“Before You Sign on the Dotted Line: A Comprehensive Guide to Avoiding Employment Traps in Your Job Contract

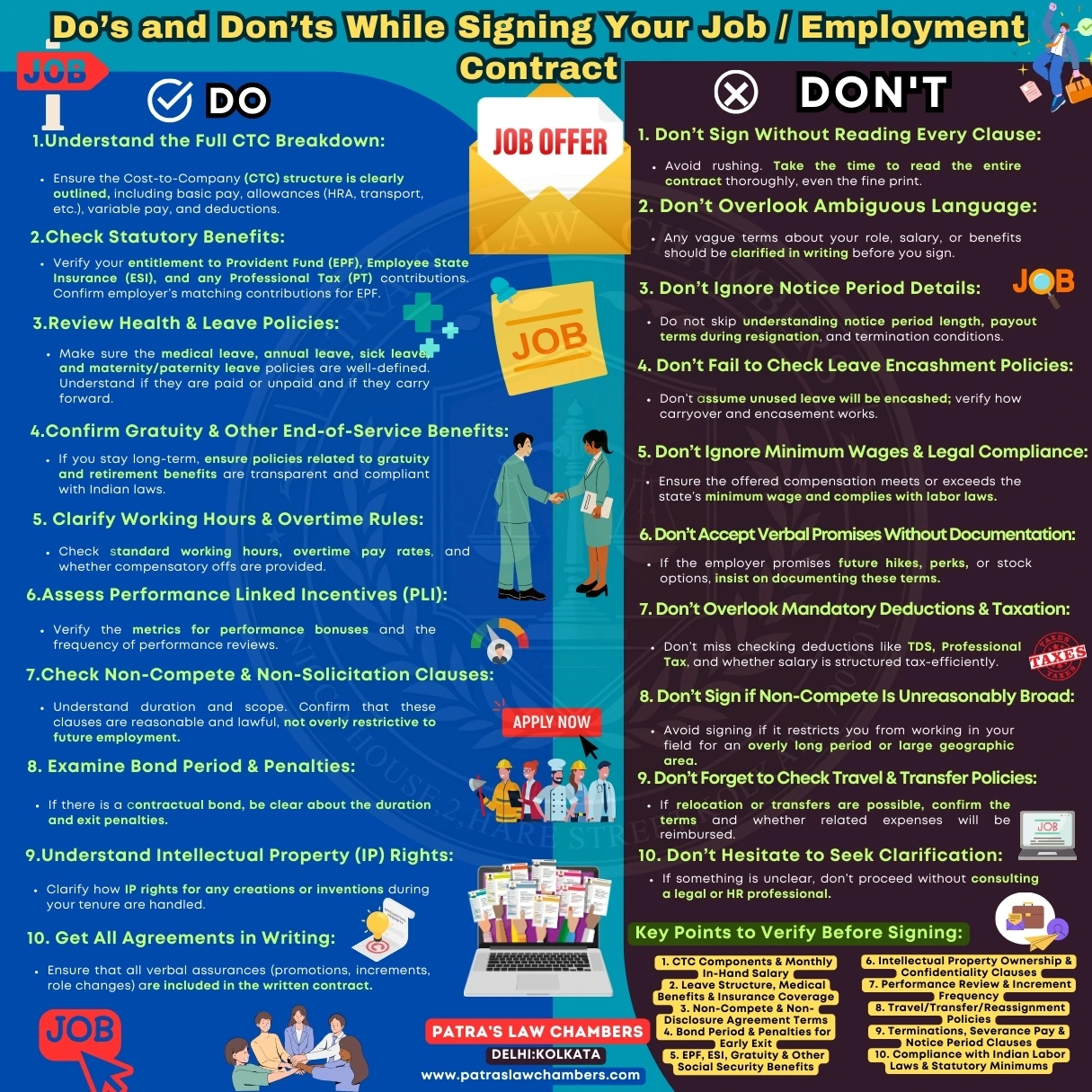

Infographics:

YouTube Video:

Introduction:

In today’s competitive job market, receiving a job offer can feel like a big win. However, the real due diligence begins after you receive the offer letter, when you must carefully examine your employment contract. This legal document shapes your work conditions, financial well-being, job stability, and future career moves. Employers may sometimes include clauses that are difficult to understand, overly restrictive, or not compliant with local labor laws. Taking the time to scrutinize your contract’s details is crucial to avoid falling into subtle “employment traps” that can limit your growth, drain your finances, or compromise your rights.

This guide provides a detailed look at what to consider in an Indian context, including compensation structures, statutory benefits, leave policies, restrictive covenants, notice periods, and more. While this article offers general guidance, it’s always wise to consult a legal professional for personalized advice.

1. Compensation Structure and Total Cost-to-Company (CTC)

Key Insight: Make sure you’re not lured by a high gross salary without knowing what you’ll actually take home.

•CTC Breakdown: Understand the exact components of your pay. A CTC figure often includes basic salary, allowances (House Rent Allowance, Travel Allowances), bonuses, performance incentives, and deductions (Provident Fund, Employee State Insurance, and taxes).

•In-Hand Salary: Ask for a salary breakup or a sample payslip to avoid surprises on payday. Sometimes, a high CTC can mask lower monthly take-home pay due to heavy deductions and performance-based variables that may not always be achieved.

Avoiding the Trap: Never sign if the net monthly payout is unclear or if the contract is vague on how and when incentives are calculated and paid.

2. Statutory Benefits and Compliance

Key Insight: Indian labor laws offer a safety net—ensure your employer is providing it.

•EPF, ESI, and Gratuity: Confirm that the employer complies with Employee Provident Fund (EPF) and Employee State Insurance (ESI) contributions. If you stay for the long term, gratuity eligibility should be clearly defined.

•Minimum Wage & Taxation: Ensure that the offered salary meets state-prescribed minimum wages and that deductions such as TDS (Tax Deducted at Source) are transparent and documented.

Avoiding the Trap: Do not rely on vague verbal assurances. All statutory benefits must be explicitly stated in the contract.

3. Leave and Holiday Policies

Key Insight: A balanced leave policy is central to work-life harmony.

•Types of Leaves: Clarify your entitlement to casual, sick, and earned leaves. Confirm if maternity/paternity leaves follow statutory guidelines.

•Leave Accumulation and Encashment: Understand if leaves can be carried forward or encashed at the end of the year or upon resignation.

•Public Holidays: Know the public holidays you are entitled to, and if substitutions or compensatory offs are provided.

Avoiding the Trap: If the leave policy is too restrictive, unclear, or more stringent than statutory requirements, this is a red flag.

4. Non-Compete, Non-Solicitation, and Bond Clauses

Key Insight: Restrictive covenants can hamper your career mobility and freedom.

•Non-Compete Agreements: Ensure these are reasonable in terms of time (e.g., 6-12 months post-employment) and geographical scope. Unreasonable restrictions can limit your future job opportunities.

•Non-Solicitation Clauses: Check if you are barred from reaching out to former clients or colleagues.

•Bond Periods: If the contract requires you to serve for a minimum period, understand the financial penalty for leaving early.

Avoiding the Trap: Overly broad non-compete clauses or lengthy bond periods with heavy penalties can be exploitative. Seek legal advice before signing.

5. Intellectual Property (IP) Rights

Key Insight: Know who owns the work you produce.

•Work-Related Creations: The employer typically owns IP created on the job. Confirm that this does not overreach into personal projects or ideas developed outside working hours.

•Clarity on IP Transfer: Ensure that the clauses differentiate between company-related work and personal intellectual endeavors.

Avoiding the Trap: Avoid contracts that claim blanket ownership over any creative or innovative output without clear boundaries.

6. Performance Reviews, Appraisals, and Incentives

Key Insight: Your professional growth and earning potential often hinge on regular, fair evaluations.

•Performance Metrics: Confirm how and when performance is reviewed. Are criteria objective, quantifiable, and communicated upfront?

•Frequency of Appraisals: Understand the timeline for increments, bonuses, or promotions.

Avoiding the Trap: Steer clear of contracts that make vague promises about future increments or promotions without specifying metrics or timelines.

7. Notice Period, Termination, and Exit Conditions

Key Insight: An unfair notice period can trap you in an unwanted job or cause financial strain if you want to leave.

•Reasonable Notice Period: Standard notice periods range from one to three months. Anything excessive, such as a 6-month notice, is a potential red flag.

•Severance Pay & Termination Clauses: Understand the conditions under which you can be terminated and any severance benefits offered.

Avoiding the Trap: Avoid contracts that impose disproportionately long notice periods or allow the employer to terminate without fair compensation or reason.

8. Get Verbal Assurances in Writing

Key Insight: Oral promises hold no legal weight.

•Document Everything: If the employer assures you of future hikes, flexible working conditions, or remote work options, insist that these are added as an addendum or clause in the contract.

Avoiding the Trap: Verbal agreements are easily disputed. Written words are enforceable.

9. Seek Legal Advice if in Doubt

Key Insight: Professional guidance can save you from future hassles.

•When to Consult a Lawyer: If any clause feels unfair, ambiguous, or too restrictive, consult an experienced employment lawyer for clarity.

•Asking Questions: Don’t hesitate to request revisions or clarifications from HR.

Avoiding the Trap: Ensuring legal compliance protects your rights and prevents unpleasant surprises down the road.

Conclusion

Your employment contract is the foundation of your professional relationship with your employer. By carefully examining each clause—from pay and perks to leaves and legal obligations—you empower yourself to make informed decisions. Don’t fall into the employment trap of signing a contract that undervalues your worth or limits your future growth. Take the time, ask questions, seek legal advice if needed, and sign only when you are completely confident in the terms.

Download pdf :Employment Contract Loopholes

1. #EmploymentContract

2. #JobOfferChecklist

3. #KnowYourRights

4. #HRCompliance

5. #LaborLaws

6. #EmploymentLaw

7. #WorkplaceRights

8. #LegalAdvice

9. #EmployeeBenefits

10. #ContractNegotiation

11. #CTCBreakdown

12. #StatutoryCompliance

13. #EPFandESI

14. #AvoidingEmploymentTraps

15. #NonCompeteClause

16. #LeavePolicies

17. #IPClauses

18. #PerformanceReviews

19. #NoticePeriod

20. #InformedEmployee