to compel a bank to accept an OTS.81

- M/s. Sha Selections v. SBI (2024) 109: A High Court ruling showing that once a bank accepts an OTS and the borrower substantially complies, the bank cannot arbitrarily refuse to release the property.

- On Tenant Rights

- Harshad Govardhan Sondagar v. CBI (2014) 6 SCC 1: (Tenant Protection) A tenant with a valid, registered, pre-mortgage lease is protected and cannot be evicted under S.14.47

- Vishal N. Kalsaria v. Bank of India (2016) 3 SCC 762: Held that SARFAESI’s non-obstante clause (S.35) cannot “bulldoze” the statutory rights of tenants under State Rent Acts.24

- Bajarang Shyamsunder Agarwal v. CBI (2019) 9 SCC 103: (The Clarification) Reconciled the above cases. A tenant must provide strong documentary evidence (registered lease, bills) to prove the tenancy is bona fide and pre-dates the mortgage.24

- PNB Housing Finance Ltd. v. Manoj Saha (2025) 2025 (SC) 723: Re-affirmed Bajarang. An unregistered or oral lease provides no protection to a tenant from a S.14 eviction.49

- On Parallel Proceedings (NI Act / IBC / Writs)

- Madhusudan Garai v. State of West Bengal (2019) 94: (Parallel Proceedings) Settled law. SARFAESI (civil recovery) and Section 138 NI Act (criminal) proceedings can be initiated and run simultaneously for the same debt.96

- D. Purushotama Reddy vs. K. Sateesh (2008) 8 SCC 492: Held that any amount recovered by the bank under SARFAESI shall be adjusted against the compensation/deposit ordered in the S.138 appeal.99

- Anand Rao Korada v. Varsha Fabrics (2019) 12 SCC 16: (IBC Overrides SARFAESI) The IBC Moratorium under Section 14 overrides SARFAESI. All SARFAESI proceedings must be stayed once CIRP begins.112

- P. Mohanraj v. Shah Brothers Ispat (2021) 6 SCC 258: (IBC Overrides NI Act) The IBC Moratorium also stays S.138 NI Act proceedings against the corporate debtor.114

- United Bank of India v. Satyawati Tondon (2010) 8 SCC 110: (Alternative Remedy Bar) The key “Alternative Remedy” case. High Courts must not interfere under Article 226 when an effective statutory remedy (S.17) is available.65

- Kotak Mahindra Bank Ltd. v. M/s Shri Sendhur Agro (2025) 115: A recent case discussing the nuances of territorial jurisdiction for S.138 NI Act complaints.

- BM, The Urban Co-operative Bank Ltd. v. Registrar, DRT (2021) ibclaw.in 44 HC: A High Court judgment (now superseded by Seshnath) that held delay cannot be condoned, illustrating the legal conflict.30

- State Bank of India v. V. Ramakrishnan (2018) 17 SCC 394: Clarified that the IBC moratorium (S.14) applies to the corporate debtor, not the personal guarantors (this has since been modified by the 2019 inclusion of personal guarantors under the IBC).112

- Bank of India v. Sri Nangli Rice Mills (2025) 116: Reinforces that the S.17 remedy is the only remedy for any dispute over S.13(4) measures.

9. Conclusion: Formulating a Coherent Defensive Strategy

The SARFAESI Act is a powerful tool for banks, but its power is brittle. It is built entirely on strict procedural compliance. The borrower’s entire defense, therefore, rests on finding the cracks in the bank’s procedure.

Based on the analysis, a coherent defensive strategy involves the following:

- Immediate Action (Post 13(2) Notice): Never ignore this notice. The only correct response is a dual-track approach:

- Legal: Engage legal counsel to immediately file a detailed Section 13(3A) objection. This objection must be comprehensive, challenging the NPA classification, the calculation of interest, and any other available discrepancy. This “sets the trap” for the bank.

- Commercial: Simultaneously, submit a “without prejudice” OTS or restructuring proposal. This demonstrates good faith and opens a channel for negotiation.

- Vigilance (Post 13(4) Measure): The moment a Section 13(4) measure, such as a possession notice, is taken, the 45-day clock for filing the Section 17 SA begins. This is the only effective legal remedy.

- The SA is the Leverage: A well-drafted SA, which highlights the bank’s failure to reply to the 13(3A) objection (the ITC v. Blue Coast defense) or other procedural flaws (bad notice, wrong valuation), is the only leverage the borrower has to force the bank to seriously negotiate an OTS or rescheduling.

- Know the New Realities: The borrower must be advised of two harsh truths:

- The right of redemption (S.13(8)) is extinguished the moment the auction notice is published (per Bafna Motors and M. Rajendran). Time is of the essence.

- An OTS is a concession, not a right (per Tanya Energy). The SA cannot force an OTS, it can only create the pressure that makes an OTS the bank’s most logical choice.

The complexity of the law, the strict timelines, and the severe financial consequences (like the mandatory S.18 pre-deposit) make navigating SARFAESI perilous. Seeking expert legal counsel immediately upon receipt of the S.13(2) notice is not just recommended; it is essential for survival.

This article is for informational purposes only and does not constitute legal advice. For specific advice on your case, please contact our team of experts.

Patra’s Law Chambers

Our firm specializes in civil, criminal, writ, intellectual property, company, tax, land disputes, service law, family law, and Supreme Court matters, with a dedicated practice in banking and debt recovery laws.

- Kolkata Office: NICCO HOUSE, 6th Floor, 2, Hare Street, Kolkata-700001 (Near Calcutta High Court)

- Delhi Office: House no: 4455/5, First Floor, Ward No. XV, Gali Shahid Bhagat Singh, Main Bazar Road, Paharganj, New Delhi-110055

- Website: www.patraslawchambers.com

- Email: [email protected]

- Phone: +91 890 222 4444 / +91 9044 04 9044

Works cited

- Section 13 (2 – India Code, accessed on November 1, 2025, https://www.indiacode.nic.in/show-data?actid=AC_CEN_2_11_00037_200254_1517807324604§ionId=20655§ionno=13&orderno=16

- Remedies available to the Borrowers against actions of Secured Creditor – Redlaw Legal Services, accessed on November 1, 2025, https://redlaw.in/remedies-available-to-the-borrowers-against-action-of-secured-creditor/

- SARFAESI Act 2002: Guide to NPA Recovery & Asset Auction | Kotak Bank, accessed on November 1, 2025, https://www.kotak.com/en/stories-in-focus/loans/home-loan/sarfaesi-act-2002.html

- Enforcement of Security Interest by Banks under SARFAESI Act – Taxmann, accessed on November 1, 2025, https://www.taxmann.com/post/blog/enforcement-of-security-interest-by-banks-under-sarfaesi-act?amp

- Section 13 of the SARFAESI Act: Enforcement of Security Interest – The Legal School, accessed on November 1, 2025, https://thelegalschool.in/blog/section-13-sarfaesi-act

- What to Do if Your Property is Taken Under SARFAESI: A Step-by-Step Guide | CG Legal, accessed on November 1, 2025, https://www.cglegal.in/blog-13-2-demand-notice-13-4-possession-notice-sarfaesi-drt

- SARFAESI Act: Balancing Debt Recovery & Borrower Rights – Maheshwari & Co., accessed on November 1, 2025, https://www.maheshwariandco.com/blog/sarfaesi-act-balancing-debt-recovery-borrower-rights/

- Understanding SARFAESI Act Section 13(2) | Bajaj Finance, accessed on November 1, 2025, https://www.bajajfinserv.in/understanding-sec-13-2-of-sarfaesi-act

- Understanding Section 13(4) of SARFAESI Act | Bajaj Finance, accessed on November 1, 2025, https://www.bajajfinserv.in/understanding-sec-13-4-of-sarfaesi-act

- How to Challenge a SARFAESI Action Before DRT – Chennai Bench Insight, accessed on November 1, 2025, https://legalfirm.in/how-to-challenge-a-sarfaesi-action-before-drt-chennai-bench-insight/

- Rights Of Borrowers Under The SARFAESI Act What You Need To Know – FinLender, accessed on November 1, 2025, https://finlender.com/rights-of-borrowers-under-the-sarfaesi-act-what-you-need-to-know/

- Supreme Court Rules on Mandatory Procedure under the SARFAESI Act – IndiaCorpLaw, accessed on November 1, 2025, https://indiacorplaw.in/2018/04/04/supreme-court-rules-mandatory-procedure-sarfaesi-act/

- The borrower who neither paid debt nor replied to notice was to be estopped from challenging the violation of Section 13(3A), rules SC – Taxmann, accessed on November 1, 2025, https://www.taxmann.com/post/blog/the-borrower-who-neither-paid-debt-nor-replied-to-notice-was-to-be-estopped-from-challenging-the-violation-of-section-133a-rules-sc

- J U D G M E N T – Supreme Court of India, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2020/6478/6478_2020_46_1501_31810_Judgement_03-Dec-2021.pdf

- Procedure for Sale of Immovable Assets under SARFAESI Act 2002 – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/procedure-for-sale-of-immovable-assets-under-sarfaesi-act-2002/

- The SARFAESI Act Step By Step Procedure For Asset Seizure – FinLender, accessed on November 1, 2025, https://finlender.com/the-sarfaesi-act-step-by-step-procedure-for-asset-seizure/

- Reportable IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO., accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2024/11545/11545_2024_2_1501_62321_Judgement_15-Jul-2025.pdf

- REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. 10873 OF 2018 [ARISING OUT OF SLP(CIVI, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2018/7145/7145_2018_Judgement_01-Nov-2018.pdf

- “Continuing Cause of Action” under SARFAESI Act: Correlation between Sections 13 and 17, accessed on November 1, 2025, https://www.scconline.com/blog/post/2021/07/08/continuing-cause-of-action-under-sarfaesi-act-correlation-between-sections-13-and-17/

- THE SECURITISATION AND RECONSTRUCTION OF FINANCIAL ASSETS AND ENFORCEMENT OF SECURITY INTEREST ACT, 2002 ARRANGEMENT OF SECTIONS – India Code, accessed on November 1, 2025, https://www.indiacode.nic.in/bitstream/123456789/2006/1/A2002-54.pdf

- Magistrate’s jurisdiction under S. 14 of SARFAESI Act doesn’t involve adjudication; passing orders in printed format with just filled-in details is unjustifiable: Kerala HC – SCC Online, accessed on November 1, 2025, https://www.scconline.com/blog/post/2025/03/29/magistrates-jurisdiction-section-14-sarfaesi-act-kerala-hc/

- District Magistrate not adjudicating authority under SARFAESI Act; only duty to assist secured creditor in taking possession of property: Jharkhand HC – SCC Online, accessed on November 1, 2025, https://www.scconline.com/blog/post/2024/07/23/jhc-dm-not-adjudicating-authority-sarfaesi-act-only-duty-to-assist-secured-creditor-taking-possession-property/

- REPORTABLE IN THE SUPREME COURT OF INDIA EXTRA ORDINARY APPELLATE JURISDICTION SPECIAL LEAVE PETITION NO. 16013 O, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2022/26932/26932_2022_7_1502_38526_Judgement_26-Sep-2022.pdf

- IMPORTANT JUDGMENTS UNDER SARFAESI ACT, DRBT ACT & IBC – Economic Laws Practice, accessed on November 1, 2025, https://elplaw.in/wp-content/uploads/2023/09/JUDGMENTS-UNDER-SARFAESI-ACT.pdf

- REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO.6662 OF 2022 KOTAK MAHINDRA BANK LIMITED, accessed on November 1, 2025, https://csis.tshc.gov.in/hcorders/scorders/2022/ca/ca_6662_2022.pdf

- Important Supreme Court and High Court Judgments of 2022 on SARAFESI Act, 2002/ Recovery of Debts and Bankruptcy Act, 1993 – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/important-supreme-court-and-high-court-judgments-of-2022-on-sarafesi-act-2002-recovery-of-debts-and-bankruptcy-act-1993/

- A Borrower’s Guide to Filing a Securitisation Application (S.A.) Before the DRT | CG Legal, accessed on November 1, 2025, https://www.cglegal.in/blog-drt-guide-sa-mistakes

- User Manual – DRT, accessed on November 1, 2025, https://efiling.drt.gov.in/edrt/user_manual.pdf

- SUPREME COURT OF INDIA, accessed on November 1, 2025, https://www.wbja.nic.in/wbja_adm/files/Title%20-%205%20SC.pdf

- Limitation period u/s 17 of SARFAESI – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/drb-subject/limitation-period-u-s-17-of-sarfaesi/

- If the possession notice has been served or is admitted to have been served by the borrowers/guarantors, then it is to be challenged within 45 days and in case of delay, the same is required to be condoned by showing a plausible reason. Further, no relief can be granted without any specific pleading on that issue, because it prejudicialy affects the right of the opposite party, who has no occasion to explain the unpleaded issue – Bank of India Vs. M/s Alchemist – DRAT Allahabad – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/if-the-possession-notice-has-been-served-or-is-admitted-to-have-been-served-by-the-borrowers-guarantors-then-it-is-to-be-challenged-within-45-days-and-in-case-of-delay-the-same-is-required-to-be-con/

- before the debts recovery tribunal, cuttack – DRT, accessed on November 1, 2025, https://cis.drt.gov.in/drtlive/order/pdf/pdf1.php?file=L3VwbG9hZHMvZHJ0L2RydGNvdXJ0L2RhaWx5X29yZGVyLzIwMjQvTWFyY2gvMjEwMTEwMDAxNzEyMDIyX2NlZTJjZTI3ZjM3ODU4ODE3YWRhNTlmZTVjYWFkNWQxLnBkZioqKjY4MjUzIzEjY3V0dGFjaw==

- 45 days Time limit for filing application u/s 17 SARFAESI Act provided for quick enforcement of security: Top Court – LawBeat, accessed on November 1, 2025, https://lawbeat.in/top-stories/time-limit-45-days-filing-application-us-17-sarfaesi-act-provided-quick-enforcement-security-top-court

- Whether DRT can condone the delay in filing an application under Section 17(1) of the SARFAESI Act, 2002 preferred on behalf of a Borrower by giving the benefit of the provisions of the Limitation Act, 1963? – Baruah C.C. and Anr. Vs. State Bank of India and Ors. – Gauhati High Court – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/baruah-c-c-and-anr-vs-state-bank-of-india-and-ors-gauhati-high-court/

- SARFAESI Newsletter – March 2024 – Dentons Link Legal, accessed on November 1, 2025, https://www.dentonslinklegal.com/en/insights/newsletters/2024/march/12/sarfaesi-newsletter/sarfaesi-newsletter—march-2024

- User Manual, accessed on November 1, 2025, https://drt.etribunals.gov.in/edrt/user_manual.pdf

- FORM-1 – Debts Recovery Tribunal, Coimbatore, accessed on November 1, 2025, https://drtcbe.tn.nic.in/Actsrules/DRT_Rules_Forms_Formats_2015.pdf

- 25.04.2025 Judgment pronounced on – Delhi High Court, accessed on November 1, 2025, https://delhihighcourt.nic.in/app/showFileJudgment/68004062025CW139542018_144624.pdf

- set+aside+sarfaesi | Indian Case Law – CaseMine, accessed on November 1, 2025, https://www.casemine.com/search/in/set%2Baside%2Bsarfaesi

- Stages of OA (Original Application) Cases in Debt Recovery Tribunal (DRT) | Advocate Paresh M Modi | 9925002031, accessed on November 1, 2025, https://www.advocatepmmodi.in/stages-of-oa-original-application-cases-in-debt-recovery-tribunal-drt/

- DRT Litigation Support: Your Complete Guide to Debt Recovery Tribunal Cases in India, accessed on November 1, 2025, https://unique-swift-qs22ws.mystrikingly.com/blog/drt-litigation-support-your-complete-guide-to-debt-recovery-tribunal-cases

- Blog Archive » Defences under SARFAESI ACT – Mentoassociates.com – Legal Articles, accessed on November 1, 2025, https://articles.mentoassociates.com/2009/01/defences-under-sarfaesi-act.html

- Top 5 Defenses Available to Borrowers Before the Debt Recovery Tribunal | CG Legal, accessed on November 1, 2025, https://www.cglegal.in/blog-sarfaesi-wrongful-valuation-loan-notice

- Defenses and Counterclaims in DRT Cases, accessed on November 1, 2025, https://www.drtlaw.in/2024/08/Defenses-and-Counterclaims-in-DRT-Cases.html

- SARFAESI ACT, 2002- Applicability, Objectives, Process, Documentation – ClearTax, accessed on November 1, 2025, https://cleartax.in/s/sarfaesi-act-2002

- Upgradation of NPA Account – Whether Permissible After Issuance of Demand Notice under Section 13(2) of the Sarfaesi Act – SCC Online, accessed on November 1, 2025, https://www.scconline.com/blog/post/2024/05/17/upgradation-of-npa-account-whether-permissible-after-issuance-of-demand-notice-under-section-132-of-the-sarfaesi-act/

- Landmark ruling on tenancy/lease/rent right under SARFAESI Act 2002 – Bajarang Shyamsunder Agarwal Vs. Central Bank of India and Anr. – Supreme Court – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/bajarang-shyamsunder-agarwal-vs-central-bank-of-india-anr-sc/

- C No. – 39191 of 2022 Petitioner :- V Mart Retail Ltd Respondent :- Lic Housing Finance Ltd – eLegalix, accessed on November 1, 2025, https://elegalix.allahabadhighcourt.in/elegalix/WebDownloadOriginalHCJudgmentDocument.do?translatedJudgmentID=10235

- No Sarfaesi protection for tenants without proof of tenancy before mortgage: Supreme Court [18.7.2025] – Legal Eagle Elite, accessed on November 1, 2025, https://legaleagleweb.com/newsdetail.aspx?newsid=8296

- Judicial Remedies Available To Borrowers Under The SARFAESI Act – FinLender, accessed on November 1, 2025, https://finlender.com/judicial-remedies-available-to-borrowers-under-the-sarfaesi-act/

- Section 18 of SARFAESI Act, 2002: Appeal to Appellate Tribunal – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/section-18-appeal-to-appellate-tribunal/

- DEBT RECOVERY APPELLATE TRIBUNAL, CHENNAI, accessed on November 1, 2025, https://drt2chennai.tn.nic.in/ActsRules/Securitisation-Act.pdf

- Pre-deposit under SARFAESI is mandatory | India – Law.asia, accessed on November 1, 2025, https://law.asia/pre-deposit-sarfaesi/

- The Conundrum Relating to the Restricted Right of Appeal Available to Borrower under Section 18 of the SARFAESI Act, 2002 Owing to Mandatory Requirement of Pre-Deposit – SCC Online, accessed on November 1, 2025, https://www.scconline.com/blog/post/2025/05/28/the-conundrum-relating-to-the-restricted-right-of-appeal-available-to-borrower-under-section-18-of-the-sarfaesi-act-2002-owing-to-mandatory-requirement-of-pre-deposit/

- SARFAESI – DRAT has no Power for Complete Waiver of the Deposit – IndiaLaw LLP, accessed on November 1, 2025, https://www.indialaw.in/blog/commercialcorporate/sarfaesi-drat-no-power-complete-waiver-deposit/

- Pre-deposits for Appeals before DRAT under Section 18 of the SARFAESI Act – azb, accessed on November 1, 2025, https://www.azbpartners.com/bank/pre-deposits-for-appeals-before-drat-under-section-18-of-the-sarfaesi-act/

- Where DRT did not determined prima facie the debt due, the amount claimed by Creditor would be the amount to be taken into consideration for the purpose of determining the amount to be deposited (pre-deposit) under the second and third provisos to section 18(1) of SARFAESI Act 2002 – Keystone Constructions Vs. State Bank of India – Bombay High Court – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/messrs-keystone-constructions-vs-state-bank-of-india-bombay-high-court/

- REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. 8969 OF 2022 M/s Sidha Neelkanth Paper In, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2021/3665/3665_2021_4_1503_40734_Judgement_05-Jan-2023.pdf

- Entire waiver of pre-deposit for filing appeal before DRAT under Section 21 of the Recovery of Debts and Bankruptcy Act, 1993 is impermissible – -Manupatra, accessed on November 1, 2025, https://updates.manupatra.com/roundup/contentsummary.aspx?iid=30843

- NONREPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. 1902 OF 2020 (@ SPE, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2019/43283/43283_2019_16_1501_21082_Judgement_02-Mar-2020.pdf

- Supreme Court | Borrower Has To Pre-Deposit 50% Of The “Debt Due” In Appeal Under Section 18 Of The Sarfaesi Act Before DRAT – IndiaLaw LLP, accessed on November 1, 2025, https://www.indialaw.in/blog/debt-recovery-blog/supreme-court-borrower-has-to-pre-deposit-50-of-the-debt-due-in-appeal-under-section-18-of-the-sarfaesi-act-before-drat/

- Borrower to pre-deposit 50% of the “debt due” including ‘interest’ under Section 18 of SARFAESI Act: Supreme Court – SCC Online, accessed on November 1, 2025, https://www.scconline.com/blog/post/2023/01/07/borrower-50-percent-pre-deposit-debt-due-includes-interest-sarfaesi-act-section-18-supreme-court-legal-research-updates-news-law/

- Sidha Neelkanth Paper Industries Pvt. … vs Prudent Arc Limited on 5 January, 2023 – Indian Kanoon, accessed on November 1, 2025, https://indiankanoon.org/doc/197077609/

- Supreme Court Clarifies Refund of Pre-Deposits in SARFAESI Act Appeals – CaseMine, accessed on November 1, 2025, https://www.casemine.com/commentary/in/supreme-court-clarifies-refund-of-pre-deposits-in-sarfaesi-act-appeals/view

- MKO30052025CW79392025_18… – Delhi High Court, accessed on November 1, 2025, https://delhihighcourt.nic.in/app/showFileJudgment/MKO30052025CW79392025_182824.txt

- REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. OF 2024 (Arising out of SLP(C) No. 8, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2022/12978/12978_2022_3_1501_52269_Judgement_10-Apr-2024.pdf

- WRIT PETITION NO – Mphc.gov.in, accessed on November 1, 2025, https://mphc.gov.in/upload/indore/MPHCIND/2024/WP/19972/WP_19972_2024_FinalOrder_30-08-2024.pdf

- ISSUE XI : Section 17 of SARFAESI: Is it effective for the borrowers?, accessed on November 1, 2025, https://www.psalegal.com/issue-xi-section-17-of-sarfesi-is-it-effective-for-the-borrowers/

- IN THE HIGH COURT OF JUDICATURE AT BOMBAY, accessed on November 1, 2025, https://images.assettype.com/barandbench/2021-12/239e5dc8-827a-409b-8f94-e6f209d3bc01/Bank_of_Bahrain_and_Kuwait_BSC_v__UOI___another_writ_petition.pdf

- 7 Case :- MATTERS UNDER ARTICLE 227 No. – 2135 of 2022 Petitioner – eLegalix, accessed on November 1, 2025, https://elegalix.allahabadhighcourt.in/elegalix/WebDownloadOriginalHCJudgmentDocument.do?translatedJudgmentID=10290

- 1 REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO.1188/2025 (@Petition for Special Leave t, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2019/37037/37037_2019_14_8_58808_Judgement_29-Jan-2025.pdf

- The Supreme Court’s recent take on statutory arbitration under the SARAFESI Act – ELP Law, accessed on November 1, 2025, https://elplaw.in/leadership/the-supreme-courts-recent-take-on-statutory-arbitration-under-the-sarafesi-act/

- What to Do When a Bank Files a Case in DRT? Your Legal Options – Ask Advocates, accessed on November 1, 2025, https://askadvocates.com/what-to-do-when-a-bank-files-a-case-in-drt-your-legal-options/

- How to Negotiate Favourable Terms for One-Time Settlement with the Bank – Tulja Legal, accessed on November 1, 2025, https://tuljalegal.in/blog/how-to-negotiate-favourable-terms-for-one-time-settlement-with-the-bank

- HIGH COURT FOR THE STATE OF TELANGANA ******** WRIT PETITION NOs.21511 of 2020 AND 13330 OF 2021 WRIT PETITION No.21511 of 202, accessed on November 1, 2025, https://csis.tshc.gov.in/hcorders/2020/wp/wp_21511_2020.pdf

- When the bank itself postponed the sale and revived the right of redemption on payment of OTS amount, the submission of the Bank that the right of redemption is available to the Borrowers only till the date of publication of the Notice cannot be accepted – The Authorised Officer, Canara Bank Vs. Casuarina Bay and Ors. – DRAT Chennai – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/the-authorised-officer-canara-bank-vs-casuarina-bay-and-ors-drat-chennai/

- REPORTABLE IN THE SUPREME COURT OF INDIA INHERENT JURISDICTION CONTEMPT PETITION (C) NOS. 158-159 OF 2024 IN CIVIL APPEAL NOS. 5, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2024/9980/9980_2024_15_1503_58012_Judgement_13-Dec-2024.pdf

- Bank OTS scheme not a borrower’s right without upfront payment: Supreme Court [17.9.2025] – Legal Eagle Elite, accessed on November 1, 2025, https://legaleagleweb.com/newsdetail.aspx?newsid=8346

- Mandatory Upfront Payment a Precondition for Consideration of Application – FoxMandal, accessed on November 1, 2025, https://foxmandal.in/News/mandatory-upfront-payment-a-precondition-for-consideration-of-application/

- Supreme Court: One-time settlement scheme valid only if all bank terms are met, accessed on November 1, 2025, https://government.economictimes.indiatimes.com/news/governance/supreme-court-rules-on-banks-one-time-settlement-scheme-conditions/123967929

- REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. 6954 OF 2022 State Bank of, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2022/12325/12325_2022_6_1507_39466_Judgement_04-Nov-2022.pdf

- Bank OTS scheme not a borrower’s right without upfront payment: SC – Business Standard, accessed on November 1, 2025, https://www.business-standard.com/industry/news/ots-scheme-not-a-borrower-s-right-without-upfront-payment-supreme-court-125091701267_1.html

- REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. 12174 OF 2025 [Arising out of Special Lea, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2023/20228/20228_2023_8_1501_64472_Judgement_22-Sep-2025.pdf

- Section 13(8) of SARFAESI Act: SC settles conundrum on right of redemption of borrower, accessed on November 1, 2025, https://disputeresolution.cyrilamarchandblogs.com/2023/10/section-138-of-sarfaesi-act-sc-settles-conundrum-on-right-of-redemption-of-borrower/

- Borrower’s Right of Redemption Limited under SARFAESI: Supreme Court Clarifies in Sanjay Sharma v. Kotak Mahindra Bank Ltd. & Ors. – IndiaLaw LLP, accessed on November 1, 2025, https://www.indialaw.in/blog/civil/borrower-redemption-limited-sarfaesi-sc/

- Borrowers can’t redeem property after publication of auction notice under SARFAESI: SC – TaxTMI, accessed on November 1, 2025, https://www.taxtmi.com/news?id=56535

- Borrowers’ Right to Redeem vs Auction Rules: SC Points to SARFAESI Act-Rules Conflict, accessed on November 1, 2025, https://lawbeat.in/supreme-court-judgments/borrowers-right-to-redeem-vs-auction-rules-sc-points-to-sarfaesi-act-rules-conflict-1519346

- REDEMPTION OF SECURED ASSETS UNDER SECTION 13(8) OF SARFAESI ACT, 2002, accessed on November 1, 2025, https://www.taxtmi.com/article/detailed?id=12461

- Supreme Court Clarifies Amended Section 13(8) SARFAESI Act; Right of Redemption Extinguished Upon Notice Publication. – – CaseGuru, accessed on November 1, 2025, https://caseguru.in/judgements/supremecourt/supreme-court-clarifies-amended-section-138-sarfaesi-act-right-of-redemption-extinguished-upon-notice-publication

- Difference Between Debt Recovery Act and SARFAESI Act | PDF | Debt | Loans – Scribd, accessed on November 1, 2025, https://www.scribd.com/document/903874441/Difference-Between-Debt-Recovery-Act-and-SARFAESI-Act

- Debts Recovery Tribunals / Debts Recovery Appellate Tribunals | Department of Financial Services | Ministry of Finance | Government of India, accessed on November 1, 2025, https://financialservices.gov.in/beta/en/page/debts-recovery-tribunals-debts-recovery-appellate-tribunals

- Challenges Faced By Lenders in Enforcing The SARFAESI Act – FinLender, accessed on November 1, 2025, https://finlender.com/challenges-faced-by-lenders-in-enforcing-the-sarfaesi-act/

- Interplay between Section 96 and Section 138 – Bhatt & Joshi Associates, accessed on November 1, 2025, https://bhattandjoshiassociates.com/interplay-between-section-96-of-the-insolvency-and-bankruptcy-code-2016-and-section-138-of-the-negotiable-instruments-act-1881/

- No bar under the law for simultaneous proceeding both under the Negotiable Instrument Act, 1881 (NI Act) and under the SARFAESI Act, 2002 in respect of the same transaction and the question of enrichment in such circumstances does not arise – Madhusudan Garai Vs. State of West Bengal and Anr. – Calcutta High Court – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/madhusudan-garai-vs-state-of-west-bengal-and-anr-calcutta-high-court/

- SARFAESI Act – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/drb-ni-subject/sarfaesi-act/

- SARFAESI Newsletter | February 2025 – Dentons Link Legal, accessed on November 1, 2025, https://www.dentonslinklegal.com/en/insights/newsletters/2025/february/17/sarfaesi-newsletter/sarfaesi-newsletter-february-2025

- accessed on November 1, 2025, https://ibclaw.in/drb-ni-subject/sarfaesi-act/#:~:text=Accordingly%20there%20is%20no%20bar,does%20not%20arise%20at%20all.&text=India’s%20Leading%20Insolvency%20Platform.

- Debt Recovery-Weekly Case Laws Digest: 3rd February, 2025 to 9th February, 2025, accessed on November 1, 2025, https://ibclaw.in/debt-recovery-weekly-case-laws-digest-3rd-february-2025-to-9th-february-2025/

- Vivek Sahni And Another v. Kotak Mahindra Bank Ltd . . | Punjab & Haryana High Court | Judgment – CaseMine, accessed on November 1, 2025, https://www.casemine.com/judgement/in/5e316e4e46571b557cd4ce7c

- JUDGMENT/ORDER IN – MISC. SINGLE No. 20026 of 2017 at Lucknow Dated-6.2.2018 CASE TITLE – eLegalix – Allahabad High Court, accessed on November 1, 2025, https://elegalix.allahabadhighcourt.in/elegalix/WebShowJudgment.do?method=A&judgmentID=6117569

- symbolic+possession+and+physical+possession | Indian Case Law | Law – CaseMine, accessed on November 1, 2025, https://www.casemine.com/search/in/symbolic%2Bpossession%2Band%2Bphysical%2Bpossession

- Considering representation under S. 13(3A) SARFAESI Act mandatory, time provided to communicate response thereon is not: Del HC – SCC Online, accessed on November 1, 2025, https://www.scconline.com/blog/post/2018/11/03/considering-representation-under-s-133a-sarfaesi-act-mandatory-time-provided-to-communicate-response-thereon-is-not-del-hc/

- REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO. 175 OF 2022 M/s R.D. Jain, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2018/3692/3692_2018_11_1501_36699_Judgement_27-Jul-2022.pdf

- Analyzing Section 14 of SARFAESI Act, 2002 and related myriad issues – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/analyzing-section-14-of-sarfaesi-act-2002-and-related-myriad-issues-by-adv-r-p-agrawal-adv-manisha-agrawal-and-adv-harnaryan/

- Understanding Symbolic vs Physical Possession under SARFAESI – CG Legal, accessed on November 1, 2025, https://www.cglegal.in/blog-symbolic-possession-physical-property

- Compliance of order dated 23.05.2025 passed by Hon’ble Supreme Court of India in Civil Appeal No. 7110 of 2025 – S3waas, accessed on November 1, 2025, https://cdnbbsr.s3waas.gov.in/s3ec02e8258e5140317ff36c7f8225a3bf/uploads/2025/08/2025081496.pdf

- The Verdict On OTS Settlements: Judicial Insights Into Bank Obligations And Mortgage Release – King Stubb & Kasiva, accessed on November 1, 2025, https://ksandk.com/newsletter/verdict-ots-settlement-judicial-bank-mortgage/

- Record Of Proceedings_SUPREME COURT, accessed on November 1, 2025, https://www.wbja.nic.in/wbja_adm/files/How%20can%20the%20right%20of%20the%20PROTECTED%20TENENT%20be%20preserved%20in%20cases%20where%20the%20debtor-lanlord%20secures%20a%20loan%20by%20offering%20the%20very%20same%20property%20as%20a%20security%20interest%20either%20to%20Banks%20or%20Financial%20Institutions_1.pdf

- SARFAESI Act | Tenant Cannot Resist Eviction Without Establishing Tenancy Was Created Before Mortgage: Supreme Court – Infra Legal Services, accessed on November 1, 2025, https://infralegalservices.in/sarfaesi-act-tenant-cannot-resist-eviction-without-establishing-tenancy-was-created-before-mortgage-supreme-court/

- The Moratorium under Section 14 of the IBC: A Legal and Empirical Analysis of its Scope and Limitations – By Abhijeet Patra, accessed on November 1, 2025, https://ibclaw.in/the-moratorium-under-section-14-of-the-ibc-a-legal-and-empirical-analysis-of-its-scope-and-limitations-by-abhijeet-patra/

- Interplay between Moratorium under IBC and issuance of Sale Certificate under SARFAESI Act – By Amir Bavani and Ayushi Verma – IBC Laws, accessed on November 1, 2025, https://ibclaw.in/interplay-between-moratorium-under-ibc-and-issuance-of-sale-certificate-under-sarfaesi-act-by-amir-bavani-and-ayushi-verma/

- Interplay between Moratorium under IBC and issuance of Sale Certificate under SARFAESI Act – AB Legal, accessed on November 1, 2025, https://ablegal.in/interplay-between-moratorium-under-ibc-and-issuance-of-sale-certificate-under-sarfaesi-act/

- REPORTABLE IN THE SUPREME COURT OF INDIA (CRIMINAL ORIGINAL JURISDICTION) TRANSFER PETITION (CRL.) NO. 608 OF 2024 M/s Shri Send, accessed on November 1, 2025, https://api.sci.gov.in/supremecourt/2024/28709/28709_2024_13_1503_59957_Judgement_06-Mar-2025.pdf

- Remedy for Secured Creditors Aggrieved by Actions under Section 13(4) of the SARFAESI Act: Where does it Lie? – SCC Online, accessed on November 1, 2025, https://www.scconline.com/blog/post/2025/09/23/remedy-for-secured-creditors-aggrieved-by-actions-under-section-134-of-the-sarfaesi-act-where-does-it-lie/