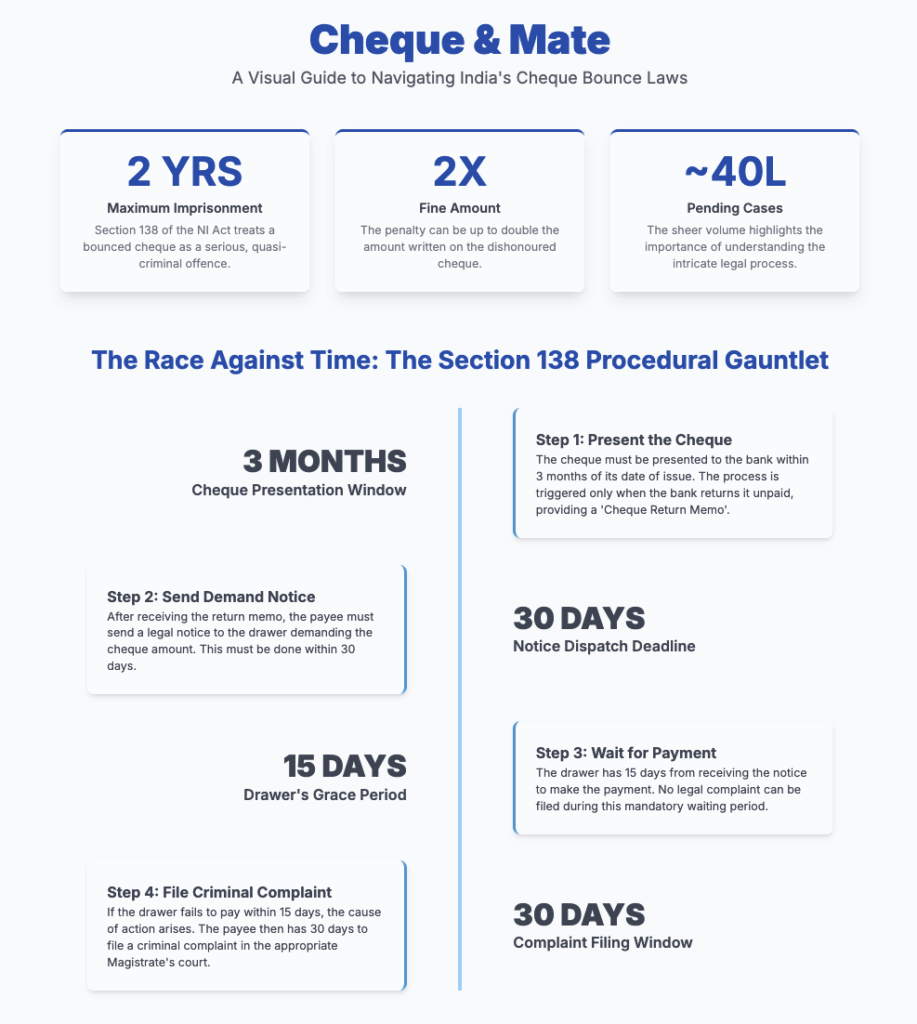

- Section 138 of the NI Act criminalizes cheque dishonor, ensuring swift accountability in financial transactions.

- Prosecution requires proving five essential components, including issuing, presenting, and dishonoring the cheque.

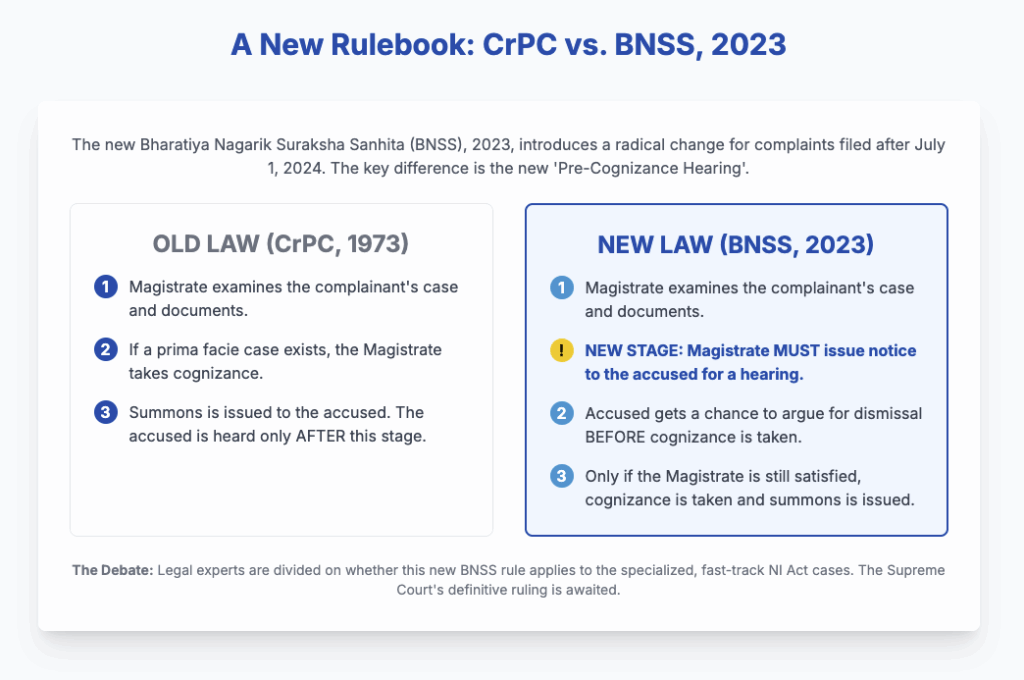

- New BNSS, effective July 1, 2024, presents complexities, especially regarding pre-cognizance hearings.

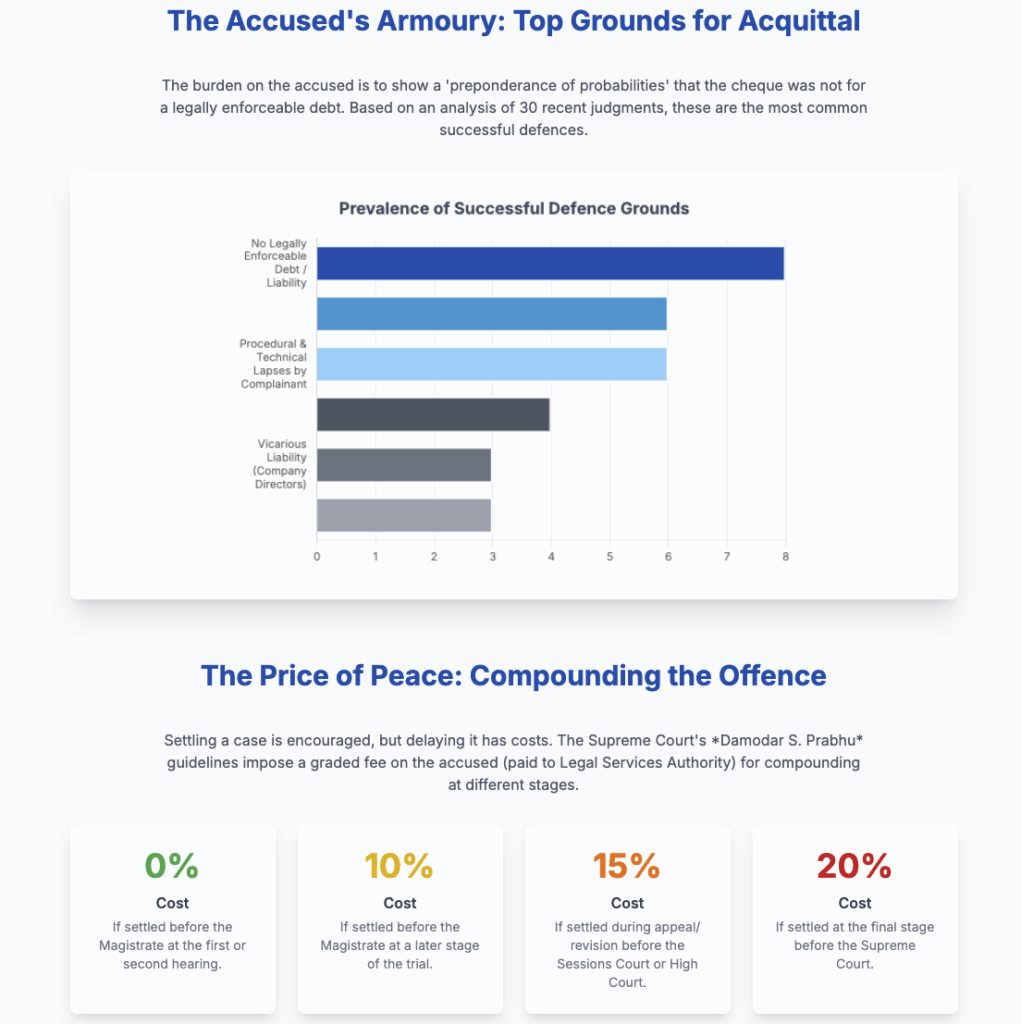

- Accused can challenge the legality of the debt, shifting the presumption onto the complainant.

- Courts favor compounding cases to expedite justice and reduce litigation backlog.

- Mandatory adherence to timelines is critical; procedural missteps can invalidate a claim.

- Recent judicial trends emphasize the significance of the complainant's burden in proving enforceable debts.

A Definitive Guide to Navigating Cheque Bounce Cases in India Under the NI Act and New BNSS, 2023

Audio Synopsis of the the topic:

Part I: The Anatomy of a Cheque Bounce Case (Section 138, NI Act)

1.1. Introduction: The Quasi-Criminal Nature and Enduring Significance of Section 138

The dishonour of a cheque, colloquially known as a “cheque bounce,” is a pervasive issue within India’s commercial landscape. To fortify the credibility and reliability of cheques as a vital instrument of commerce, the Indian Parliament introduced Chapter XVII, encompassing Sections 138 to 142, into the Negotiable Instruments Act, 1881 (NI Act) through an amendment in 1988.1 The primary objective was to deter individuals and businesses from issuing cheques without sufficient funds, thereby promoting financial discipline and safeguarding the trust of creditors.2

The offence under Section 138 of the NI Act is unique in its legal characterization. It is a “strict liability” offence, meaning that the prosecution is not required to prove mens rea, or a guilty mind, on the part of the drawer. The mere act of issuing a cheque that is subsequently dishonoured for specified reasons, coupled with the failure to pay after a statutory notice, is sufficient to attract penal consequences.1 This approach was deliberately adopted to avoid complex inquiries into the drawer’s intent and to ensure a swift deterrent mechanism.

Furthermore, the offence is described as “quasi-criminal” in nature. It essentially criminalizes a civil wrong, blending the procedural aspects of a criminal trial with the substantive nature of a civil dispute over a debt.4 This hybrid nature has profound implications for how these cases are adjudicated, particularly concerning the standards of proof, the possibility of settlement (compounding), and the overarching judicial philosophy, which often leans towards restitution for the complainant rather than mere punishment for the accused. The penalties prescribed—imprisonment for up to two years, a fine that may extend to twice the amount of the cheque, or both—underscore the seriousness with which the legislature views this offence.6

1.2. The Five Foundational Pillars: Deconstructing the Offence

For a prosecution under Section 138 of the NI Act to succeed, the complainant must establish a chain of five essential components or ingredients. The Supreme Court has repeatedly held that the offence is only completed upon the concatenation of all these acts; a failure to prove even one component is fatal to the complaint.3

The five foundational pillars are:

- Drawing of the Cheque: The cheque must be drawn by a person on an account maintained by them with a banker for the payment of money to another person. A crucial element here is that the cheque must be issued for the discharge, in whole or in part, of a “legally enforceable debt or other liability”.3 Cheques issued as gifts, for charity, or for illegal considerations do not fall under this ambit.3

- Presentation of the Cheque: The cheque must be presented to the bank within its period of validity. Following a notification by the Reserve Bank of India, this period has been reduced from six months to three months from the date mentioned on the cheque.2

- Return Unpaid (Dishonour): The cheque must be returned unpaid by the drawee bank. The most common reasons for dishonour are “funds insufficient” or “account closed,” but other reasons like “payment stopped by drawer” are also covered. The bank issues a “Cheque Return Memo” specifying the reason for dishonour, and this document serves as indispensable primary evidence to initiate legal action.6

- Issuance of a Demand Notice: The payee or the holder in due course of the cheque must make a demand for the payment of the said amount by giving a notice in writing to the drawer. This notice is a mandatory prerequisite for filing a complaint.7

- Failure to Make Payment: The drawer of the cheque must fail to make the payment of the cheque amount to the payee within 15 days of the receipt of the said notice.3

The cause of action for filing a criminal complaint under Section 138 arises only after the drawer fails to comply with the demand made in the notice within this 15-day period. This sequential fulfillment of conditions is non-negotiable and forms the bedrock of any prosecution.

1.3. The Procedural Gauntlet: A Step-by-Step Chronology from Dishonour to Complaint

Navigating the pre-litigation phase of a cheque bounce case requires meticulous adherence to strict statutory timelines. Any deviation can render a legitimate claim unenforceable. The process unfolds as follows:

Step 1: Dishonour and the Bank Return Memo

The entire legal process is triggered when the payee presents the cheque for payment and the bank returns it unpaid. The bank provides a “Cheque Return Memo,” a formal document stating the precise reason for the dishonour.6 This memo is the most critical piece of evidence, as it formally establishes the fact of dishonour and starts the clock for subsequent legal steps. The payee must collect and preserve this memo along with the original dishonoured cheque.8

Got a notice for a bounced cheque? 😱 Facing a court case? Don’t panic! 🚫

Accused in a cheque bounce case in Kolkata, Alipore, Barasat, Howrah, or any nearby court? 🏛️ You have rights and strong defenses! 🛡️

We are here to defend YOU! 🤝

Don’t let a false case ruin your peace. 🧘♂️

📞 Call us immediately for expert legal defense!

☎️ 8902224444 / 7003715325

Protect yourself now!

👨⚖️ Get the right legal advice and fight back! 💪

💪Visit this page for immediate assistance 💪

Step 2: The Statutory Demand Notice

Upon receiving the return memo, the payee must send a formal legal notice to the drawer. This notice serves as a final opportunity for the drawer to settle the matter before criminal proceedings are initiated.

- Content: The notice must be drafted with precision. It should clearly state the particulars of the cheque (number, date, amount), the reason for dishonour as mentioned in the return memo, a clear assertion that the cheque was issued in discharge of a legally enforceable debt, and an unequivocal demand for the payment of the cheque amount within 15 days of receipt of the notice. It should also explicitly warn that failure to pay will result in legal action under Section 138 of the NI Act.8

- Timeliness: This demand notice must be dispatched within 30 days of the payee receiving the cheque return memo from their bank.7 This is a mandatory and non-extendable deadline.

- Service: Proving that the notice was served upon the drawer is vital for statutory compliance. The most reliable methods are Registered Post with Acknowledgement Due (R.P.A.D.) or a reputable courier service that provides a tracking receipt and delivery confirmation. The payee must securely archive the postal receipt and the delivery acknowledgement as proof of service.10

Step 3: The 15-Day Waiting Period

After the drawer receives the notice, the law provides a mandatory grace period of 15 days for them to make the full payment of the cheque amount.8 The payee cannot initiate legal proceedings during this period. Filing a complaint prematurely, before the expiry of these 15 days, is a procedural flaw that can lead to the dismissal of the case.10

Step 4: Filing the Criminal Complaint

If the drawer fails to make the payment within the 15-day notice period, the cause of action to file a criminal complaint arises.

- Limitation Period: The payee must file the complaint in the appropriate court within 30 days from the date on which the 15-day notice period expires.3

- Jurisdiction (Post-2015 Amendment): A crucial aspect is determining the correct court. The Negotiable Instruments (Amendment) Act, 2015, settled the long-standing jurisdictional confusion. Now, the complaint must be filed in a Magistrate’s court that has territorial jurisdiction over the bank branch where the payee (complainant) presented the cheque for collection.6 This applies regardless of where the drawer resides or where their bank is located.

- Essential Documents: A comprehensive dossier of documents must be compiled and filed along with the complaint. This includes: the original dishonoured cheque, the bank’s return memo, a copy of the legal demand notice sent to the drawer, proof of service of the notice (postal receipts, acknowledgement card), a sworn affidavit from the complainant detailing the facts of the case, and a Vakalatnama if represented by a lawyer.6

Got a notice for a bounced cheque? 😱 Facing a court case? Don’t panic! 🚫

Accused in a cheque bounce case in Kolkata, Alipore, Barasat, Howrah, or any nearby court?

🏛️ You have rights and strong defenses! 🛡️

We are here to defend YOU! 🤝

Don’t let a false case ruin your peace. 🧘♂️

📞 Call us immediately for expert legal defense for free!

☎️ 890224444 / 7003715325

Protect yourself now! 👨⚖️ Get the right legal advice and fight back! 💪

1.4. The Court Process: From Summons to Judgment

Once the complaint is filed, the judicial machinery is set in motion. The typical stages of the court proceedings are as follows:

- Scrutiny and Pre-Summoning Verification: The Magistrate court scrutinizes the complaint and the annexed documents to ensure they are in order and filed within the limitation period. The Magistrate then records the statement of the complainant on oath, a process known as pre-summoning verification, which was governed by Section 200 of the Code of Criminal Procedure, 1973 (CrPC) and is now under Section 223 of the BNSS, 2023. The purpose is to determine if a prima facie case is made out against the accused.6

- Issuance of Summons: If the Magistrate is satisfied that there are sufficient grounds to proceed, they will “take cognizance” of the offence and issue a summons to the accused. This was done under Section 204 of the CrPC, now replaced by Section 227 of the BNSS.6 The summons directs the accused to appear before the court on a specified date.

- Trial Procedure: To expedite the resolution of the massive backlog of cheque bounce cases, Section 143 of the NI Act mandates that these cases should, as far as possible, be tried as Summary Trials.8 A summary trial is a faster procedure with simplified recording of evidence. The key stages within the trial are 15:

- Appearance of Accused and Bail: Upon receiving the summons, the accused must appear in court. If they fail to appear, the court may issue a warrant. The accused is required to furnish a bail bond to ensure their presence throughout the trial.12

- Recording of Plea: The court explains the substance of the accusation to the accused and asks if they plead guilty or claim trial. This is a critical stage that determines the future course of the case.15

- Evidence: The complainant presents their evidence, typically through an affidavit as permitted under Section 145 of the NI Act. The accused’s counsel then has the right to cross-examine the complainant and their witnesses. Subsequently, the accused is given an opportunity to present their defence evidence.12

- Statement of the Accused: After the complainant’s evidence is closed, the court examines the accused, putting forth the incriminating circumstances appearing in the evidence against them and seeking their explanation.

- Final Arguments: Both parties present their final arguments, citing evidence and legal precedents to support their respective cases.15

- Judgment: After hearing the arguments, the court delivers its judgment, either convicting or acquitting the accused.15

Table 1: The Unforgiving Timelines of a Section 138 Case

| Stage | Action Required | Governing Provision | Time Limit | Clock Starts From |

| Presentation of Cheque | The cheque must be presented for payment to the bank. | Section 138(a) NI Act & RBI Notification | 3 months | The date written on the cheque. |

| Sending of Demand Notice | The payee must send a written demand notice to the drawer. | Section 138(b) NI Act | 30 days | The date of receipt of the cheque return memo from the bank. |

| Waiting Period for Drawer | The payee must wait for the drawer to make the payment. | Section 138(c) NI Act | 15 days | The date of receipt of the demand notice by the drawer. |

| Filing of Complaint | The payee must file a criminal complaint before the Magistrate. | Section 142(1)(b) NI Act | 30 days | The date of expiry of the 15-day notice period. |

Part II: The New Legal Landscape: Impact of the Bharatiya Nagarik Suraksha Sanhita (BNSS), 2023

2.1. A Paradigm Shift: From the CrPC, 1973 to the BNSS, 2023

On December 25, 2023, India’s criminal justice system underwent a monumental overhaul with the enactment of three new laws: the Bharatiya Nyaya Sanhita, 2023 (BNS), the Bharatiya Nagarik Suraksha Sanhita, 2023 (BNSS), and the Bharatiya Sakshya Adhiniyam, 2023 (BSA). These laws, which became effective on July 1, 2024, repealed and replaced the Indian Penal Code, 1860, the Code of Criminal Procedure, 1973 (CrPC), and the Indian Evidence Act, 1872, respectively.17

For cheque bounce proceedings, which are governed by the special NI Act but rely on the procedural framework of the criminal code, this transition is of immense significance. The savings clause, Section 531 of the BNSS, clarifies the transition: any investigation, inquiry, or trial pending before July 1, 2024, will continue to be governed by the old CrPC. However, any new complaint filed on or after this date must adhere to the procedures laid out in the new BNSS.18 This has introduced a new layer of complexity and, in some areas, significant legal debate.

2.2. The Pre-Cognizance Conundrum: Demystifying Section 223 BNSS

The term “pre-cognizance notice” has become a source of considerable confusion as it can refer to two entirely different legal instruments in the context of a cheque bounce case. A clear understanding of this distinction is crucial.

- The Statutory Demand Notice (under the NI Act)

This is the traditional, well-understood notice sent by the payee to the drawer before a complaint is even filed with the court. It is a private communication between the parties, mandated by Section 138(b) of the NI Act.6 Its purpose is to demand payment and give the drawer a final chance to settle the debt. This notice is a

sine qua non—an essential condition—for initiating prosecution. There is no provision to file a formal “objection” to this notice in court. The drawer’s response is either to pay the amount or to send a reply letter disputing the liability, which can later be used as evidence during the trial.13

- The Judicial Pre-Cognizance Hearing Notice (under the BNSS)

This is a new and revolutionary concept introduced by the BNSS. The first proviso to Section 223(1) of the BNSS states: “Provided that no cognizance of an offence shall be taken by the Magistrate without giving the accused an opportunity of being heard”.17

This marks a radical departure from the CrPC, where the accused had no role or right to be heard until after the Magistrate had already taken cognizance and issued summons.17 Under the new regime, for cases initiated by a private complaint (which includes Section 138 NI Act cases), the Magistrate, after examining the complainant, must issue a notice to the proposed accused and hear their arguments

before deciding whether to take cognizance and proceed with the case.

Can Objections be Filed at this Stage?

Yes. The very purpose of this “opportunity of being heard” is to allow the accused to raise preliminary objections. An accused can appear before the Magistrate and argue that no prima facie case is made out, that the complaint is an abuse of the process of law, or that it suffers from a fatal defect. This provides a powerful new tool for the accused to seek dismissal of the complaint at the very threshold, potentially avoiding the rigours of a full trial.17

The Karnataka High Court, in the Basanagouda R. Patil v. Shivananda S. Patil judgment, has clarified the procedure: the Magistrate must first examine the complainant and their witnesses on oath, and only then issue the notice to the accused for this pre-cognizance hearing. Issuing the notice prematurely, without first recording the complainant’s statement, is a procedural violation.17

2.3. The Great Debate: Does Section 223 BNSS Apply to Section 138 NI Act Proceedings?

The introduction of the pre-cognizance hearing under Section 223 BNSS has ignited a fierce legal debate regarding its applicability to cheque bounce cases, creating a direct conflict between a new general law and an established special law.

- The Argument FOR Applicability: Proponents argue that the language of Section 223 BNSS is clear and applies to all cases initiated on a “complaint.” Since a Section 138 case is instituted via a private complaint, it naturally falls within the ambit of this new provision. This view prioritizes the enhanced procedural safeguard granted to the accused by the new legislation.

- The Argument AGAINST Applicability: Opponents raise the well-established legal principle of generalia specialibus non derogant, which means that the provisions of a general law do not override the provisions of a special law.20 The NI Act is a special statute with its own self-contained procedure (Sections 143-147) designed specifically for the speedy and summary disposal of cheque bounce cases.1 Introducing a pre-cognizance hearing would add a significant layer of proceedings, causing delays that would defeat the very object of the NI Act amendments. This view has found favour with the Madras High Court, which ruled that cheque bounce cases should not be burdened by this new BNSS rule to prevent them from getting bogged down.20 The Supreme Court has also previously observed in

Harihara Krishnan v. Thomas that NI Act cases are governed by special rules.20 - Current Status: The legal position remains in a state of flux. With conflicting judicial opinions emerging from different High Courts, the matter is ripe for a definitive pronouncement by the Supreme Court. Until then, this ambiguity presents a significant strategic consideration for both complainants and accused in all new Section 138 cases filed post-July 1, 2024.

2.4. Other Relevant BNSS Provisions

- Section 227 BNSS (Issuance of Process): This section, corresponding to the former Section 204 CrPC, deals with the issuance of summons or a warrant to the accused after the Magistrate has taken cognizance of the offence.13 A notable and modernizing change is the new proviso that explicitly allows for summons and warrants to be issued and served through electronic means, which could help expedite proceedings.13

- Section 281 BNSS (Stopping of Proceedings in Summons-Cases): This corresponds to Section 258 CrPC. In a landmark ruling in In Re: Expeditious Trial of Cases (2021), the Supreme Court has already held that this provision, which allows a Magistrate to stop proceedings in certain summons cases, does not apply to complaints filed under Section 138 of the NI Act. This is because the NI Act has its own specific mechanism for withdrawal and compounding.5 This ruling will continue to hold the field under the new BNSS.

Table 2: CrPC vs. BNSS – A Comparative Analysis for Private Complaints

| Procedural Stage | Under CrPC, 1973 | Under BNSS, 2023 | Key Change/Implication |

| Filing of Complaint | Complaint filed with Magistrate. | Complaint filed with Magistrate. | No change. |

| Examination of Complainant | Magistrate examines complainant on oath (S. 200 CrPC). | Magistrate examines complainant on oath (S. 223 BNSS). | No substantive change in this step. |

| Pre-Cognizance Hearing for Accused | No such stage. Accused had no right to be heard at this point. | Mandatory stage. Magistrate must issue notice and hear the proposed accused (Proviso to S. 223(1) BNSS). | Paradigm Shift. Creates a new right for the accused to seek dismissal at the threshold, potentially delaying proceedings. |

| Taking of Cognizance | Magistrate applies judicial mind to decide if a prima facie case exists. | Magistrate applies judicial mind after hearing the accused. | The point of taking cognizance is now deferred until after the accused has been heard. |

| Issuance of Summons | Summons issued to accused if cognizance is taken (S. 204 CrPC). | Summons issued to accused if cognizance is taken (S. 227 BNSS). | Process remains the same, but now allows for electronic service. |

Part III: Answering the Critical Questions

3.1. The Art of Settlement: Compounding of Offences Under Section 147 NI Act

Compounding is a legal process where the parties agree to settle the dispute, resulting in the acquittal of the accused. Given the quasi-criminal nature of Section 138, courts actively encourage compounding to ensure the complainant receives their money and to reduce the massive backlog of cases.23

Can a Case be Compounded at Any Stage?

Yes. Section 147 of the NI Act makes the offence of cheque dishonour compoundable, and judicial precedents have firmly established that this can be done at any stage of the proceedings. This includes during the trial before the Magistrate, during an appeal before the Sessions Court or High Court, or even during a revision or a special leave petition before the Supreme Court.5 The Supreme Court has consistently held that the interests of justice are better served by resolving these disputes amicably rather than engaging in protracted litigation.23

The Central Role of Consent: Can a Court Compel Compounding?

This question has been the subject of a significant judicial pendulum swing. For a period, following the Supreme Court’s decision in Meters & Instruments (P) Ltd. v. Kanchan Mehta (2017), it was believed that a court could dispose of a Section 138 case without the complainant’s consent if the accused was willing to pay the cheque amount along with reasonable interest and costs.5 The rationale was that the offence was primarily a civil wrong, and the complainant’s primary interest was financial restitution.

However, this position was explicitly overruled by a five-judge Constitution Bench of the Supreme Court in the landmark case of In Re: Expeditious Trial of Cases under Section 138 NI Act (2021).5 The Court held that compounding under Section 147 of the NI Act is not possible without the

mutual consent of both parties. The current, binding legal position is that a court cannot compel an unwilling complainant to accept a settlement and compound the offence. This ruling restores significant bargaining power to the complainant, who can refuse to settle and insist on the continuation of criminal proceedings, even if the accused offers to pay the entire amount due.

The Cost of Compounding: The Damodar S. Prabhu Guidelines

To encourage early settlements and disincentivize delaying tactics, the Supreme Court in Damodar S. Prabhu v. Sayed Babalal H. (2010) laid down a structured, graded cost system for compounding.23 These costs are to be paid by the accused to the appropriate Legal Services Authority, in addition to the amount paid to the complainant. The guidelines are as follows:

- Before the Magistrate (at the first or second hearing): Compounding may be allowed without any cost.

- Before the Magistrate (at a subsequent stage): Compounding is allowed upon payment of 10% of the cheque amount as costs.

- Before the Sessions Court/High Court (in appeal/revision): Compounding is allowed upon payment of 15% of the cheque amount as costs.

- Before the Supreme Court: Compounding is allowed upon payment of 20% of the cheque amount as costs.

These guidelines create a strong financial incentive for the accused to seek a settlement at the earliest possible stage of the litigation.

3.2. The Accused’s Stand: Understanding the Plea

The recording of the accused’s plea is a pivotal moment in the trial that sets the stage for all subsequent proceedings.

- The Notice of Accusation: After the accused appears in court and furnishes bail, the Magistrate states the particulars of the offence to them, as required under Section 251 of the CrPC (the corresponding provision in the BNSS will apply for new cases). The accused is then asked whether they plead guilty or have a defence to make.16 This is not a formal framing of charges as in a warrant case, but a notice of the accusation.

- Pleading “Not Guilty” and Stating a Defence: If the accused pleads “not guilty,” they claim trial. At this stage, they are also given an opportunity to briefly state their defence. Common defences stated at this stage include: “The cheque was given as a security and not for any existing debt,” “There is no legally enforceable debt,” “My signature on the cheque has been forged,” or “The particulars on the cheque were filled by the complainant without my authority”.26 This statement helps in framing the contested issues for the trial.

- Legal Effect: The plea is determinative of the trial’s trajectory.

- If the accused pleads guilty, the court can proceed to convict them based on that admission and pass a sentence.15

- If the accused pleads not guilty, the case moves to the evidence stage. The complainant is then required to prove their case, and the accused gets the right to cross-examine the complainant and their witnesses, and subsequently lead their own defence evidence.15

Part IV: The Accused’s Armoury: 30 Judgments Paving the Way for Acquittal

4.1. Introduction: Rebutting the Presumption – The “Preponderance of Probabilities”

While Section 139 of the NI Act creates a formidable presumption in favour of the complainant, it is not insurmountable. The Supreme Court has repeatedly clarified that the burden on the accused to rebut this presumption is not as onerous as the prosecution’s burden to prove guilt “beyond a reasonable doubt.” The accused only needs to establish a defence based on a “preponderance of probabilities”.26 This can be achieved either by leading direct defence evidence or by demonstrating, through the cross-examination of the complainant and their witnesses, that the complainant’s version of events is improbable, inconsistent, or unreliable. If the accused succeeds in creating a probable defence that casts a doubt on the existence of a legally enforceable debt, the presumption is rebutted, and the onus shifts back to the complainant to prove their case on the basis of independent evidence.4

4.2. Categorized Analysis of Judgments

The following is a curated list of 30 landmark and recent judgments where Indian courts have granted relief to the accused, categorized by the primary ground of defence.

Ground 1: Absence of a Legally Enforceable Debt or Liability (Judgments 1-8)

This is the most fundamental defence. If the very foundation of the transaction—the debt—is shown to be non-existent or unenforceable, the entire prosecution collapses.

- Krishna Janardhan Bhat vs. Dattatraya G. Hegde (2008): The Supreme Court held that the initial burden to prove the existence of a legally enforceable debt lies on the complainant. The presumption under Section 139 is rebuttable, and the accused can raise a probable defence.4

- Basalingappa vs. Mudibasappa (2019): A landmark ruling where the Supreme Court affirmed that an accused can rebut the presumption by demonstrating that the complainant lacked the financial capacity to advance the loan amount in question. This shifts the onus back to the complainant to prove their financial standing.4

- Rajesh Jain vs. Ajay Singh (2023): While the Supreme Court ultimately overturned the acquittal, the judgments of the trial court and High Court (detailed in the SC ruling) provide a textbook example of how lower courts acquit based on the complainant’s failure to provide material particulars of the loan and prove the debt independently once the presumption is challenged.32

- Somnath vs. Mukesh Kumar (2015): The Punjab & Haryana High Court held that a complaint under Section 138 is not maintainable if the cheque was issued in respect of a debt that was already barred by the statute of limitation.3

- Sasseriyil Joseph vs. Devassia (2001): The Supreme Court also affirmed that a criminal prosecution under Section 138 cannot be maintained for a time-barred debt, as it is not a “legally enforceable” liability.9

- Kusum Ingots and Alloys Ltd. vs. Pennar Peterson Securities Ltd. (2000): The Supreme Court clarified that for an offence under Section 138, the debt or liability must be legally enforceable on the date the cheque was issued.3

- Ashok Tayal vs. Ghanshyam Sharma (2024): A Delhi court acquitted the accused after he successfully proved that the cheque was not for a loan but was intended for the adjustment of hire charges that the complainant’s company owed to him. The court found the complainant failed to establish a legally recoverable debt.33

- Karnataka High Court Judgment (March 2025): The High Court upheld an acquittal, reasoning that the complainant’s failure to produce any documents (bank statements, ITRs) to prove his financial capacity to lend a large sum (Rs 6,35,000) made the accused’s defence probable.28

Ground 2: The “Security Cheque” Defence (Judgments 9-14)

This defence is nuanced. Merely labelling a cheque as “security” is not enough, but it can be a valid defence under specific circumstances.

- Prem Raj vs. Poonamma Menon & Anr. (2024): The Supreme Court quashed a conviction under Section 138 because a competent civil court had already passed a decree declaring that the very same cheque was issued only for security purposes, not for the discharge of an existing debt.34

- Sripati Singh vs. State of Jharkhand (2021): The Supreme Court clarified that a security cheque is not a “worthless piece of paper.” If a cheque is issued to secure a loan and the loan is not repaid, the cheque can be presented, and its dishonour will attract Section 138. The defence is valid only if the underlying debt was not due or had already been paid.35

- Indus Airways Pvt. Ltd. vs. Magnum Aviation Pvt. Ltd. (2014): The Supreme Court held that if a cheque is issued as an advance payment for a purchase order that is later cancelled, Section 138 is not attracted as there was no “debt or other liability” at the time of dishonour.9

- Sunil Todi vs. State of Gujarat (2021): The Supreme Court delved into the complexities of advance payments, holding that the question of whether a cheque issued as an advance constitutes a legally enforceable debt depends on the nature of the transaction and the obligations of the parties at the time of dishonour.31

- Sudhir Kumar Bhalla vs. Jagdish Chand (2008): An often-cited case where the Supreme Court held that Section 138 is not attracted if a cheque is issued not for an existing debt but for a liability that would arise in the future (contingent liability).35

- High Court Acquittal (Unnamed): A High Court upheld an acquittal where the cheque was given as collateral security, not towards a debt, and the original drawee had passed away before the cheque was cleared, making the transaction unenforceable against the accused.36

Ground 3: Procedural & Technical Lapses by Complainant (Judgments 15-20)

The procedure under Section 138 is rigid, and any non-compliance by the complainant can be fatal to their case.

- Charanjeet Singh vs. Kulwant Singh (2025): The Punjab & Haryana High Court quashed a complaint because the statutory demand notice was defective, having been erroneously sent in the name of a different person. The court held this was an incurable illegality that vitiated the entire proceedings.37

- Dashrathbhai Trikambhai Patel vs. Hitesh Mahendrabhai Patel (2022): The Supreme Court held that if the drawer makes a part-payment towards the debt after the cheque is issued but before it is presented, the complainant cannot present the cheque for the full original amount. The legal notice demanding the full cheque amount in such a scenario is invalid.9

- Dashrath Rupsingh Rathod vs. State of Maharashtra (2014): A landmark judgment that settled the law on territorial jurisdiction, holding that a complaint can only be filed in a court within whose jurisdiction the drawee bank (payee’s bank branch) is located. This led to the dismissal or transfer of thousands of cases filed in incorrect jurisdictions.4

- Allahabad High Court Judgment (June 2024): The court held that no liability under Section 138 can be attracted for the dishonour of an invalid cheque. In this case, a cheque from Allahabad Bank was held to be invalid after its merger with Indian Bank, leading to the quashing of proceedings.40

- Yogendra Pratap Singh vs. Savitri Pandey (2014): The Supreme Court ruled that a complaint filed before the expiry of the 15-day statutory period provided in the demand notice is premature and not maintainable.39

- H.N. Jagadeesh vs. R. Rajeshwari (2024): The Supreme Court restored an acquittal, holding that the complainant’s failure to produce the statutory notice on record was a fatal flaw, and the High Court erred in giving the complainant a second chance to produce evidence.41

Ground 4: Material Alteration & Signature Mismatch (Judgments 21-24)

Any unauthorized change to a cheque can render it void.

- Gogulapati Lokeswara Rao vs. State of Andhra Pradesh: The Andhra Pradesh High Court ruled that once a cheque is materially altered (e.g., changes to date, amount, or payee name) without the drawer’s consent, it loses its legal sanctity under Section 87 of the NI Act, and no penal liability can be fastened.42

- Veera Exports vs. T. Kalavathy (2002): The Supreme Court clarified that it is permissible for a drawer to voluntarily re-validate a stale cheque by altering the date with their consent, giving it a fresh life. This is not considered an adverse material alteration.43

- Ajitsinh Chehuji Rathod vs. State of Gujarat (2024): The Supreme Court held that in cases of alleged signature mismatch, courts can use their power under Section 73 of the Evidence Act to compare the signature on the cheque with the specimen signature from the bank. However, the burden is on the accused to rebut the presumption of genuineness.44

- M. Rajanna vs. Lalitha (2018): A Bangalore District Court acquitted an accused where the cheque was dishonoured for “Drawer Signature Differs,” and the complainant could not prove that the signature was indeed the accused’s, especially when the accused denied it from the outset.45

Ground 5: Vicarious Liability – When Company Directors Are Not Liable (Judgments 25-27)

Section 141 of the NI Act fastens vicarious liability on directors, but this is not absolute.

- K.S. Mehta vs. Morgan Securities & Credits Pvt. Ltd. (2025): The Supreme Court reaffirmed that non-executive directors, who are not involved in the day-to-day affairs of the company, cannot be held liable under Section 138 unless there are specific and clear allegations about their active role in the company’s financial transactions.46

- Delhi High Court Judgment (per Asha Menon, J., May 2022): The court held that if no offence is attributable to the company itself, it is not possible to attach vicarious liability to its Managing Director through the deeming provisions of Section 141.40

- Supreme Court Judgment (March 2025): The SC quashed proceedings against a former director because the cause of action (failure to pay after notice) arose after a moratorium under the Insolvency and Bankruptcy Code (IBC) was imposed. The director was suspended, had no control over the company’s accounts, and thus could not be held liable.47

Ground 6: Quashing of Proceedings at the Initial Stage (Judgments 28-30)

The High Court can exercise its inherent powers under Section 482 of the CrPC (now Section 528 BNSS) to quash proceedings that are an abuse of the process of law.

- Deepinder Singh Bedi vs. State (2024): The Delhi High Court quashed proceedings where the accused’s bank account was frozen by a statutory order from the CGST Department. The court reasoned that the account could not be considered as being “maintained” by the drawer in such a situation, thus an essential ingredient of Section 138 was not met.48

- Rekha Sharad Ushir vs. Saptashrungi Mahila Nagari Sahkari Patsansta Ltd. (2025): The Supreme Court quashed a complaint at the initial stage because the complainant had suppressed material facts, specifically the detailed reply sent by the accused to the legal notice, which disputed the liability. The court held this was an abuse of the process of law.13

- M/s. Gimpex Private Limited vs. Manoj Goel (2021): The Supreme Court, while dealing with parallel proceedings, held that once a settlement has been reached and the underlying debt is satisfied, continuing with a Section 138 prosecution would be an abuse of process, and such proceedings can be quashed.4

Table 3: Master List of 30 Judgments in Favour of the Accused

| Sr. No. | Case Name & Citation | Court | Key Ground for Acquittal/Relief | Core Principle Clarified |

| 1 | Krishna Janardhan Bhat vs. Dattatraya G. Hegde (2008) 4 SCC 54 | SC | No Legally Enforceable Debt | Complainant must prove the existence of debt; accused can rebut presumption. |

| 2 | Basalingappa vs. Mudibasappa (2019) 5 SCC 418 | SC | No Legally Enforceable Debt | Accused can rebut presumption by questioning complainant’s financial capacity. |

| 3 | Rajesh Jain vs. Ajay Singh (2023) SCC OnLine SC 1296 | SC | No Legally Enforceable Debt | Lower courts’ acquittal reasoning (lack of material particulars) detailed. |

| 4 | Somnath vs. Mukesh Kumar 2015(4) Law Herald 3629 | P&H HC | Time-Barred Debt | A cheque for a time-barred debt is not maintainable under S.138. |

| 5 | Sasseriyil Joseph vs. Devassia (2001) Crl. J. 24 | SC | Time-Barred Debt | Prosecution for a time-barred debt is not legally enforceable. |

| 6 | Kusum Ingots vs. Pennar Peterson (2000) 2 SCC 745 | SC | No Legally Enforceable Debt | The debt must be legally enforceable on the date of the cheque’s issuance. |

| 7 | Ashok Tayal vs. Ghanshyam Sharma 2024 SCC OnLine Dis Crt (Del) 5 | Delhi Court | No Legally Enforceable Debt | Acquittal where cheque was for adjustment of dues owed by the complainant. |

| 8 | Veerayya vs. G.K. Madivalar (2025) | Kar. HC | No Legally Enforceable Debt | Acquittal due to complainant’s failure to prove financial capacity for a large loan. |

| 9 | Prem Raj vs. Poonamma Menon & Anr. (2024) | SC | Security Cheque | Conviction quashed as a civil court had already declared the cheque was for security. |

| 10 | Sripati Singh vs. State of Jharkhand (2021) SCC OnLine SC 1002 | SC | Security Cheque | A security cheque is prosecutable if the underlying debt is due and unpaid. |

| 11 | Indus Airways Pvt. Ltd. vs. Magnum Aviation (2014) 12 SCC 539 | SC | Security Cheque | Cheque for an advance payment against a cancelled order is not for an existing debt. |

| 12 | Sunil Todi vs. State of Gujarat (2021) SCC OnLine SC 1174 | SC | Security Cheque | Nuanced analysis of when an advance payment cheque becomes an enforceable debt. |

| 13 | Sudhir Kumar Bhalla vs. Jagdish Chand (2008) 7 SCC 137 | SC | Security Cheque | Section 138 not attracted for a cheque issued for a future/contingent liability. |

| 14 | High Court Acquittal (Unnamed) (2023) | HC | Security Cheque | Acquittal where cheque was collateral and original drawee had passed away. |

| 15 | Charanjeet Singh vs. Kulwant Singh 2025:PHHC:010518 | P&H HC | Defective Notice | Complaint quashed as notice was sent to the wrong person, an incurable defect. |

| 16 | Dashrathbhai T. Patel vs. Hitesh M. Patel (2023) 1 SCC 578 | SC | Defective Notice | Notice for full cheque amount is invalid if part-payment has been made. |

| 17 | Dashrath Rupsingh Rathod vs. State of Maharashtra (2014) 9 SCC 129 | SC | Jurisdiction | Complaint must be filed at the payee’s bank location. |

| 18 | Allahabad Bank Cheque Case (2024) | All. HC | Invalid Cheque | No liability for dishonour of a cheque that became invalid post-bank merger. |

| 19 | Yogendra Pratap Singh vs. Savitri Pandey (2014) 10 SCC 713 | SC | Premature Complaint | Complaint filed before the 15-day notice period expires is not maintainable. |

| 20 | H.N. Jagadeesh vs. R. Rajeshwari (2024) | SC | Procedural Lapse | Acquittal restored due to complainant’s failure to produce the statutory notice. |

| 21 | Gogulapati Lokeswara Rao vs. State of A.P. | AP HC | Material Alteration | Unauthorized material alteration on a cheque renders it void under S.87 NI Act. |

| 22 | Veera Exports vs. T. Kalavathy (2002) 1 SCC 97 | SC | Material Alteration | Re-validation of a cheque by altering the date with the drawer’s consent is valid. |

| 23 | Ajitsinh C. Rathod vs. State of Gujarat (2024) SCC OnLine SC 92 | SC | Signature Mismatch | Courts can compare signatures, but the burden is on the accused to rebut genuineness. |

| 24 | M. Rajanna vs. Lalitha (2018) | District Court | Signature Mismatch | Acquittal where cheque dishonoured for “signature differs” and accused denied it. |

| 25 | K.S. Mehta vs. Morgan Securities (2025) | SC | Vicarious Liability | Non-executive directors not liable without specific allegations of an active role. |

| 26 | Delhi HC Judgment (Asha Menon, J.) (2022) | Delhi HC | Vicarious Liability | If no offence by the company, MD cannot be held liable. |

| 27 | Supreme Court Judgment (IBC) (2025) | SC | Vicarious Liability | Proceedings quashed against a director when cause of action arose post-IBC moratorium. |

| 28 | Deepinder Singh Bedi vs. State (2024) | Delhi HC | Quashing of Proceedings | No prosecution if the account was frozen by a statutory authority. |

| 29 | Rekha Sharad Ushir vs. Saptashrungi Ltd. (2025) | SC | Quashing of Proceedings | Complaint quashed for suppression of material facts by the complainant. |

| 30 | M/s Gimpex Pvt. Ltd. vs. Manoj Goel (2021) 11 SCC 733 | SC | Quashing of Proceedings | Continuing prosecution after settlement of underlying debt is an abuse of process. |

Part V: Conclusion

5.1. Conclusion: Key Takeaways for Litigants and Legal Practitioners

The legal framework governing cheque bounce cases in India is a dynamic and complex interplay of statutory law and judicial interpretation. The journey of a Section 138 complaint is governed by unforgiving timelines and rigid procedural mandates, where a single misstep can be fatal to a case. For complainants, this necessitates meticulous documentation and strict adherence to the statutory chronology.

The introduction of the Bharatiya Nagarik Suraksha Sanhita, 2023, has injected a significant dose of legal uncertainty. The debate over the applicability of the pre-cognizance hearing under Section 223 BNSS to NI Act cases represents a critical battleground that could reshape the landscape of these proceedings, potentially offering a powerful early-exit strategy for the accused but also risking further delays in a system already burdened with nearly 40 lakh such cases.

For the accused, the judicial trend has shifted the focus from a purely technical examination of the dishonour to a substantive inquiry into the underlying transaction. The courts have empowered the accused to challenge the very existence of a “legally enforceable debt” by questioning the complainant’s financial capacity, the validity of the consideration, or the timeliness of the debt. The presumption under Section 139 NI Act, while strong, is no longer an impenetrable shield for complainants who come to court with unclear or unsubstantiated claims.

Ultimately, while Section 138 was designed to uphold the sanctity of commercial transactions, the judiciary remains vigilant against its misuse as a tool for harassment or undue pressure. The path to justice, for both complainant and accused, requires a deep understanding of these evolving legal nuances, strategic litigation, and a readiness to adapt to a legal framework in transition.

Works cited

- AN ANALYSIS OF THE DECRIMINALISATION OF SECTION 138, NEGOTIABLE INSTRUMENTS ACT, 1881 – HeinOnline, accessed on July 2, 2025, https://heinonline.org/hol-cgi-bin/get_pdf.cgi?handle=hein.journals/injlolw9§ion=46

- Section 138 of Negotiable Instruments Act, 1881 – iPleaders, accessed on July 2, 2025, https://blog.ipleaders.in/section-138-of-negotiable-instruments-act-1881/

- OFFENCES U/S 138 OF NEGOTIABLE INSTRUMENTS ACT, accessed on July 2, 2025, https://cdnbbsr.s3waas.gov.in/s3ec03333cb763facc6ce398ff83845f22/uploads/2024/09/2024091181.pdf

- Cheque Bounce Case in Favour of Accused in india with cases, accessed on July 2, 2025, https://aiacb.com/cheque-bounce-case-in-favour-of-accused/

- Compounding under Section 138 of The NI Act: Judicial Uncertainty …, accessed on July 2, 2025, https://ibclaw.in/compounding-under-section-138-of-the-ni-act-judicial-uncertainty-and-the-consent-debate-by-gurkaran-singh-kratagya-pathak-and-samarth-gosavi/

- Cheque Bounce Proceedings in India Guide – ACM Legal, accessed on July 2, 2025, https://www.acmlegal.org/blog/cheque-bounce-proceedings-in-india-guide/

- What You Need to Know About Cheque Bounce Law in India, accessed on July 2, 2025, https://www.legalpay.in/post/what-you-need-to-know-about-cheque-bounce-law-in-india

- How to File or Defend a 138 Cheque Bounce Case in India, accessed on July 2, 2025, https://www.advdharmendraassociates.in/post/how-to-file-or-defend-a-138-cheque-bounce-case-in-india

- offences under section 138 of negotiable instruments act, accessed on July 2, 2025, https://cdnbbsr.s3waas.gov.in/s3ec01a0ba2648acd23dc7a5829968ce53/uploads/2024/09/2024092543.pdf

- How to File a Cheque Bounce Case: 7 Proven Steps, accessed on July 2, 2025, https://prashasthalegal.com/how-to-file-a-cheque-bounce-case/

- Cheque Bounce Case Procedure – Advocate Sudhir Rao, accessed on July 2, 2025, https://sudhirrao.com/cheque-bounce-case-procedure/

- Cheque bounce and its legal remedies: an overview – iPleaders, accessed on July 2, 2025, https://blog.ipleaders.in/cheque-bounce-and-its-legal-remedies-an-overview/

- Section 227 of Bharatiya Nagarik Suraksha Sanhita, 2023 – Drishti Judiciary, accessed on July 2, 2025, https://www.drishtijudiciary.com/current-affairs/section-227-of-bharatiya-nagarik-suraksha-sanhita-2023

- IN THE SUPREME COURT OF INDIA CRIMINAL ORIGINAL JURISDICTION – SUO MOTU WRIT PETITION (CRL.) NO.2 OF 2020 In Re: EXPEDITIOUS TRIAL OF CASES UNDER SECTION 138 OF NI ACT 1881., accessed on July 2, 2025, https://api.sci.gov.in/supremecourt/2020/9631/9631_2020_31_501_27616_Judgement_16-Apr-2021.pdf

- Stages in a cheque bounce case | Blogs – AdvocateKhoj, accessed on July 2, 2025, https://www.advocatekhoj.com/blogs/index.php?bid=4754e0067f477051623581446&bcmd=VIEW

- Procedure laid down under NI Act for trial of 138 cases and …, accessed on July 2, 2025, https://fireflieslegal.com/procedure-laid-down-under-ni-act-for-trial-of-138-cases-and-supreme-courts-directions/

- Demystifying Section 223 of the Bharatiya Nagarik Suraksha …, accessed on July 2, 2025, https://disputeresolution.cyrilamarchandblogs.com/2025/06/demystifying-section-223-of-the-bharatiya-nagarik-suraksha-sanhita-2023/

- At the junction: Should procedures stick with CrPC or take the BNSS detour? – numen law offices, accessed on July 2, 2025, https://www.numenlaw.com/at-the-junction-should-procedures-stick-with-crpc-or-take-the-bnss-detour.php

- Cheque Bounce – Indian Law, accessed on July 2, 2025, https://indianlaw.jiinfo.in/crpc/cheque-bounce/

- Does BNSS Complicate Cheque Bounce Cases? Legal Experts …, accessed on July 2, 2025, https://advamritaverma.com/legal-updates/f/does-bnss-complicate-cheque-bounce-cases-legal-experts-debate?blogcategory=S.+138+NI+Act

- Opportunity of Hearing to the Proposed Accused at Pre-Cognizance …, accessed on July 2, 2025, https://www.scconline.com/blog/post/2025/06/25/opportunity-of-hearing-to-the-proposed-accused-at-pre-cognizance-stage-in-complaint-cases-implications-of-proviso-to-section-2231-of-the-bnss/

- NOTICE FIRST, THINK LATER? AN ANALYSIS OF THE PRE-COGNIZANCE HEARING UNDER SECTION 223 OF BNSS – Lectio Law, accessed on July 2, 2025, https://lectiolaw.com/notice-first-think-later-an-analysis-of-the-pre-cognizance-hearing-under-section-223-of-bnss/

- GUIDELINES FOR COMPUNDING OF OFFENCE OF DISHONOUR …, accessed on July 2, 2025, https://medium.com/@ujjwal_60379/guidelines-for-compunding-of-offence-of-dishonour-of-cheque-u-s-138-ni-act-78fc31aeee1a

- Compounding of Offenses Under Section 138 NI Act: Steps & Advantages – ACM Legal, accessed on July 2, 2025, https://www.acmlegal.org/blog/compounding-of-offenses-under-section-138-procedure-and-benefits/

- Guidelines for compunding of offence of dishonor of cheque – MyAdvo.in, accessed on July 2, 2025, https://www.myadvo.in/blog/guidelines-for-compunding-of-offence-of-dishonour-of-cheque-us-138-ni-act/

- Avneet Singh vs Ravinder Kumar on 18 March, 2025 – Indian Kanoon, accessed on July 2, 2025, https://indiankanoon.org/doc/159196657/

- [Cheque Dishonour] Trial Court Overlooked Accused’s Guilty Plea, Deposit Of Amount: Gauhati High Court Sets Aside Conviction – Live Law, accessed on July 2, 2025, https://www.livelaw.in/high-court/gauhati-high-court/gauhati-high-court-ruling-cheque-bounce-case-acquittal-section-138-negotiable-instruments-act-296040

- Karnataka High Court Affirms Acquittal in Cheque Bounce Case: Complainant Fails to Prove Financial Capacity to Lend ₹6,35,000, Accused Successfully Rebuts Presumption Under Section 139 of Negotiable Instruments Act – Raw Law, accessed on July 2, 2025, https://rawlaw.in/karnataka-high-court-affirms-acquittal-in-cheque-bounce-case-complainant-fails-to-prove-financial-capacity-to-lend-%E2%82%B9635000-accused-successfully-rebuts-presumption-under-section-139-of-nego/

- Understanding Burden of Proof in Cheque Bounce Cases: Insights from a Landmark Judgment – Tax Management India, accessed on July 2, 2025, https://www.taxtmi.com/tmi_notes?id=1112

- Fundamental burden is on complainant to prove existence of legally enforceable debt, accessed on July 2, 2025, https://updates.manupatra.com/roundup/contentsummary.aspx?iid=46175&text=

- legally enforceable debt – Indian Kanoon, accessed on July 2, 2025, https://indiankanoon.org/search/?formInput=legally%20enforceable%20debt

- Rajesh Jain Vs. Ajay Singh | Latest Supreme Court of India …, accessed on July 2, 2025, https://www.advocatekhoj.com/library/judgments/announcement.php?WID=16850

- Delhi Court acquits accused under Section 138 NI Act on failure to establish debt adjustment, accessed on July 2, 2025, https://www.scconline.com/blog/post/2024/03/08/delhi-court-acquits-accused-under-section-138-negotiable-instruments-act-failure-establish-debt-adjustment-legal-news/

- Cheque Dishonor under Section 138 NI Act: SC set aside conviction …, accessed on July 2, 2025, https://www.freelaw.in/legalnews/Cheque-Dishonor-under-Section-138-NI-Act-SC-set-aside-conviction-based-on-the-civil-court-s-declaration-that-the-cheque-was-only-for-security-

- The “Security” Defence in Cases Relating to Dishonour of Cheques …, accessed on July 2, 2025, https://corporate.cyrilamarchandblogs.com/2021/11/the-security-defence-in-cases-relating-to-dishonour-of-cheques-not-a-get-out-of-jail-free-card/

- Dishonor of cheque case where accused was acquitted. Cheque… – Tax Management India, accessed on July 2, 2025, https://www.taxtmi.com/highlights?id=82378

- Defective Notice In A Cheque Bounce Case Vitiates Entire …, accessed on July 2, 2025, https://www.verdictum.in/court-updates/high-courts/punjab-and-haryana-high-court/defective-notice-in-a-cheque-bounce-case-charanjeet-singh-v-kulwant-singh-2025-phhc-010518-1566451

- Compilation of Important Judgments of Supreme Court and High Courts regarding Section 138 of the Negotiable Instruments Act, 1881 – SCC Online, accessed on July 2, 2025, https://www.scconline.com/blog/post/2023/01/04/compilation-of-important-judgments-of-supreme-court-and-high-courts-regarding-section-138-of-the-negotiable-instruments-act-1881/

- 138 ni act doctypes: judgments – Indian Kanoon, accessed on July 2, 2025, https://indiankanoon.org/search/?formInput=138%20ni%20act+doctypes:judgments

- cheque bounce Archives | SCC Times – SCC Online, accessed on July 2, 2025, https://www.scconline.com/blog/post/tag/cheque_bounce/

- Supreme Court Restores Acquittal in Cheque Bounce Case – Legal Light Consulting, accessed on July 2, 2025, https://legallightconsulting.com/supreme-court-restores-acquittal-in-cheque-bounce-case/

- Cheque Bounce: Key Legal Defenses, accessed on July 2, 2025, https://www.acmlegal.org/blog/cheque-bounce-key-legal-defenses/

- AIR 2002 SUPREME COURT 38 – AIROnline, accessed on July 2, 2025, https://www.aironline.in/legal-judgements/2002+CLC+618

- In Cheque Bounce Cases, Courts Can Compare Specimen Signature Maintained By Bank With Signature On Cheque: SC – Verdictum, accessed on July 2, 2025, https://www.verdictum.in/court-updates/supreme-court/ajitsinh-chehuji-rathod-v-state-of-gujarat-anr-2024-insc-63-specimen-signature-cheque-bounce-case-1517908

- signature differ on cheque – Indian Kanoon, accessed on July 2, 2025, https://indiankanoon.org/search/?formInput=signature%20differ%20on%20cheque

- regstreetlaw.com, accessed on July 2, 2025, https://regstreetlaw.com/blog/%F0%9D%90%8D%F0%9D%90%A8%F0%9D%90%A7-%F0%9D%90%84%F0%9D%90%B1%F0%9D%90%9E%F0%9D%90%9C%F0%9D%90%AE%F0%9D%90%AD%F0%9D%90%A2%F0%9D%90%AF%F0%9D%90%9E-%F0%9D%90%83%F0%9D%90%A2%F0%9D%90%AB%F0%9D%90%9E/#:~:text=The%20Supreme%20Court%2C%20in%20K.S.,active%20role%20in%20financial%20transactions.

- Section 138 NI Act proceedings can be quashed against former director of company: SC, accessed on July 2, 2025, https://www.scconline.com/blog/post/2025/03/19/section-138-ni-act-proceedings-can-be-quashed-against-former-director-of-company-sc/

- Cheque Dishonour due to Frozen Account not Offence Under NI Act: Delhi High Court interprets “account maintained” under Section 138 NI Act – SCC Online, accessed on July 2, 2025, https://www.scconline.com/blog/post/2025/06/19/cheque-dishonour-frozen-account-not-offence-ni-act-delhi-high-court-legal-news/