INFOGRAPHICS

Legal Aspects to Consider When Buying Property in India: A Comprehensive Guide

Purchasing property in India is a significant financial and emotional investment. It is crucial to conduct detailed legal due diligence to avoid future disputes and ensure a secure transaction. This blog explores the critical legal aspects, including verifying property records, ensuring compliance with building plans, and referring to relevant statutes and case laws that govern property transactions in India.

1. Verification of Title Documents

Key Legal Requirement: Clear title is essential to establish ownership. The seller must have the absolute legal right to sell the property.

Documents to Check:

•Title Deed: Ensure the property is free from disputes or encumbrances by verifying the title deed.

•Encumbrance Certificate (EC): Obtain this from the sub-registrar’s office to ensure the property is free of financial liabilities (Section 55(1)(a) of the Transfer of Property Act, 1882).

Relevant Case Law:

•K. S. Vidyanadam v. Vairavan, (1997) 3 SCC 1: The Supreme Court emphasized the importance of a clear title in property transactions.

2. Compliance with Building Plans and Regulations

Key Legal Requirement: Construction must adhere to approved building plans and local municipal laws.

Steps to Ensure Compliance:

1.Building Plan Approval: Check if the local municipal authority has sanctioned the building plan.

2.Permissible Floors: Verify compliance with the permissible Floor Area Ratio (FAR) or Floor Space Index (FSI) under local laws. Unauthorized floors are liable to demolition under Section 271 of the Indian Penal Code (IPC).

3.Completion and Occupancy Certificates: Ensure these certificates are issued to confirm the building is ready for occupation and adheres to the sanctioned plan.

Relevant Statute: The Real Estate (Regulation and Development) Act, 2016 (RERA) mandates builders to register their projects and provide approved plans.

3. Land Revenue Records

Key Legal Requirement: Ensure the property’s records are updated in the land revenue department.

Documents to Check:

1.Mutation Certificate: Confirms property ownership transfer in revenue records.

2.Property Tax Records: Verify if all taxes are paid and no dues exist with the municipal authority.

3.Revenue Records: Check for historical ownership and land use details.

Relevant Case Law:

•Suraj Lamp & Industries Pvt. Ltd. v. State of Haryana, (2012) 1 SCC 656: The Supreme Court clarified that mutation records alone do not confer ownership; the title must be established independently.

4. Litigation and Encumbrance Check

Key Legal Requirement: Properties with pending litigation or encumbrances must be avoided.

Steps to Ensure:

1.Litigation Search: Conduct a thorough search at local courts for pending cases involving the property.

2.Encumbrance Certificate: Validate if the property is free from mortgages or other financial encumbrances.

Relevant Case Law:

•P. Chandrasekharan v. A.S. Manoharan, AIR 2005 SC 117: The Court ruled that a property buyer must conduct due diligence to ensure no encumbrances.

5. Quality of Construction and Structural Integrity

Key Legal Requirement: Ensure the structural safety of the building and adherence to quality standards.

Steps to Follow:

1.Engage a Civil Engineer: Verify the quality of materials (e.g., cement, steel) and compliance with structural safety norms.

2.Earthquake-Resistant Construction: For properties in seismic zones, ensure compliance with the National Building Code of India.

Relevant Statute: The Building and Other Construction Workers’ (Regulation of Employment and Conditions of Service) Act, 1996 governs construction safety and quality.

6. Tax and Financial Compliance

Key Legal Requirement: Ensure all tax liabilities are clear and property costs are transparent.

Steps to Verify:

1.Property Tax Records: Check for any pending property tax dues.

2.GST Compliance: For under-construction properties, verify the GST applicability as per the Central Goods and Services Tax Act, 2017.

3.Stamp Duty and Registration: Pay applicable stamp duty (as per the Indian Stamp Act, 1899) and register the property under Section 17 of the Registration Act, 1908.

Relevant Case Law:

•K.K. Modi v. K.N. Modi, (1998) 3 SCC 573: Emphasized the importance of proper documentation and registration in property transactions.

7. Builder-Buyer Agreement

Key Legal Requirement: This agreement must detail all aspects of the transaction, including timelines, payment schedules, and penalties for delays.

Important Clauses:

1.Possession Date: Ensure a clear possession timeline with penalties for delays.

2.Structural Defects Liability: Include a clause for the builder’s responsibility to repair structural defects within five years, as mandated by RERA.

Relevant Statute: Section 14 of the RERA outlines builder obligations for structural safety.

8. Environmental and Safety Compliance

Key Legal Requirement: For large projects, builders must obtain environmental clearances under the Environment Protection Act, 1986.

Documents to Check:

1.Environmental clearance for projects near sensitive zones.

2.Fire safety compliance certification under local fire safety laws.

Relevant Case Law:

•Vellore Citizens Welfare Forum v. Union of India, AIR 1996 SC 2715: Reinforced the importance of environmental compliance in construction projects.

9. Loan and Financial Approvals

Key Legal Requirement: Ensure the property is approved for loans by reputable financial institutions, as it indicates additional due diligence.

Steps to Follow:

1.Check loan eligibility and interest rates.

2.Verify the builder’s history with lenders.

10. Resale and Future Appreciation

Key Legal Requirement: Analyze the property’s resale potential by assessing the locality’s development and infrastructure.

Steps to Verify:

1.Research market trends.

2.Ensure property records and legal compliance are in place for smooth future transactions.

11. Statutory Clearances and Documents Checklist

Here’s a quick checklist of critical documents to verify:

•Title Deed

•Encumbrance Certificate

•Mutation Certificate

•Property Tax Receipts

•Approved Building Plan

•Completion and Occupancy Certificates

•Builder-Buyer Agreement

•Environmental Clearances

•Fire Safety Certification

Conclusion

Purchasing property in India is a meticulous process that requires legal, financial, and structural scrutiny. By following the above guidelines and referring to relevant statutes and case laws, buyers can safeguard their investment and ensure a hassle-free transaction. Always consult legal experts and property consultants to navigate the complexities of real estate laws effectively.

Relevant Statutes and Sections

1.Transfer of Property Act, 1882: Section 55

2.Registration Act, 1908: Section 17

3.Indian Stamp Act, 1899

4.Real Estate (Regulation and Development) Act, 2016

5.Environment Protection Act, 1986

6.Indian Penal Code, 1860: Section 271

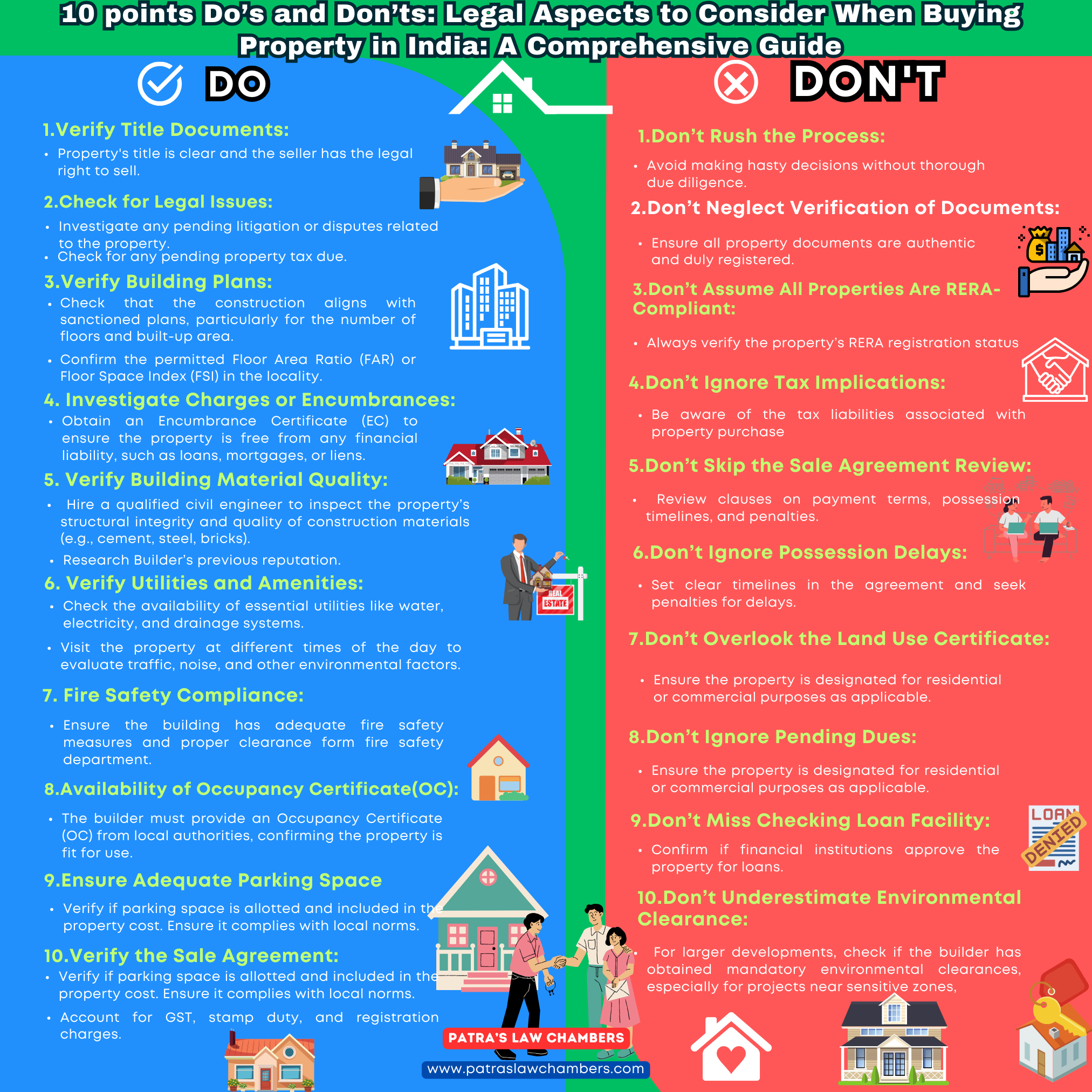

Do’s and Don’ts for Buying Property in India

Hashtags

#PropertyLaw #RealEstateIndia #BuildingCompliance #PropertyDueDiligence #LegalTips #PropertyInvestment #HomeBuyingGuide #IndianRealEstateLaw #LandRevenueRecord