- NGOs are critical for social welfare and development in India, registered under various legal structures.

- NGOs can be formed as a Section 8 Company, Society, or Trust, each with specific regulations.

- A Section 8 Company promotes charitable objectives, has limited liability, and no minimum capital requirement.

- A Society requires a minimum of 7 members and is suitable for large memberships.

- A Trust is established by a settlor for societal benefit and can be private or public.

- Tax exemptions for NGOs include 80G and 12A registrations under the Income Tax Act, 1961.

- Compliance with annual filings and audits is essential to maintain NGO status and enjoy benefits.

- NGOs are critical for social welfare and development in India, registered under various legal structures.

- NGOs can be formed as a Section 8 Company, Society, or Trust, each with specific regulations.

- A Section 8 Company promotes charitable objectives, has limited liability, and no minimum capital requirement.

- A Society requires a minimum of 7 members and is suitable for large memberships.

- A Trust is established by a settlor for societal benefit and can be private or public.

- Tax exemptions for NGOs include 80G and 12A registrations under the Income Tax Act, 1961.

- Compliance with annual filings and audits is essential to maintain NGO status and enjoy benefits.

Non-Governmental Organizations (NGOs) play a crucial role in social welfare and development. In India, NGOs can be registered under three legal structures:

- Section 8 Company (under the Companies Act, 2013)

- Society (under the Societies Registration Act, 1860)

- Trust (under the Indian Trusts Act, 1882 or relevant state laws)

This guide provides a detailed legal overview of forming an NGO, including legal provisions, documentation, benefits, capital requirements, and income tax exemptions.

Related video:

1. Section 8 Company

A Section 8 Company is a non-profit entity registered under the Companies Act, 2013 that promotes charitable objectives like education, social welfare, art, environment, and research.

Legal Provisions ⚖️

- Governed by Section 8 of the Companies Act, 2013

- Regulated by the Ministry of Corporate Affairs (MCA) ️

Benefits

✅ Limited Liability – Members are not personally liable for debts.

✅ No Minimum Capital Requirement – Can be started with any amount.

✅ Better Credibility – More recognized than a Trust or Society.

✅ Eligible for Tax Exemptions – Under Income Tax Act, 1961.

✅ Government Grants & CSR Funding – Eligible for financial support.

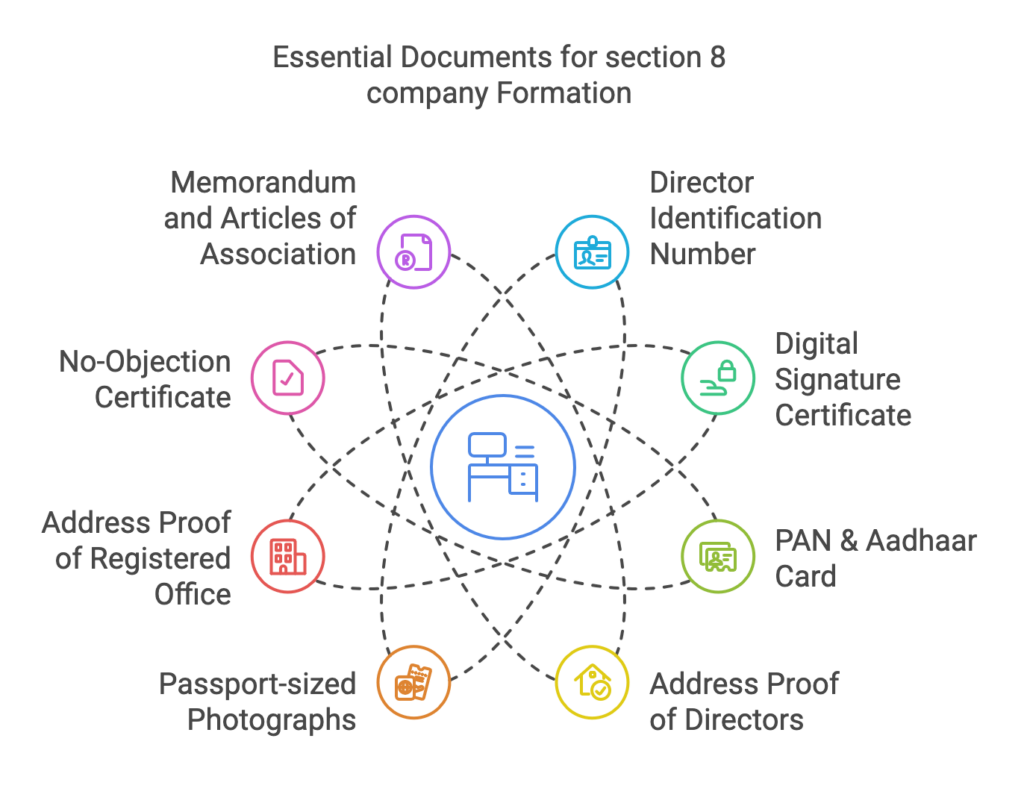

Documents Required

Director Identification Number (DIN) of all directors.

Digital Signature Certificate (DSC) of all directors.

PAN & Aadhaar Card of directors.

Registered Office Address Proof (rent agreement or ownership proof).

No-Objection Certificate (NOC) from the property owner.

Memorandum of Association (MoA) & Articles of Association (AoA).

Capital Requirement & Maintenance Charges

No minimum capital required.

Annual Compliance Costs – ₹10,000 to ₹50,000 depending on filings and audit fees.

Financial Statements & Tax Filings required yearly.

2. Society Registration ️

A Society is a group of individuals coming together for charitable, cultural, religious, or social purposes. It is registered under the Societies Registration Act, 1860.

Legal Provisions ⚖️

- Governed by the Societies Registration Act, 1860

- Requires a minimum of 7 members to form a society

Benefits

✅ No Minimum Capital Requirement

✅ Suitable for Large Memberships

✅ Greater Transparency & Democratic Functioning

✅ Eligible for Government Grants & Foreign Funding (FCRA approval required)

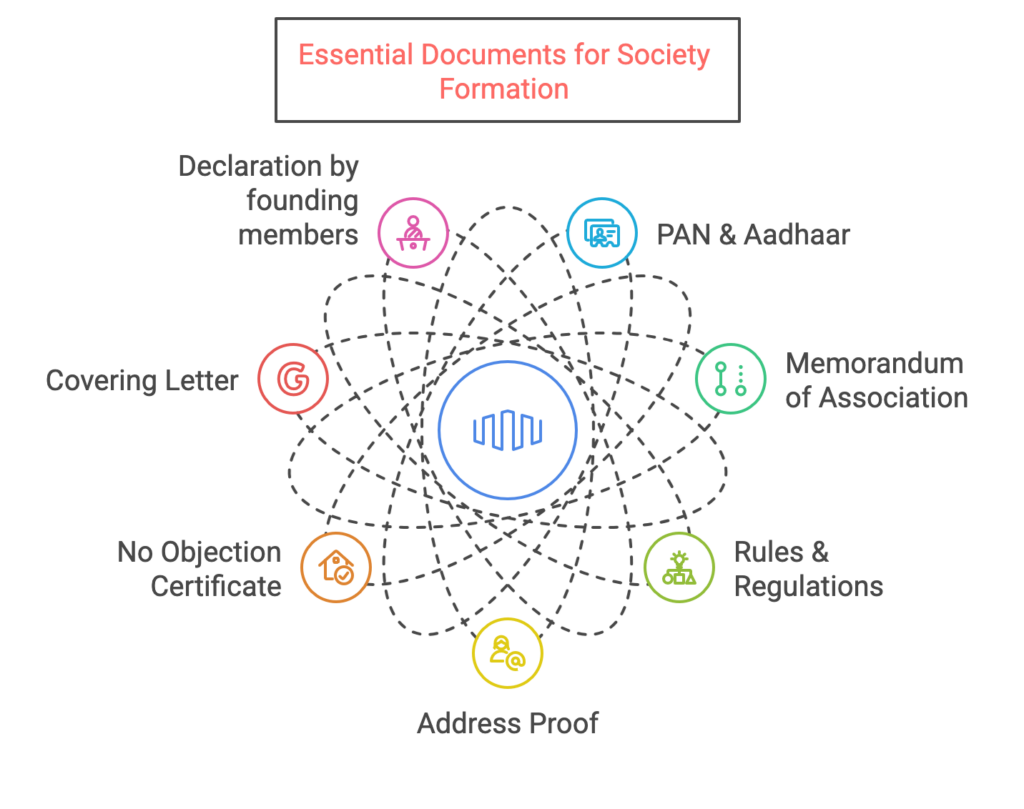

Documents Required

PAN & Aadhaar of Founding Members

Memorandum of Association (MoA) outlining objectives

Rules & Regulations Document

Registered Office Address Proof

No Objection Certificate (NOC) from the Landlord

Declaration Signed by the President of the Society

Annual Maintenance & Compliance

Annual Report Filing with the Registrar.

Proper Accounting & Auditing Required.

Compliance Costs:₹5,000 – ₹20,000 per year.

3. Trust Formation

A Trust is an entity where a settlor transfers property to trustees for the benefit of society. It can be registered as a Private Trust or a Public Charitable Trust.

Legal Provisions ⚖️

- Indian Trusts Act, 1882 (for Private Trusts)

- Public Trusts Act (State-Specific for Charitable Trusts)

- Requires Minimum Two Trustees (no upper limit)

Benefits

✅ Easy & Cost-Effective Registration

✅ Ideal for Religious, Educational & Welfare Activities

✅ Trust Properties Are Legally Protected

✅ Eligible for 12A & 80G Tax Exemptions

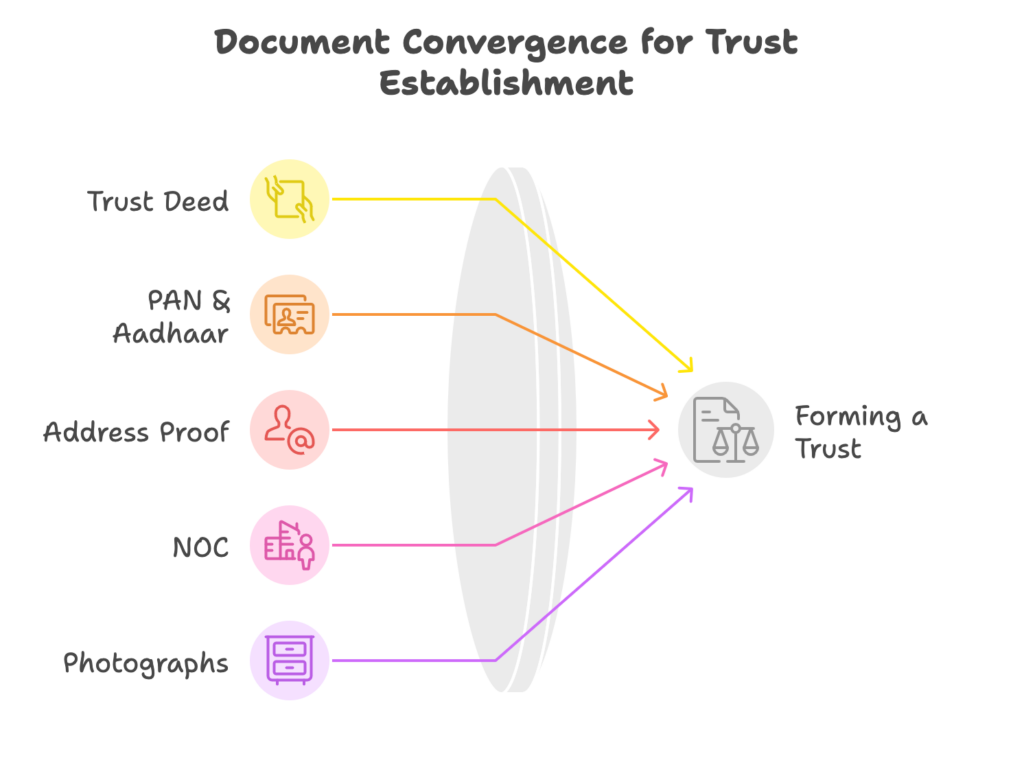

Documents Required

Trust Deed (on Non-Judicial Stamp Paper)

PAN & Aadhaar of Settlor & Trustees

Registered Office Address Proof

NOC from the Property Owner

Photographs of Trustees

Annual Maintenance & Compliance

Financial Statements & Audit Reports Required

Income Tax Returns (ITR) Filing Mandatory

Compliance Costs: ₹5,000 – ₹30,000 per year.

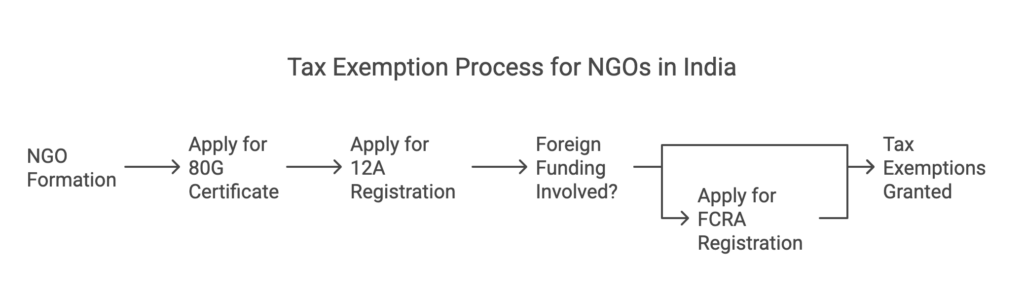

Income Tax Exemptions for NGOs

To enjoy tax benefits, NGOs must obtain the following under the Income Tax Act, 1961:

✅ 80G Certificate – Allows donors to claim tax deductions.

✅ 12A Registration – Exempts NGO from paying income tax.

✅ FCRA Registration (For foreign contributions) – Required under Foreign Contribution Regulation Act, 2010.

Process for Tax Exemptions

1️⃣ Form 10A – For 12A Registration (via the Income Tax e-filing portal).

2️⃣ Form 10G – For 80G Approval.

3️⃣ Submission of Audited Financials, PAN, and Registration Certificate.

4️⃣ Approval from the Commissioner of Income Tax (Exemptions).

5️⃣ Issuance of 80G & 12A Certificates ✅

Let Us Help You Register Your NGO!

Need expert guidance for NGO registration? Our legal experts & consultants are here to assist you with seamless registration, documentation, compliance & tax exemptions. Contact us today and start your social impact journeyhassle-free!

Email Us: [email protected]

Call Us:(+91) 890 222 4444/8250 422 880

Visit Us: https://patraslawchambers.com/ngo-registration-cheapest-cost/